Hold Gujarat State Petronet Ltd For Target Rs.311 by Prabhudas Liladhar Capital Ltd

EBITDA declines, while PAT improves sequentially

Quick Pointers:

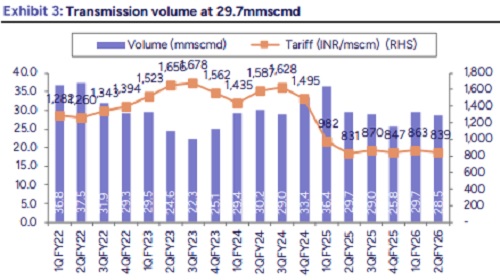

* Transmission volume declined from 29.7mmscmd to 28.5mmscmd QoQ.

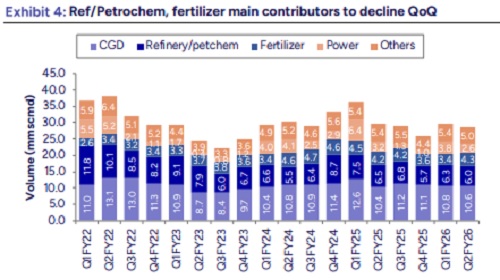

* Fertilizer and CNG segments accounted for the YoY volume growth.

Gujarat State Petronet (GSPL) reported a decline in transmission volume QoQ from 29.7mmscmd to 28.5mmscmd during the quarter led by decline in power sector, ref/petrochem and other volumes, partly offset by increase in fertilizer volumes. Implied tariff stood at Rs839.1/mscm compared with Rs863.3/mscm in the previous quarter. Opex per mscm increased from Rs149/mscm to Rs207/mscm QoQ. As a result, EBITDA declined to Rs1.7bn (Ple Rs1.9bn, BBGe Rs2.1bn, -10.2% YoY, -14.4% QoQ). PAT stood at Rs3.8bn (Ple Rs2.2bn, BBGe Rs3.1bn, -1.8% YoY, +168.4% QoQ). Sequential increase in PAT was driven by increase in other income, which stood at Rs3.1bn vs Rs0.4bn in Q1FY26 and Rs2.9bn in Q2FY25. We lower our rating to ‘Hold’ (from ‘Accumulate’) owing to slower-than-anticipated volume pickup. Investments in Gujarat Gas (54.2% stake) and Sabarmati Gas (27.5% stake) at a 25% holding discount provide a valuation of Rs202 and valuing the core business at 10x FY27/FY28E adj EPS at Rs109, we arrive at a TP of Rs311 (earlier: Rs339).

Transmission volume declines: Transmission volume stood at 28.5mmscmd vs 29.7mmscmd in Q1FY26 and Q2FY26. Fertilizer sector witnessed sharpest improvement from 3.4mmscmd in Q1FY26 and 4.2mmscmd in Q2FY25 to 4.3mmscmd in Q2FY26. Growth in CNG volumes YoY also aided the overall volume growth. Ref/Petrochem, power and other declined QoQ and YoY basis.

Implied tariff improves YoY: Implied tariff stood at Rs839.1/mscm, vs Rs863.3 in Q1FY26 (-2.8% QoQ) and Rs830.9 in Q2FY25 (+1.0% YoY). The company had filed a writ against the tariff order of the regulatory board and is awaiting a decision.

GIGL acquisition - GSPL Board approved additional investment in GSPL India Gasnet Ltd (GIGL) through a Rs0.4bn subscription to GIGL’s rights issue and an additional equity contribution of up to Rs 0.01bn, taking the total cumulative investment to Rs13.4bn. GSPL’s stake will remain unchanged at 52%. Other JV Partners are IOCL (26%), BPCL (11%) & HPCL (11%). GIGL is engaged in the execution / implementation of Gas Transmission Pipeline Projects namely: Mehsana Bhatinda Pipeline Project and Bhatinda - Gurdaspur Pipeline Project.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271