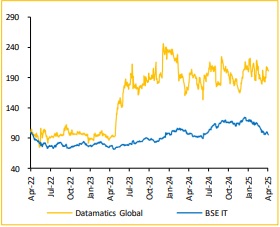

Hold Datamatics Global Services Ltd For the Target Rs. 610 by Choice Broking Ltd

Assessing Q3 Results amid Trump Tariffs & Macroeconomic Challenges

Revenue beats estimates, EBIT misses, PAT rises on exceptional gain.

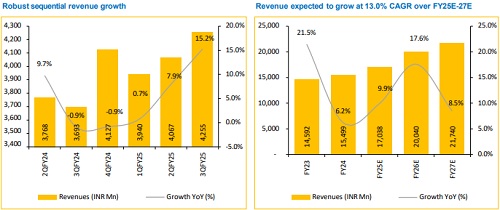

* Revenue for Q3FY25 came at INR 4.2Bn up 15.2% YoY and 4.6% QoQ (vs CEBPL est. at INR 4.1Bn).

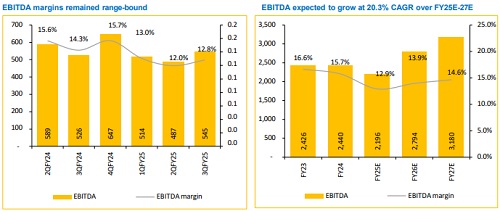

* EBIT for Q3FY25 came at INR 0.4Bn, up 2.3% YoY and 13.7% QoQ (vs CEBPL est. at INR 0.6Bn). EBIT margin was down 133bps YoY but up 84bps QoQ to 10.5% (vs CEBPL est. at 14.6%).

* PAT for Q3FY25 stood at INR 0.7Bn, up 80.0% YoY and 75.4% QoQ (vs CEBPL est. at INR 0.6Bn).

DATA's acquisition of TNQTech to drive INR2.8Bn revenue growth and deliver positive EBITDA accretion:

Acquisition of TNQTech is set to significantly boost DATA's Digital Operations segment, which specializes in managing digital content for scientific journals. TNQTech, with annual revenue of INR2.8Bn & robust EBITDA margins of 24- 25%, will positively impact DATA’s financial performance starting Q4FY25. This acquisition also strengthens DATA’s position in the European market, where 47% of TNQTech's revenue is generated. Post-acquisition, the combined revenue from the US and Europe is expected to increase to 80-85%. Moreover, we expect that the deal is expected to enhance margins, with DATA targeting mid-teen margin levels by FY26E, thus improving overall profitability

DATA aims to achieve INR20Bn topline for FY26E: DATA reported strong Q3FY25 performance, with total revenues of INR4,255Mn, reflecting a 15.2% YoY & 4.6% QoQ growth. DATA added 12 new customers during the quarter. On the segment front, Digital Technologies contributed 41%, Digital Operations 42%, & Digital Experiences 17% to total revenue. Management is optimistic about the outlook for all three segments.

* Digital Technologies segment is set to maintain its growth, fuelled by digital transformation projects and partnerships with hyperscalers like Microsoft and Google. DATA is actively pursuing joint go-to-market strategies, with results expected in the coming years. Dextara acquisition, providing Salesforce services, will contribute further growth.

* Digital Operations segment is poised for substantial growth with the TNQTech acquisition, enhancing DATA's market position in digital content. TNQTech’s strong technology platform will also expand the company's reach, particularly in Europe.

* Digital Experiences segment is expected to perform well, driven by ongoing demand. For FY26, consolidated revenue is anticipated to beat INR20Bn.

Potential slowdown in IT spends amid Trump tariffs poses risk for DATA:

DATA could encounter revenue challenges due to uncertainty over the Fed's interest rate decisions and concerns about a potential US economic slowdown. With 54% of its revenue from US, reduced IT spending or delayed contract renewals in key sectors may impact growth. Currency volatility also poses margin risks, though easing inflation and stable tariffs could boost demand.

View & Valuation:

DATA has shown moderate sales growth (6%-9%) over past 2 years & faced margin pressures (from 16.6% in FY23 to 13% now) due to its small market share in competitive IT services market. Additionally, gradual dilution of the promoters' stake since FY23 (from 74% to 66%), has moderated, remains a concern. However, the strategy to drive topline growth through inorganic expansion highlighted by acquisitions of Dextara & TNQTech holds potential for positive outcomes. Successful integration of these acquisitions could lead to margin expansion, while innovations like Agentic AI powering platforms such as FINATO and TruBot, may further fuel growth. We value DATA at a PE multiple of 14x (no change) implying target price of INR610 based on FY27E EPS of INR 43.5. DATA is a potential candidate for rerating if company meets industry matching sales growth, margin expansion with successful acquisition integration & no further dilution of promoter stakes.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)