Add HDFC Asset Management Ltd For Target Rs. 6,200 By JM Financial Services

Good things come with a price tag, upgrade to ADD

HDFC AMC reported strong results – PAT of INR 7.2bn was 11% ahead of JMFe, -4% QoQ, +24.5% YoY. Operating PBT was in line at INR 7.8bn, with higher revenues (+1% JMFe) compensated by higher expenses on ESOPs and NFOs. The company relooked at its on-book tax liabilities, resulting in an effective tax rate of 18% for a quarter, resulting in PAT beat. With sustained strength in yields and strong industry inflows at INR 400bn+ for three straight months, we revise our revenues estimates upwards. Despite higher costs, we raise our EPS by 4%/6%/8% over FY26/FY27/FY28e. We value the company at 38x FY27e EPS of INR 164 to get a revised target price of INR 6,200 (up from INR 5,650). We upgrade to ADD in our new rating system, from HOLD earlier.

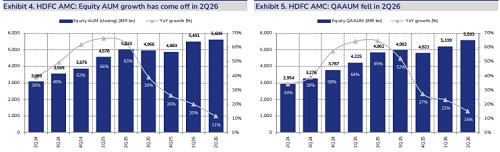

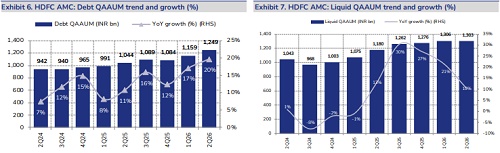

* Growth in AUM came with inflows, as markets declined: IN 2Q, broader markets fell 3.8%, however, HDFC AMC’s schemes outperformed with an MTM of -1.4% (for top 80% AUM). The 1.6% growth in equity AUM came with strong inflows, which included INR 24bn raised in the Innovation Fund NFO. Meanwhile, equity QAAUM grew 8% QoQ (15% YoY) as the closing AUM as of Jun’25 was 6% above the QAAUM for the quarter. While debt and “Other” schemes grew at similar levels of 8% QoQ, liquid funds AUM was flattish on a QoQ basis, hence, supporting revenue yields.

* Revenue yields hold up at 0.47% as share of equity QAAUM improves sequentially: After rationalising its distribution payouts, the company has reported flattish yields of 0.47% for the last 3 quarters. In this quarter, yields were supported by NFO (New Fund Offer) inflows in equity and improving share of higher yielding AUM, as all the AUM buckets, except liquid funds, grew 8% on a quarterly average basis.

* Higher expenses led by ESOP costs, NFO and the accrual of business expansion: Employee expenses grew (13% QoQ, 29% YoY) with a non-cash expense of INR 211mn on account of ESOPs (Employee Stock Option Plan) and RSUs (Restricted Stock Units) while business development and other expenses grew with the NFO. The company has added capacity in terms of employees, especially in building the Alternatives business, and offices, which further put pressure on the costs. After a reset in FY26e, the company expects growth in expenses to be limited to 12-15% on a YoY basis, in the near term. With a 1% beat in core revenues, operating PBT was in line with JMFe at INR 7.8bn. A relook in on-book tax liabilities resulted in an effective tax rate of 18%, leading to an 11% beat on PAT.

* Valuations and view – good things come with a price tag, upgrade to ADD: With strong performance (-1.4% for equity AUM vs -3.8% for the wider market) and its distribution and brand strength, HDFC AMC continues to scale its AUM despite rationalising commissions. We raise our EPS by 4%/6%/8% over FY26/FY27/FY28e. However, valuations of 36x FY27e EPS capture most of the positives. We value the company at 38x FY27e EPS of INR 164 to get a revised target price of INR 6,200 (up from INR 5,650). We upgrade to ADD in our new rating system, from HOLD earlier.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361