Buy Bharat Electronics Ltd For the Target Rs.370 by Choice Broking Ltd

Big BEAT from BHE in the beaten down sector; execution prowess shines

* Revenue for Q3FY25 came at INR 57.7 Bn (vs CEBPL est. INR 49.6 Bn), up 39.3% YoY and up 25.3% QoQ to, led by robust orders execution.

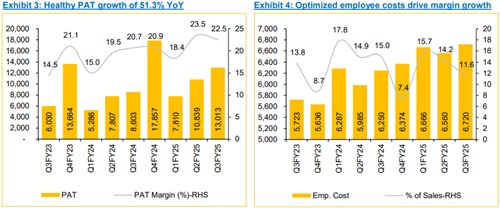

* EBIDTA up 55.7% YoY and 19.3% QoQ to INR 16.7 Bn (vs CEBPL est. INR 11.2 Bn), the margin stood at 28.9%, improved 304bps YoY (vs CEBPL est. of 22.5% YoY) due to cost control measures.

* PAT jumped significantly by 51.3% to INR 130.1 Bn (vs CEBPL est. INR 7.6 Bn).

* The management has upgraded its guidance, forecasting strong revenue growth exceeding 16%, supported by expanding gross margins of 42-44% and a healthy EBITDA range of 23-25%.

* LRSAM, Weapon Locating Radar (WLR), ISECS system, Shakti EW System, Akash, and Civic infrastructure project are the major orders which were executed in Q3FY25.

A strong order pipeline of INR 711Bn (3.1x TTM Sales) provides revenue visibility over the next few years:

BHE has set a target of INR 250 Bn in order wins for FY25. It has so far secured orders worth INR 110 Bn in 9MFY25, with 85-90% of these originating from the defence sector. We believe BHE to meet the target of INR 250 Bn. Looking ahead, BHE anticipates significant growth in new orders, ranging between INR 300-400 Bn in FY26. It has several notable upcoming projects, including the QR-SAM project worth INR 250-300 Bn (expected by March 2026), MR-SAM, MF-STAR & NGC Corvettes valued at INR 140-150 Bn (expected in FY26), and Akash Prime along with other smaller projects worth over INR 50 Bn. Additionally, BHE diversification into non-defence sectors such as metro projects, civil aviation, and IT infrastructure further strengthens its growth.

Consistent execution to drive profitability growth:

We expect BHE is projected to achieve 19.8% CAGR revenue growth over FY24-27, driven by a robust order book, efficient project execution, and contributions from both the defence and non-defence sectors, and export orders leading to overall profitability. Additionally, we expect EBITDAM to remain in the range bound from 24.9% in FY24 to 25.2% in FY27. We anticipate EPS is expected to grow at an accelerated pace, increasing from INR 5.5 in FY24 to INR 9.24 in FY27 due to cost optimization measures and long-term contracts. We do not expect significant changes in WC days. It remains the same in the range of FY24(~200 days)

View & Valuation:

We maintain a positive outlook on BHE given its strong longterm growth prospects, supported by a robust order backlog and pipeline, driven by the government's emphasis on defence indigenization. The company's strong financials and return ratios, along with consistent margin improvement, reinforce our confidence in its financial performance. We revise our estimates of FY26/27 EPS estimates by 3.4%/4.3% and maintain our rating to ‘BUY’ with a revised TP of INR 370, valuating it at 40x of FY27E EPS

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131