Hold Apar Industries Ltd For Target Rs.9,744 by Prabhudas Liladhar Capital Ltd

Structural strength intact amid near-term delays

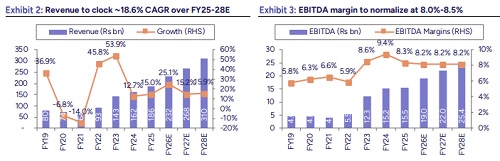

We interacted with the management of Apar Industries (APR) to assess the domestic demand environment, the implications of US reciprocal tariffs, and the company’s overall business outlook. The management reiterated guidance of ~Rs30,000 EBITDA/mt and ~10% volume growth in conductors, alongside ~8% YoY growth in specialty oils in FY26. The impact of reciprocal tariffs is expected to be limited to order finalization timelines. The tariffs are unlikely to have a material financial impact. Domestically, demand continues to be driven by power T&D, renewables and railways, while exports are supported by the US, Asia, the Middle East and Africa. The cables business remains a key growth engine, with the management targeting ~Rs100bn in revenue, underpinned by capacity expansion and rising demand for specialty, power and low-duty cables. Q3FY26 is expected to remain muted due to elevated raw material prices and slower order finalizations, followed by a recovery in Q4FY26. The stock is trading at a P/E of 28.4x/24.8x on FY27/28E earnings. We maintain our ‘HOLD’ rating valuing the conductors/cables/specialty oils segment at a PE of 34x/34x/12x Sep’27E (same as earlier) arriving at SoTP-derived TP of Rs9,744 (same as earlier).

Chinese competition in non-US markets, pace of re-tendering in Indian market, and potential tariff impact on cables segment will be key monitorables in the medium term. However, we are long-term positive on the stock owing to

1) robust T&D capex driving demand across segments,

2) focus on premium conductors in the domestic market,

3) healthy traction in elastomeric cables used in renewables, defense and railways, and

4) market leadership in the growing transformer oils (T-oils) business.

Management meet key takeaways:

Conductors: Premium mix, capacity scale-up and domestic strength anchor EBITDA/mt of ~Rs30,000

EBITDA/mt to remain above Rs30,000 going forward

* EBITDA/mt of at least Rs30,000 is anticipated to be driven by higher contribution of premium products (having higher margin compared to nonpremium) and the company’s expansion into newer geographies.

* Margins will also be supported by an anticipated ~10% YoY volume growth in FY26, driven by capacity expansion given the strong traction in the domestic market.

* APR’s conductors capacity stood at 2,50,000t in FY25, which is anticipated to reach 2,75,000–2,80,000t by end-FY26.

* APR’s conductors capacity is anticipated to grow at ~10% CAGR from FY26. ? H2FY26 outlook

* Conductors’ Q3FY26 performance is expected to be muted due to higher raw material prices and slower order finalizations.

? But the segment is expected to bounce back in Q4FY26 and see a healthy H1FY27.

US tariff impact limited to order finalization delays

* Conductors are metal-intensive products with 65-70% of aluminum or copper content.

* And this metal content is currently attracting ~50% tariff.

* In most of the contracts, metal cost escalation clauses allow APR to pass through any increase in costs due to tariffs, thus protecting margins.

* Hence, the impact of reciprocal tariffs is short term and limited to order finalization delays.

Domestic market dynamics

* APR commands strong leadership in niche conductor segments, with ~50% market share in HTLS, ~20% in CTC, and ~70% in railways, reflecting high entry barriers.

* CTC scale-up has materially improved APR’s market positioning, with volumes up ~3x post capex and 3–4 of 6 expansion phases already completed.

* CTC is a structurally critical component, forming ~30% of transformer cost, with APR contributing ~35% to overall production value.

* Higher penetration of HTLS and CTC is expanding APR’s domestic addressable market, strengthening its participation across power T&D and transformer-led capex cycles.

Exports

* Exports account for ~25% of conductors revenue. The US accounts for 5- 8% of total exports, while the volume contribution stands at 3-4%.

* The US demand is driven by data centers, renewable energy and refurbishment projects from 50-60 year-old power plants.

* In FY25, the Middle East and Africa together accounted for 5-6% of APR’s conductors revenue, while Asia stood at ~4% and others, including Europe, accounted for ~15%.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271