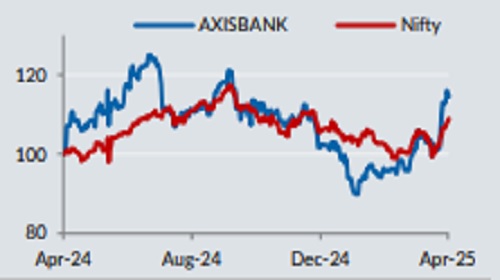

Buy Axis Bank Ltd for the Target Rs. 1,475 by Axis Securities Ltd

Reasonable outcomes on key parameters

Our view – Balance sheet growth a key monitorable

Asset Quality – Gross slippages declined on sequential basis partly on account of seasonality pertaining to agri slippages: Gross NPA additions amounted to Rs 48.05bn for 4QFY25, translating to an annualized slippage ratio of 1.9% for the quarter. Gross NPA additions had amounted to Rs 54.32bn during 3QFY25. Agri slippages are elevated in the first and third quarters of the Indian financial year. Provisions were Rs 13.59bn, down by -36.9% QoQ but up 14.7% YoY, translating to all-inclusive annualised credit cost of 53bps. Provisions were driven lower by upgrades in the wholesale book and also due to the Bank reversing provision of Rs 8.01bn on SR book.

Net Interest Margin – NIM expanded marginally on sequential basis due to moderate improvements in asset quality and spread: NIM was at 3.97%, up 4bps QoQ but down -9bps YoY. The benefit to NIM from improved asset quality and spread was 2 bps each. Management stated that the impact due to differential in the number of days is negligible. Management highlighted that the bank runs a tightly matched duration for assets and liabilities from an interest rate perspective and, as a result, the bank is able to manage interest rate upcycles and downcycles well. The margin is having a cushion over the structural margin of 3.8% and the bank would try to retain as much of this.

Balance sheet growth – Loan growth remained relatively sluggish but management stated that the environment has improved for the bank: The advances for the bank stood at Rs 10,408 bn, up by 2.6% QoQ and 7.8% YoY. Assuming the liquidity created flows into the deposit side, one will see growth coming back. They further stated that the CD ratio has not declined due to any regulatory nudge. The CD ratio is not a constraining factor for the bank. The bank had stated that it would dial up growth when it would find the conditions right and the sequential loan growth are early signs of this.

We reiterate BUY rating on AXSB with a revised price target of Rs 1475: We value the standalone bank at 1.7x FY27 P/BV for an FY26/27E RoE profile of 14.6/14.5%. We assign a value of Rs 171 per share to the subsidiaries, on SOTP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633