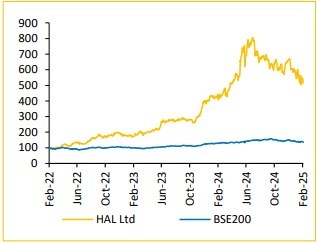

Buy Hindustan Aeronautics Ltd For the Target Rs. 5,000 by Choice Broking Ltd

Decent Q3 performance; Revenue & EBITDA in-line with PAT beating consensus

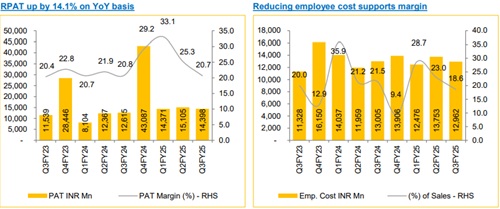

* Revenue for Q3FY25 came at INR 69.6 Bn (vs Consensus Est. of INR 70.1 Bn), up 14.8% YoY and up 16.4% QoQ.

* EBIDTA for Q3FY25 came at INR 16.8 Bn (vs Consensus Est. INR 17.1 Bn), up 17.2% YoY and up 2.6% QoQ. The EBITDA Margin came at 24.2%, improved 50 bps YoY and contracted 326 bps QoQ (vs CEBPL Est. of 24.4%).

* PAT for Q3FY25 came INR 14.4 Bn (vs Consensus Est. of INR 13.2 Bn), up 14.1% YoY and down 4.7%. PAT Margin decreased by 12 bps YoY and 458 bps QoQ, reaching 20.7% (vs CEBPL Est. of 18.8%)

ROH segment: A cornerstone of HNAL's stable revenue growth:

HNAL derives the majority of its revenue (60-70%) from the Repair and Overhaul (ROH) segment, which is expected to grow at a CAGR of 8-9%. The Indian Air Force (IAF) is modernizing its Su-30MKI fleet through a INR 60,000 crore indigenization plan, upgrading 84 aircraft with 78% domestic production. This initiative includes Indianmade avionics, AESA radar, mission computers, and IRST systems, positioning HNAL as the primary beneficiary of the program. HNAL is leading the Su-30MKI upgrade efforts and collaborating with the Gas Turbine Research Establishment (GTRE) on engine modifications. These advancements will reduce dependence on foreign support, extend aircraft lifespan, and are expected to drive significant order inflow in the future

Resolution of GE Engine program could lead to material upside for the stock:

Despite holding a strong order book of INR 941 Bn in end of Mar-24 (~2.9x of TTM sales), we will closely monitor its near-term performance due to execution challenges and supply chain issues. HNAL has faced delays in the delivery of Tejas Mk-1A variant fighter aircraft, impacting order fulfillment. Delays in the GE F404-IN20 variant engine program, which is now more than a year behind schedule, has hindered the company’s ability to meet these high growth expectations in the manufacturing segment. This delay has led to a revision in market expectations regarding HNAL’s manufacturing revenue growth. However, once the GE Engine issue is resolved, we anticipate an order for an additional 97 Tejas Mk-1A aircraft from the Indian Air Force (IAF), which could substantially increase HNAL’s order book and drive long-term growth.

View & Valuation:

We project HNAL Revenue, EBITDA, and PAT to grow at a CAGR of 13.0%, 12%, and 11.3%, respectively, over FY24-27E. As a result, we have revised our earnings estimates for FY26E and FY27E, lowering EPS projections by 2.8% and 2.2%, respectively due to delays in F404-IN20 standard engine. Based on these adjustments, we maintain our "BUY" recommendation and revise our target price to INR 5,000, implying a valuation of 32x FY27E EPS (Earlier 35x). We will closely monitor execution progress, and any improvement in the GE F404-IN20 variant engine delivery timeline could lead to a reassessment of our target price and valuation multiples.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131