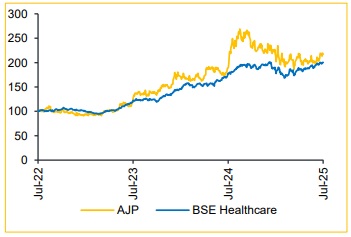

Add Ajanta Pharma Ltd For Target Rs. 2,995 By Choice Broking Ltd

Growth Continues, but Margins Under Pressure

While the company has posted healthy revenue growth—particularly in US generics—most of the contribution stemmed from H2FY25 product launches. We believe the company is currently in an investment phase, actively building its pipeline and filing ANDAs. This is expected to drive higher promotional and employee-related costs, resulting in EBITDA margin pressure. Management has revised its EBITDA margin guidance downward, now expecting margins to moderate to 26–27%, compared to the earlier range of 28–29%. However, we expect launch-related and employee expenses to normalise from FY27E, easing the pressure on margins. In light of this, we revise our FY26E/FY27E EPS estimates downward by 9.7%/6.3% and introduce FY28E estimates. We value the company at 30x (unchanged) average of FY27E/FY28E EPS, arriving at a revised target price of INR 2,995 (Q4FY25: INR 3,180), and downgrade our rating to ADD.

Revenue Beat on US Generics Growth; Margins Under Pressure

* Revenue grew 13.8% YoY / 11.3% QoQ to INR 13.0 Bn (vs. consensus estimate: INR 12.7 Bn).

* EBITDA rose 6.4% YoY / 18.2% QoQ to INR 3.5 Bn; margins contracted 188 bps YoY / expanded 158 bps QoQ to 27.0% (vs. consensus: 28.1%).

* PAT increased 3.9% YoY / 13.4% QoQ to INR 2.6 Bn (vs. consensus estimate: INR 2.5 Bn).

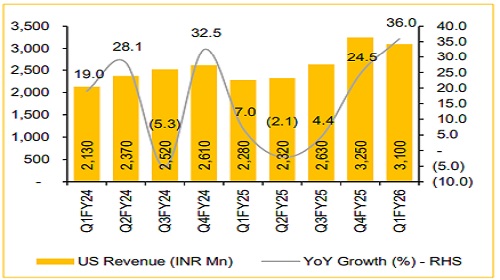

US Generics Set for Mid-Teens Growth with Healthy Launch Pipeline

US Generics delivered strong performance with 36% YoY growth, reflecting the full-quarter impact of H2FY25 launches. The company added one new product during the quarter and plans to launch 2–3 more in FY26E. Management also remains confident of filing 10–12 ANDAs over the year. Backed by a strong pipeline and ramp-up of recent launches, we believe the company is well-positioned to sustain its growth momentum and deliver midteens growth in FY26E.

EBITDA Margins Under Pressure; FY26 Guidance Lowered to 26–27%

Gross margins improved, driven by a higher contribution from US generics and favorable API pricing. However, EBITDA margins contracted slightly due to an expanded field force and elevated operating expenses. Management has revised its margin guidance downward, now expecting FY26 margins to remain in the 26–27% range (vs. earlier 28–29%). The moderation is attributed to increased R&D investments and ANDA filing costs as the company builds its pipeline.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131