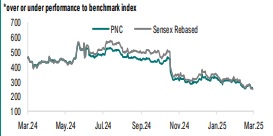

Buy PNC Infratech Ltd For Target Rs. 305 By Geojit Financial Services Ltd

Removal of MoRTH ban provides visibility...

PNC Infratech Ltd. (PNC) is an infrastructure construction, development and management company with expertise in execution of projects including highways, bridges, flyovers, airport runways, industrial areas, and transmission lines.

* MoRTH had lifted the ban on PNC in February, which is a highly positive development. This change allows the company to participate in bidding for new road and highway projects.

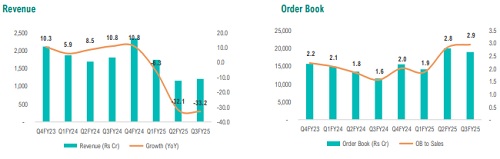

* The company's performance in Q3FY25 was weak due to subdued project execution, which resulted from slow progress in project awards and delays in receiving the appointed date.

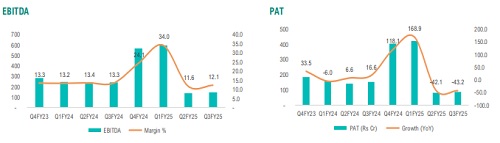

* Consequently, EBITDA margin during the quarter declined by 117 bps YoY to 12.1%. However, the management expects the execution to pick up substantially in FY26 with a growth of 35%+ with an EBITDA margin of 13%.

* The order book stood at Rs 18,962cr (2.9x TTM revenue); with the removal of ban, the company is expecting additional orders of Rs 6,000cr to Rs 9,000cr in Q4.

* PNC is also focusing on expanding its order book to the railway and water segments. Currently, the water & canal segment constitutes 17% of the order book

Outlook & Valuation

We expect with the removal of the ban by MoRTH, the company is now eligible to bid for NHAI and MoRTH road projects, which will enhance execution for FY26. The improving order inflow and revenue will aid in a re-rate in the current discounted valuation. We therefore revise our current Neutral rating to BUY with a Target Price of Rs 305, based on a P/E of 9x FY27 EPS and HAM assets at 0.4x P/B.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345