Buy V-Mart Retail Ltd for the Target Rs. 1,040 by Motilal Oswal Financial Services Ltd

Improved productivity and margin expansion led re-rating on the cards

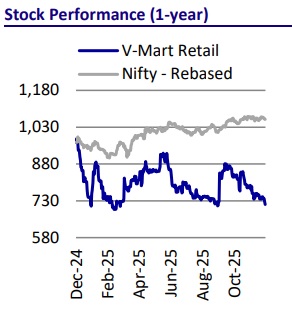

With basic needs in rural India being fulfilled through government initiatives, such as free food schemes and cash handouts for women, disposable incomes have risen, driving growth in aspirational spends that benefits value fashion retailers. V-Mart remains a key beneficiary of the unorganized-to-organized shift and rising preference for one-stop shops in tier 2+ towns in India. We expect V-Mart to deliver a robust ~18% revenue CAGR over FY25-28, driven by consistent ~13% annual store additions and mid-single-digit SSSG. Further, with a significant reduction in LimeRoad (LR) losses, improving productivity of new Unlimited stores, cost efficiency measures, and operating leverage, we expect ~290bp expansion in preINDAS EBITDA margins to reach ~7.2% by FY28, driving ~39% CAGR over FY25-28. Despite strong growth and margin expansion potential, V-Mart trades at a modest ~19x FY27 pre-INDAS EV/EBITDA (vs. 40x for VMM). We reiterate our BUY rating on V-Mart with a revised TP of INR1,040, premised on 23x Dec’27E pre-INDAS 116 EV/EBITDA (implies ~12x Dec’27 EBITDA and ~39x Dec’27 EPS). Our scenario analysis indicates compelling risk reward (bull case: INR1,250; bear case: INR685). V-Mart is among our top picks in the retail sector for 2026.

Consistent ~12-13% annual store additions to drive growth

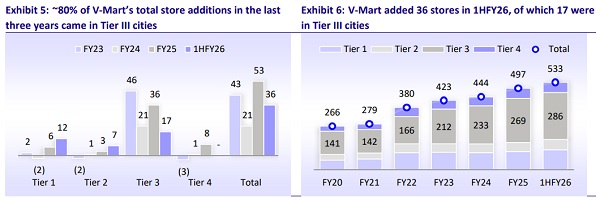

* Over FY19-25, V-Mart added stores/area at ~12% CAGR in the core V-Mart format, and also acquired Unlimited to expand its presence in South and West India.

* ~80% of V-Mart’s recent store expansions have been in tier-3 markets, which indicates a focus on deepening its presence in core markets while strategically expanding into newer areas.

* After three years of store rationalizations and pricing adjustments, the new Unlimited stores are now performing in line with core V-Mart stores. Improved performance of Unlimited, especially in markets such as Tamil Nadu, has been a key factor behind management’s decision to raise its store addition target to ~75 for FY26 (vs. 60-65 earlier).

* With the cleanup of legacy underperforming Unlimited stores largely complete, V-Mart is entering into the next phase of expansion with a clear, regionally differentiated strategy.

* Core V-Mart will continue to scale in its stronghold markets of North and East India, where brand recall and proven unit economics support steady store expansion. Meanwhile, Unlimited will focus on states such as Tamil Nadu, while selectively expanding in other Southern states.

* We expect ~50-55 annual store additions in core V-Mart and ~20-25 annual store additions in Unlimited, bringing V-Mart’s total store count to ~720 by FY28 (~13% CAGR over FY25-28).

Improved Unlimited productivity and mid-single digit SSSG to drive 18% revenue CAGR

* V-Mart is emerging from a prolonged period of disruption and strategic reset. FY19-23 experienced margin contraction, led by a series of events, such as COVID-19, the integration of acquisitions (Unlimited and LR), and high cotton prices, which impacted both growth and profitability.

* Over the last three years, management has decisively addressed these issues through aggressive store rationalization, sharper merchandising, ASP resets (especially at Unlimited), faster design to shelf cycles, higher private label mix, refreshed store formats, and tighter cost controls.

* These strategic actions have led to improved footfalls and higher conversions, translating into strong volume growth and SSSG recovery.

* As a result, V-Mart’s monthly SPSF posted ~10% CAGR over FY22-25, reaching ~INR667/sqft (though still significantly below peers, with V2 at INR957/sqft and VMM at INR771/sqft).

* Going ahead, we expect the mid-single-digit SSSG and the rising share of betterperforming Unlimited stores to drive ~INR100/sqft improvement in V-Mart’s overall monthly SPSF to INR762/sqft (~5% CAGR) over FY25-28.

* Overall, we build in ~18% revenue CAGR over FY25-28, driven by ~13% store additions and mid-single-digit SSSG.

Margin inflection firmly underway

* V-Mart’s productivity was adversely impacted by the tepid growth recovery following COVID-19, as well as integration and profitability challenges in its acquisitions.

* Corrective measures, such as the closure of unviable legacy Unlimited stores and rationalization of growth ambitions in LR, coupled with improved productivity, have led to a rebound in pre-INDAS EBITDA margins to ~4.4% in FY25, though still significantly below ~7-8% profitability for value fashion peers.

* Improved productivity in newer Unlimited stores and their rising share in the mix, coupled with mid-single-digit SSSG-driven operating leverage in core VMart stores and continued reduction in LR losses, are expected to lift pre-INDAS EBITDA margin by ~285bp over FY25-28, reaching ~7.2% by FY28.

Valuation and view

* V-MART remains a key beneficiary of the unorganized-to-organized retail shift and the massive growth opportunity in value fashion.

* The improving productivity of V-MART and Unlimited stores, the closure of nonperforming stores, and lower losses in LR have led to an improvement in VMART’s overall profitability. However, it still lags value fashion peers on profitability, which provides room for margin expansion.

* We lower our FY26-28 EBITDA estimates by a marginal 1-2%, while the earnings cut is higher primarily due to higher depreciation (linked to accelerated store additions).

* We model a CAGR of 18%/27% in revenue/reported EBITDA over FY25-28E, driven by ~13% CAGR in store additions, mid-single-digit SSSG, and further reduction in LR losses.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412