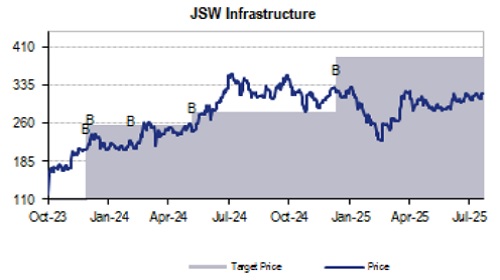

Buy JSW Infrastructure Finance Ltd For Target Rs. 385 By JM Financial Services

JSWINFRA 1QFY26 was largely in line with our estimates. Management has retained its FY26 target of 10% volume growth which we view as achievable. We view JSWINFRA as proxy on Indian steel demand growth along with increase in coastal coal movement. We view a near term multiple based approach do not factor a near 4-5x rise in EBITDA from FY25 to FY30 and thus derive a DCF based TP of INR 385.

* Operationally inline; FY26 guidance of 10% volume growth retained:

1QFY26 cargo growth at 5% y-y to 29.4mnt is inline as Paradip iron ore exports continued to be impacted. A deferral of cargo to 2QFY26 at Jaigarh was offset by rise in coal movement. Management guided for captive cargo to revive back to FY24 levels which coupled with increased capacity at Goa port and addition of JNPT in 2QFY26 should enable JSWINFRA to achieve 10% volume growth (guidance has been retained at 10%).

* Pipeline of major ports terminals to be privatized can add to further capacity increases:

A key investor question has been slow pace of major ports berth privatization in FY25. We concur with management view that the pace can increase in 2HFY26 with further bids likely to be invited at Kolkata and Paradip. These can largely fulfil the remainder of its INR300bn capex targeted for ports from FY25-30.

* Logistics performance improves; further acquisitions provide increasing visibility on INR80bn top line goal for FY30:

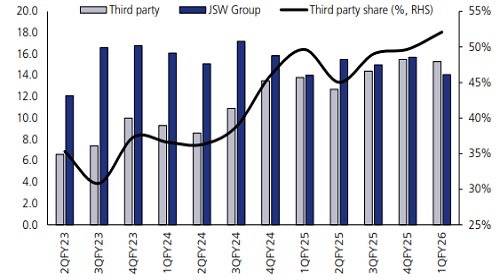

Navkar has turned profitable in 1QFY26 with FY26 guidance of INR7-8bn and INR1.0bn EBITDA appearing achievable. JSWINFRA has been acquiring terminals including the recent NCR Rail to expand its rail network. Logistics volumes will be anchored by Group volumes on which third party volumes are to be acquired reducing empty running costs. Thus, management is targeting 25% EBITDA margins FY30 vs 13-15% guided for FY26.

* Near term EV/EBITDA (FY27) appears expensive (~20x) but considering 4-5x rise in EBITDA over FY25-30 it is relatively modest at 10.5x FY30 discounted back to FY26:

We estimate besides the announced capex pipeline of INR400bn JSWINFRA has further capacity to incurr annual capex of INR30-40bn to remain within its net debt to EBITDA target of 2.5x (1QFY26 at 0.45x). Its track record of within budget execution and asset turnaround suggests ability to generate 16-18% ROCE on investments. We estimate with commissioning of key projects like Jatadhar and Keni as well as further growth capex JSWINFRA can achieve INR80-100bn in EBITDA by FY30. Our DCF based TP of INR385 implies an exit (FY30E) multiple of 12.5x discounted at a WACC of 9% to FY26 which we view as reasonable. We believe in the event of QIP to reduce promoter stake an additional INR250bn of capex can be supported which can potentially add another INR90-100/sh to our TP at ROCE of investments of 16-18%.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)