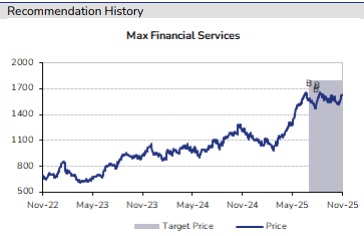

Buy Max Financial Services Ltd For Target Rs. 1,800 By JM Financial Services

Axis Max Life reported APE/VNB growth of 15%/27% YoY. While growth was in line, VNB margin of 25.5%, up 190bps YoY, +200ps JMFe, was a positive surprise. This was led by a margin-accretive product mix –ULIP volumes declined while annuity and protection grew 122%/34%. Also, par and non-par business grew 41%/17% YoY. While we had anticipated the mix shift away from ULIPs towards non-linked savings, we had expected margins to be adversely affected by GST 2.0. We wait for management commentary on that. Meanwhile, EV grew (2% QoQ, 15% YoY) to INR 268.9bn, in line with JMFe, including an impact of INR 2.7bn (~1%) due to GST 2.0. We wait for concall to revise our estimates.

* APE growth inline with RWRP, prop was strong at +18% YoY: While individual APE grew a strong 15% YoY, slightly ahead of RWRP (Retail Weighted Received Premiums) growth of 14% reported to IRDAI, which was ~800bps lower in 1Q. Growth was led by proprietary channel, up 18% YoY to INR 19.4bn, while partnership channel also reported a healthy growth of 13% YoY. The company changed its channel reporting, combining others and Banca into Partnership channel.

* Strong margin performance led by product mix shift away from ULIPs, GST impact to be quantified in concall: The product mix shift was sharp on a YoY basis - ULIPs declined by 7% YoY, while non-par grew at 17%, also seen a sharp increase in annuity by 85%. While we had anticipated the mix shift away from ULIPs towards non-linked savings, the strong shift from ULIP to non-par is seen in this quarter. Meanwhile, group credit life grew ahead of expectations, at 23%. While we await management commentary on margins, we believe the product mix justifies the strong margin performance. EV grew (2% QoQ, 15% YoY) to INR 268.9bn, in line with JMFe. The company has recognised the GST impact of INR 268mn, without which EV amounts to INR 271.6bn.

* First cut view: Axis Max Life’s management had guided for a growth of 300-400bps above the industry in FY26, with Axis Bank itself growing at 13-14%. Management commentary on sustained growth will be keenly awaited. With GST 2.0 coming in, we are awaiting the impact of GST on demand and ITC on company financials.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361