Buy Artemis Medicare Services Ltd For Target Rs. 325 By Choice Broking Ltd

Scaling Up Care – 2x Bed Expansion Propels Next Leg of Growth

ARTMSL’s flagship Gurgaon hospital recorded the highest ARPOB (INR 83,900 in Q1FY26), driven by advanced clinical programs such as robotic surgery and CyberKnife. It currently operates over 700 beds, with plans to add ~120 beds (~17%) in the Gurgaon facility over three years, plus 300 beds in Raipur and ~600 in South Delhi, effectively more than doubling the total bed capacity by FY29 to ~1,700 beds. By FY28E, total operational beds are expected to reach ~1,000 with an occupancy of ~65% and ARPOB of INR 88,490.

The ~600-bedded capacity would get support from the binding MoU with VIMHANS. With this MoU, ARTMSL marks its entry into mental health and expand neurocare, committing INR 60,000 Mn over the next 2–3 years. ARTMSL de-risks growth with INR 3,300 Mn IFC CCD funding, enabling rapid quaternary hospital expansion in NCR and Tier-2 cities, but this would dilute ~15% EPS.

Industry-leading revenue from International Patients

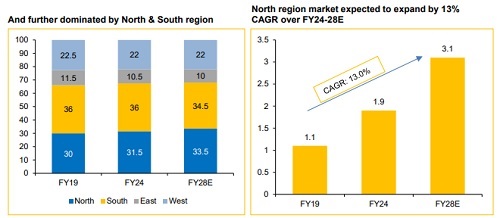

The Gurgaon facility’s proximity to Delhi International Airport (~20 km) and excellent connectivity positions it as a natural hub for International Patients. These patients generally seek high-complexity, technology-driven procedures, an area where ARTMSL demonstrated strong expertise.

International Patients (segment) generates the highest ARPOB and strong EBITDA margin at Gurgaon, enhancing revenue quality. This segment remains a key earnings driver, with its share rising, from 26% in FY23 to 29% in FY25, and expected to exceed 30% after the ~600-bed South Delhi facility launch.

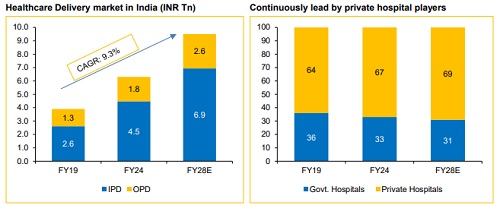

ARTMSL: Well-Positioned to Cash in on India’s Healthcare Upswing

India’s low public healthcare spending and high out-of-pocket costs are driving a shift to a multi-billion-dollar hospital market fueled by rising demand and capacity expansion. For PE investors, this sector offers a rare mix of defensive growth, predictable cash flows, and multiple levers for value creation. ARTMSL is set to benefit from India’s growing healthcare demand with its scalable, asset-light model, strong NCR base, and expansion into Tier-II cities driving long-term profitable growth.

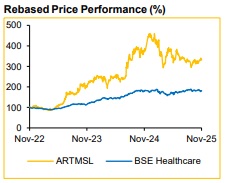

Investment View: ARTMSL plans to more than double its bed capacity (from 700 to ~1,700), sustain industry-leading revenue from International Patients and capitalise on the ongoing strong industry tailwinds. In our projections till FY28, we have included Raipur and 80-bed Gurgaon expansion, excluding South Delhi, (operational in FY29). We expect the company to deliver significant Revenue/EBITDA/PAT CAGR of 26.1%/30.3%/30.9% over FY25—28E.

Thus, we initiate coverage on ARTMSL with a BUY recommendation and target price of INR 325, with an upside of 32.7%, by valuing the company on 18x EV/EBITDA on an Avg of FY27–28E, implying a PE multiple of 41.4x/27.9x at FY27E EPS/FY28E EPS. ARTMSL trades at PEG ratio of 1.07 as compared to the peer group, which trades in the range of at 2—4, implying strong upside for ARTMSL.

BULL/BEAR Case

Optionality: Execution of the South Delhi facility by FY29 has the potential to meaningfully accelerate ARTMSL’s growth path. (Refer to Unit Economics)

Risks to our BUY rating: Potential competition in NCR for acquiring patients and experienced staff and possible delay in the execution of the upcoming facilities.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131