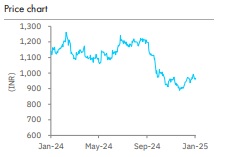

Accumulate Tata Consumer Products Ltd For Target Rs. 1,060 By Elara Capital Ltd

Tea witnesses strong recovery

Tata Consumer Products’ (TATACONS IN) core tea portfolio saw strong volume revival in Q3, remaining competitive despite high inflation. We expect sustained benefits from tea inflation, supporting near-term growth. NourishCo’s recovery post-pricing corrections was positive and should aid strong momentum. While high inflation and slower urban growth pose near-term challenges, TATACONS’ diverse product range and distribution expansion offer strong visibility for double-digit sales growth and margin expansion. We reiterate Accumulate with SoTP-TP pared to INR 1,060 (from INR 1,150).

Strong revival in tea drives organic business growth: Net sales grew 16.8% YoY in Q3 to INR 44.4bn, 1% below our estimates, with organic growth of 9% YoY (adjusted for new acquisitions). India beverages/foods grew 16%/31% YoY, led by 9%/11% growth in respective organic businesses. The tea business saw a 10% value growth and a 7% volume rise despite inflation and intense competition. Raw tea price rose 25-30% YoY, limiting TATACONS' ability to fully pass on costs, though staggered price hikes of ~10% covered 40% of inflation, with only 3% flowing through in Q3 (remainder likely in Q4).

The ready-to-drink segment (NourishCo) saw a 2% revenue drop due to price reindexation for retailers, despite a 14% volume increase and strong December exit volume growth of 39%. Salt revenue increased 7%, led by price hikes, while volume growth was limited to 1% due to channel down-stocking amid rising prices (price hike of 7%). The Tata Sampann portfolio grew 23% YoY. Meanwhile, newly-acquired businesses, Capital Foods and Organic India generated Q3 revenues of INR 2.1bn and INR 0.9bn, respectively, with sequential improvements.

Positive outlook for core portfolio: TATACONS reaffirmed its focus to post competitive, volume-led growth in the tea segment despite intense market competition. While inflationary pressures are expected to persist in the next two quarters, TATACONS anticipates gaining from the upward trajectory of tea prices, which could strain loose tea players. Additionally, the full impact of price hike implemented in Q3 will be realized in Q4, contributing to value growth. In the salt segment, primary offtake is expected to rise as the market adjusts to new pricing, supporting overall volume growth.

India business – Margin significantly hit by tea inflation: Q3 EBITDA margin contracted 230bps YoY to 12.7% (12.4% estimated), dragged down by 580bps margin dip in India branded business, due to tea inflation. Assuming normative India tea margin (same as Q3FY24), consolidated EBITDA margin for Q3 would have rose 75-100bps YoY. TATACONS expects margin pressure on tea to sustain for at least next two quarters.

Reiterate Accumulate with a lowerTP ofINR 1,060: We broadly maintain our estimate with just 1% cut in EPS estimate each for FY26E and FY27E, due to lower margin. We reiterate Accumulate with SoTP-TP pared to INR 1,060 from INR 1,150 as we assign India business 50x (unchanged) FY27E P/E with Starbucks JV valued at INR 30 per share (from INR 100) due to slower SSSG and store addition.

Please refer disclaimer at Report

SEBI Registration number is INH000000933