Hold Kajaria Ceramics Ltd For target Rs. 1,083 by Prabhudas Lilladher Ltd

Vendor fraud identified, controls tightened

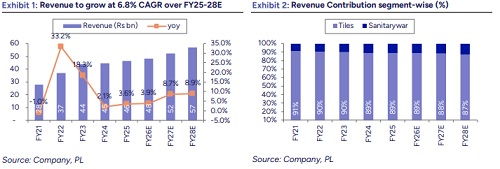

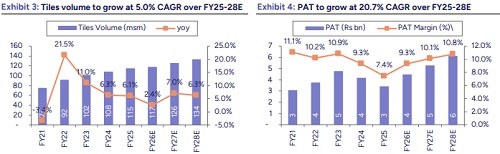

We attended the conference call hosted by Kajaria Ceramics (KJC) to discuss the fraud incident within its bathware subsidiary chain. Management stated that a limited vendor-related fraud at Kerovit Global Private Limited (KGPL), a step-down wholly owned subsidiary, was identified during the rollout of a strengthened digital vendor onboarding framework and CWIP reconciliation. The fraud involved embezzlement and fund siphoning by Mr. Dilip Kumar Maliwal, CFO of Kajaria Bathware Private Limited (KBPL), a wholly owned subsidiary of KJC. Corrective actions include termination of the executive, filing of police complaints, a potential forensic review, and recognition of ~Rs 200mn as an exceptional item in FY26, with partial recovery already initiated. The company emphasized that the incident is isolated and the financial impact remains limited. We upward our FY27E earnings estimate by 1.3% and downward FY28E earnings estimate by 2.0% and roll forward it to Dec’27 with a TP of Rs 1,083 (Earlier Rs 1,288). We have considered 5.0% CAGR in tiles volume over FY25-28E with EBITDA margin of 17.0% in FY28. We expect Revenue/EBITDA/PAT CAGR of 6.8%/15.3%/20.7% over FY25-28E. Maintained ‘HOLD.’

Kajaria currently holds an 85% stake in KBPL: Kajaria Bathware Private Limited (KBPL), incorporated in 2013, manufactures bathware fittings and trades in sanitaryware products primarily under the Kerovit brand. The company operates a manufacturing facility at Gailpur, Rajasthan, with an installed capacity of 2.8mn pieces

Conference Call Takeaways:

* KJC has implemented a structured vendor onboarding framework supported by a third-party digital platform, enabling end-to-end onboarding—from vendor registration to payment enablement—through a centralized portal across KJC and its subsidiaries. Vendors submit GST, PAN and bank details via a secure link, which are digitally validated; any discrepancies result in an immediate halt to transactions.

* The extended vendor validation exercise flagged inconsistencies at Kerovit Global, and during the transition to the new digital onboarding system and CWIP reconciliation, the fraud was detected, leading to the filing of a formal complaint and initiation of corrective actions

* The company observed that the capex investment, despite being completed, continued to be reflected as CWIP. CWIP stood at Rs 60mn in FY25 and increased to Rs 140mn in 9MFY26, aggregating to Rs 200mn

* The vendor had been associated with KJC for nearly eight years; however, the fraudulent activity occurred over the past two years.

*The fraud involved payments made by Kerovit to a vendor entity that effectively resulted in self-payments linked to the CFO.

* A complaint has been filed with the local police authorities, and investigations are ongoing. No depreciation had been charged, as the amounts remained classified under CWIP (Rs 60mn in FY25 and Rs 140mn in FY26).

*The incident pertains to a single supplier, wherein advance payments were made under the misrepresentation that they were towards plant and machinery procurement.

* The company has indicated that it will undertake further reviews and reverification and may consider a forensic audit to strengthen controls and prevent recurrence through stricter systems.

* The financial impact of Rs 200mn will be recognized as an exceptional item in FY26. Around Rs 6mn has already been recovered, and the company is pursuing recovery of the remaining amount, in consultation with auditors.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271