Hold Eternal Ltd for the Target Rs. 360 by Axis Securities Ltd

Quick Commerce Led Growth; Competitive Intensity Remains

Est. vs. Actual for Q2FY26: Revenue – BEAT; EBITDA – BEAT ; PAT – BEAT

Change in Estimates post Q2FY26

FY26E/FY27E: Revenue: 38%/103%; EBITDA: 5%/6%; PAT: 3%/7%

Recommendation Rationale

* NOV Growth: Zomato’s B2C operations delivered a strong 57% YoY rise in Net Order Value (NOV) to Rs 23,164 Cr, underscoring broad-based demand momentum. Consolidated revenue soared 183% YoY and 90% QoQ to Rs 13,590 Cr in Q2FY26, with LFL growth of 65%, primarily propelled by exceptional performance in the Quick Commerce segment, which recorded its highest-ever NOV growth of 137% YoY (27% QoQ) in the past 10 quarters. The steep topline jump was largely driven by a shift towards inventory-led operations within the quick commerce vertical. On the expansion front, the company added 272 new stores, taking the total count to 1,816 by Q2FY26. Management remains committed to aggressive footprint growth, targeting 2,100 stores by Dec’25 and 3,000 stores by Mar’27.

* Food Delivery Outlook: The Food Delivery growth rate bottomed out and is on a recovery path with 14% YoY NOV growth, while profitability improved QoQ to an all-time high of 5.3% of NOV from 5% in Q1FY26. Management expects the food business to grow 15% in FY26 (+20% in FY27).

* GST Tax Rates Impact: GST rate cuts have lowered the average tax on Blinkit’s typical basket by ~3%, likely supporting higher demand from Q3FY26 onwards. In Q2FY26, however, growth and margins were muted as customers delayed purchases in anticipation of changes. Additionally, the 18% GST on food delivery charges (affecting ~25% of paid deliveries) slightly weighed on business growth, as the tax was passed on to customers. Delivery charges on Blinkit orders remained unaffected.

Sector Outlook: Cautious on account of increased competitive intensity.

Company Outlook & Guidance: Near-term margin pressure is likely owing to increased competitive intensity.

Current Valuation: SOTP

Current TP: Rs 360/share (Earlier TP: Rs 250/share)

Recommendation: Although the long-term outlook remains strong, we believe competitive intensity is likely to see near-term volatility. Hence, we maintain our HOLD rating on the stock.

Financial Performance

In Q2FY26, Zomato reported revenue of Rs 13,590 Cr, up 183% YoY. The company reported operating profits of Rs 239 Cr and operating margins of 1.8%, down 295 bps YoY, due to higher operating costs on account of rapid store expansion. Net profit de-grew 63% YoY, to Rs 65 Cr.

Outlook:

From a long-term perspective, Zomato has built a resilient business model by securing multiple strategic verticals and delivering broad-based growth. However, near-term challenges, such as rising competitive intensity, rapid store expansion, are likely to keep profitability under pressure. Consequently, we maintain HOLD and value the stock at Rs 360/share based on an SOTP valuation, implying a 3% return from the CMP.

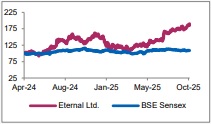

Relative Performance

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)