Buy Axis Bank Ltd For Target Rs. 1,330 By JM Financial Services

PAT miss driven by higher provisions

Axis Bank reported a disappointing 1Q26 numbers with PAT decline of 4% YoY, ~9% lower than JMFe, driving lower RoA/RoE (calc.) of ~1.45%/12.7%. Miss on PAT was mainly driven by higher credit cost (annualised) of ~1.5% (JMFe: 1%) due to change in NPA recognition norms. Adjusting for this change in norms, PAT was in-line with JMFe. Gross/net slippages spiked to 3.2%/2.3% (vs. 1.9%/0.8% in 4Q25), largely driven by technical impact (~INR 27.1bn). Operational performance was broadly in-line with loan growth of ~8%/2% YoY/QoQ which along with NIM decline of ~17bps, controlled opex and strong trading gains led to PPOP growth of ~14%/7% YoY/QoQ (4% above JMFe). Management guided for faster than Industry loan growth in FY26, further pressure on NIMs in 2QFY26 and no more policy changes incrementally until guided by the regulator. We cut our FY26E EPS estimates by 5% to factor in higher credit cost but retain FY27–28E estimates. We expect loan CAGR of ~12% during FY25-27E with avg. RoE of ~14% during FY26/27E. The stock trades at relatively inexpensive valuation of ~1.4x FY27E BVPS. Maintain BUY with an unchanged TP of INR 1,330, valuing the core bank at 1.7x FY27E BVPS.

* Elevated slippages led by technical impact: Gross/Net slippages rose sharply to 3.2%/2.3% (+126bps/+154bps QoQ), largely due to technical factor following a shift to more conservative NPA recognition norms. Of the total INR 82bn gross slippages, INR 27.1bn (~33%) were attributable to this technical impact. Consequently, the GNPA/NNPA ratios increased to 1.7%/0.5% (+28bps/+12bps QoQ), but adjusted for technical writeoffs, they stand lower at 1.4%/0.4%. Management indicated that ~80% of the technical slippages are fully secured and anticipates meaningful upgrades/recoveries over the next 1–2 quarters. While slippages are expected to remain elevated in the near term, these are likely to be offset by recoveries. We factor in average credit costs of 1.1% over FY26–27E.

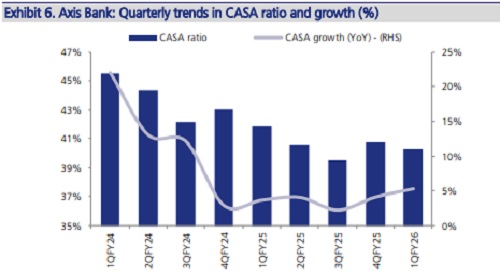

* Loan growth outpaces deposits; CASA ratio contracts: In 1Q26, the bank reported a sequential decline of 1% in overall deposits, primarily driven by a 2% drop in CASA deposits, while term deposits remained largely flat. As a result, the CASA ratio moderated to 40.3% (vs. 40.8% in 4Q25). In contrast, loan growth remained healthy at 2% QoQ (8% YoY), led by a robust pickup in corporate loans (+6% QoQ), followed by SME (+2% QoQ) and retail (+1% QoQ) segments. However, the overall momentum was partially offset by a 5% QoQ decline in agriculture loans. Consequently, the CD ratio rose to 91% (vs. 89% in 4Q25). Management targets to grow ahead of the industry over the medium term. We factor in a loan CAGR of 12% and deposit CAGR of 11% over FY25–27E.

* Healthy operating profits but margin pressure persists: Operating profit grew by (+7%/+14% QoQ/YoY, +4% JMFe) supported by strong non-interest income and moderating opex. Non-interest income rose (+7%/+25% QoQ/YoY), driven by robust trading gains of INR 14.2bn and sustained momentum in fee income (+10% YoY). Operating expenses were contained, with other opex declining 12% QoQ, leading to an improvement in the cost-to-income ratio to 44.7% (vs. 47.8% in 4Q25). However, NIMs contracted 17bps QoQ to 3.8%, impacted by a 1bp technical adjustment and a 3bps drag from seasonal agri slippages. Mgmt. guided for further margin pressure in 2Q26 due to the full-quarter impact of the 75bps repo rate cut but reiterated its medium-term guidance of maintaining average NIMs at 3.8% over the rate cycle.

* Valuation and view: Axis Bank delivered an operating beat in 1Q26, primarily driven by moderation in operating expenses. However, profitability was impacted by elevated credit costs arising from technical slippages due to a shift in NPA recognition norms. With liquidity conditions expected to improve and credit costs likely to normalize, we anticipate a pick-up in growth momentum over the coming quarters. The core bank currently trades at 1.4x FY27E BVPS, and we believe a sustained re-rating will depend on a more meaningful acceleration in earnings growth. We revise our FY26E EPS estimate downward by 5% to reflect higher credit costs, while keeping FY27–28E earnings unchanged. We maintain our target price at INR 1,330, rolling forward to 4Q25 valuations, and valuing the core bank at 1.7x FY27E BVPS. Maintain BUY.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361