Buy IPCA Laboratories Ltd for the Target Rs. 1,600 By Prabhudas Liladhar Capital Ltd

EBIDTA beat; Margin outlook strong

Quick Pointers:

* Margin will be 100bps higher YoY in H2FY26.

* Better business from EU and LatAm aided high growth in export API.

We upgrade Ipca Labs (IPCA) from Accumulate to BUY given 1) recovery in API segment 2) higher margins ex Unichem 3) steady growth in domestic formulation and 4) attractive valuations.

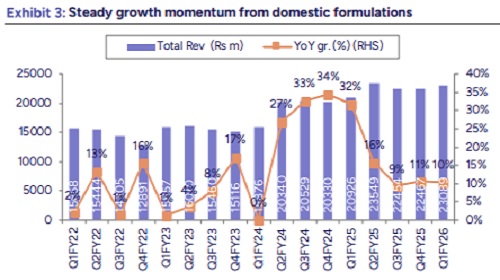

Ipca reported strong EBITDA of Rs5.6bn (up 23% YoY) which was 6% above our estimates aided by Unichem and higher API sales. Q2 EBITDA for Unichem saw recovery QoQ. Export API business witnessed recovery in H1FY26 with 36% YoY growth. Domestic formulation business, which now contributes 40% of revenues and ~55% of EBITDA, continued to outperform and grow at healthy levels. At CMP, the stock is trading at 14.5x EV/EBITDA and 24x PE on Sept 2027E adjusted for Unichem stake. We upgrade stock to Buy from ACCUMULATE with revised TP of Rs1,600/share; valuing at 18x EV/EBITDA on Sept 2027E.

In line revenue: IPCA’s revenues came in at Rs 25.6bn, up 8.6% YoY in line with our est. Domestic formulations growth was 8% YoY to Rs 10.2bn. Export formulation was down 9% YoY at Rs 5bn. Branded business was up by 2% YoY while generics business declined 6.5% YoY. Institutional businesses was down 11% YoY. API sales growth was strong at 28% YoY. Export API was up 45% YoY whereas domestic API declined 11% YoY. Revenues from subsidiaries, including Unichem were at Rs 6.3bn.

EBITDA beat aided by Unichem and higher export API sales: Consolidated gross margins improved 160bps YoY to 69.4%. There was forex loss to the tune of Rs 94mn booked under other expenses. Adj for forex; other expenses were 7% YoY. Staff cost was up 6% YoY. EBITDA adj for forex gain came in at Rs 5.54bn, up 23% YoY; vs our est of Rs5.30bn. OPM came in at 21.7%, up 330bps YoY. Sharp uptick in Unichem margins at 11.4% (up 700bps QoQ). Adj for Unichem; EBITDA growth was at 24% YoY with OPM of 24.7%. PAT came at Rs 3.4bn; up 49% YoY

Key Conference Call Takeaways:

Domestic: Growth was impacted by GST rate rationalization in Sept’25 but strong recovery seen in Oct month. Chronic portfolio share rose to 35%, both acute and chronic segments outpaced IPM. Therapy wise growth; Pain (+10%), CVS (+11%), CNS (+18%), Cough & Cold (+17%), Dermatology/Urology (+11%); Anti-malarials declined (-8%). MR strength at 700, added 2 new cardiac divisions, planning for Cosmeto dermatology division.

Unichem: Synergy work in progress: ~12 dossiers filed in Europe/other markets; approvals expected in 12–18 months. API sourcing from IPCA to start from FY27E post regulatory clearance. Ireland plant closed; production shifted to Baddi, cost saving of EUR 3.5–4 mn p.a. EBITDA expected to sustain this level near term; structural improvement in 1.5–2 yrs. US business grew 12% YoY; EU also steady. Targeting 8–10% US growth annually despite price erosion. Jogeshwari land sale completed (Q3 inflow); no further cash infusion needed.

US: Business stabilising; commercialised 6 products, 5-6 products under manufacturing. Additional launches expected from Q4FY26. For H1, reported Rs550mn of revenues

Export formulations: European softness due to one product; otherwise, healthy demand, new Germany subsidiary set up for tender participation. Cross-selling of Unichem products in ROW/Europe to begin post approvals (12–18 months). H2 growth guidance of 8-9% will be driven by generics recovery and steady branded exports.

API: Mix improvement, better business from EU and LatAm aided such high growth. FY26E growth guidance of 14-15%

R&D pipeline: 7 biosimilars in pipeline; 3 to enter clinical stage next year. FY27E range to be 4.5–4.7% with biosimilar clinical trials and expanded filings. For Q2, R&D spend was 3.9% of sales

Subsidiaries: Lyka Labs: Weak quarter due to GST change & batch rejections (~Rs 50 to 70mn hit). Critical care & animal health verticals progressing as planned. Biosimilar tech transfer (Puerto Rico partner): milestone + royalty model; aims for US market entry and regulatory collaboration.

Guidance- Domestic 10-11% growth in FY26E. Margins to be better by 100 bps in H2.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271