RBI Monetary Policy 2025 by Jainam Broking Limited

Repo Rate Reduced by 25 Bps as Inflation Eases and Economic Growth Gains Strength

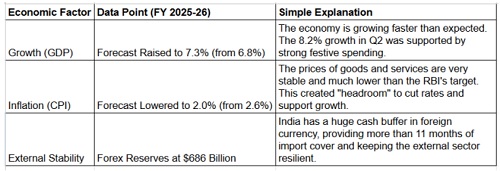

The Reserve Bank of India (RBI) delivered a major economic boost by unanimously reducing the Repo Rate by 25 basis points (bps), setting the new main borrowing rate for banks at 5.25%, while keeping its overall policy stance "Neutral." This decision was based on a highly favorable economic scenario described by Governor Sanjay Malhotra as a "rare Goldilocks period." The central bank now expects the Indian economy to grow faster, revising the GDP growth forecast upward to 7.3% for the current fiscal year. Crucially, this high growth is matched by exceptionally stable prices, with the Inflation forecast lowered to a benign 2.0%. This combination of low inflation and strong growth gave the RBI the confidence and "headroom" needed to cut rates and support further expansion.

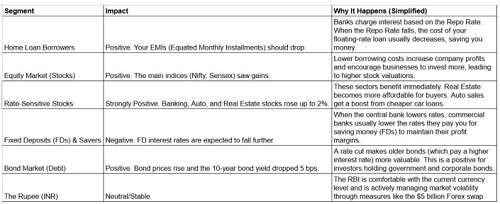

For everyday citizens and borrowers, this rate cut is a clear positive. Since the Repo Rate is the benchmark for all lending, the cut is expected to lead to lower interest rates on various loans, most notably home loans and auto loans. This means that existing borrowers on floating rates should see their monthly EMIs drop, making debt more affordable, while new buyers will find it cheaper to finance big purchases. Conversely, people who rely on traditional savings instruments will face a downside: the interest rates offered on Fixed Deposits (FDs) are likely to fall further, reducing returns for savers.

The move was seen as highly constructive for financial markets. The stock market reacted positively because the rate cut directly reduces the cost of capital for businesses, which generally leads to higher profits and encourages them to invest and expand, boosting stock valuations. Rate-sensitive sectors, such as Real Estate, Banking, and Automobile companies, saw immediate gains. In the bond market, the cut was also positive, causing existing bond prices to rise and bond yields to fall. To ensure that the entire banking system supports this policy, the RBI also announced major liquidity measures, including a large Rs.1 lakh crore purchase of government bonds and a $5 billion Forex Swap, guaranteeing that banks have plenty of cash available for lending to businesses and individuals. Now, the RBI's key focus will be on ensuring "Monetary Policy Transmission," which is the process of getting commercial banks to quickly and fully pass on this lower rate benefit to their customers.

Why the RBI Cut the Rate (The "Goldilocks" Economy)

Governor Sanjay Malhotra described the current situation as a "rare Goldilocks period"— meaning the economy is doing great without getting too hot (i.e., too much inflation).

What It Means for Investors & the Market

Conclusion

Overall, the RBI's decision to cut the Repo Rate by 25 basis points is a powerful vote of confidence in the sustained resilience and health of the Indian economy, capitalising on a favourable period of high growth and low, stable inflation. The policy is unequivocally progrowth, intended to accelerate economic activity by directly lowering the cost of borrowing for households and businesses. While the immediate effects are beneficial for borrowers and the equity market, the policy's successful outcome now hinges on Monetary Policy Transmission. The swift and full passing of the rate reduction by commercial banks to endcustomers. Coupled with aggressive liquidity injections, the RBI has provided the necessary foundation for stronger credit demand and continued expansion, ensuring the economy maintains its current positive momentum heading into the new fiscal year.

Please refer disclaimer at https://jainam.in/

SEBI Registration No.: INZ000198735, Research Analyst: INH000006448, PMS: INP000006785