Buy Hindustan Aeronautics Ltd for the Target Rs. 5,800 by Motilal Oswal Financial Services Ltd

In-line performance

Hindustan Aeronautics’ (HAL) 2QFY26 revenue/PAT came in line with our estimates. Lower-than-expected margins were offset by higher other income. During the quarter, the company received a follow-on order of 97 Tejas Mk1A worth INR624b and signed a contract with GE for engine supplies for this project. We await the deliveries of Tejas Mk1A fighter jets as the test flight was already conducted in Oct’25. HAL has a strong order book, which provides good visibility on future execution. We broadly maintain our estimates and TP of INR5,800, based on the average of DCF and 32x Sep’27E earnings. We maintain BUY on HAL. Tejas aircraft deliveries and execution of manufacturing order book will be key drivers for the stock going forward.

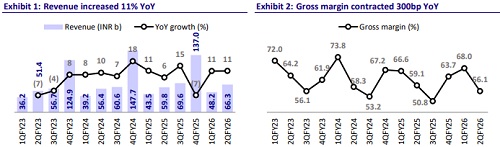

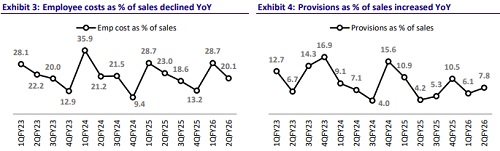

In-line revenue and PAT

HAL reported a decent set of numbers in 2QFY26 with in-line revenue and PAT. Revenue increased 11% YoY to INR66.3b vs. our estimate of INR67.5b. Gross margin contracted 300bp YoY to 56.1%% vs. our estimate of 59.0%. Lower-thanexpected gross margins and higher provisions created during the quarter led to EBITDA margin contraction of 390bp YoY to 23.5%. Absolute EBITDA declined 5% YoY to INR15.6b. The impact of softer EBITDA performance was, to some extent, offset by lower-than-expected depreciation and higher other income. Thus, PAT increased 11% YoY to INR16.7b. For 1HFY26, revenue/EBIDAT/PAT increased 11%/8%/4% YoY, while EBITDA margin contracted 70bp YoY to 24.8%. For 1HFY26, OCF/FCF increased 159%/180% YoY to INR74b/INR66b. HAL has a cash balance of INR416b as of 1HFY26-end. The company incurred a capex of INR7.3b during 1HFY26 compared to INR4.7b in 1HFY25.

Update on the Tejas Mk1A project

The MoD has signed an INR624b contract with HAL for the procurement of 97 additional LCA Mk1A aircraft for the Indian Air Force, comprising 68 single-seat and 29 twin-seat fighters. Deliveries are scheduled to commence in FY28 and conclude within six years. The order carries at least 64% indigenous content, with 67 additional locally sourced components compared to the previous contract, including the UTTAM AESA radar, Swayam Raksha Kavach electronic warfare suite, and indigenous control surface actuators. HAL has also entered into a USD1b deal with GE Aerospace, USA for the supply of 113 units of F404- GE engines and support package for timely execution of the said order. The company successfully completed the expansion of its Nashik production line in Oct’25, increasing its annual LCA manufacturing capacity from 16 to 24 aircraft. The first Tejas Mk1A aircraft produced in HAL’s Nashik complex completed its maiden flight on 17th Oct’25. We have factored in 8 Tejas deliveries for FY26 in our estimates and 16 each in subsequent years.

HAL-UAC partnership to boost India’s regional aviation capability

HAL has signed an MoU with Russia’s United Aircraft Corporation (UAC) in Moscow for the production of the SJ-100 civil commuter aircraft in India. The twin-engine, narrow-body SJ-100, already in operation with over 200 units across 16 global airlines, is expected to significantly boost short-haul connectivity under India’s UDAN scheme. This collaboration is strategically beneficial for HAL as it positions the company to enter the civil aviation manufacturing space, diversifying its portfolio beyond defense and tapping into India’s growing demand for regional connectivity. Leveraging HAL’s established infrastructure, engineering expertise, and supply chain capabilities, the tie-up can accelerate the creation of an indigenous ecosystem for commercial aircraft production

HAL in race for the AMCA project

In early FY26, the ADA issued a formal Expression of Interest (EoI) to invite bids from Indian companies, including private players, to co-own the Advanced Medium Combat Aircraft (AMCA) program and participate in the development, flight testing and certification of the aircraft. The ADA has received EoIs from 1) HAL along with two smaller firms, 2) L&T with BEL, 3) Tata Advanced Systems, 4) Adani Defence and Aerospace, 5) Goodluck India with BrahMos Aerospace Thiruvananthapuram and Axiscades Technologies, and 6) Bharat Forge-BEML-Data Patterns partnership. The ADA’s criteria stipulate that the winning consortium must be capable of building prototypes, supporting flight tests, and setting up facilities for series production, all within a strict timeline. It is a long-timeline project spanning out across 10 years. Timeline of AMCA project: ? Shortlisting of EoIs expected in 3QFY26 ? RFP expected in 4QFY26 ? Announcement of the winner to build the prototype by 4QFY27 ? First prototype expected to roll out and take maiden flight in FY29-30 ? Full scale production and induction targeted around mid-2030s In this particular project, HAL may face competition from private players. However, AMCA provides an opportunity worth INR1.2t-1.5t for the series production, with an initial budget of INR150b for prototype development.

Financial outlook

We expect the overall revenue to grow at a CAGR of 24% over FY25-28, primarily driven by a scale-up in manufacturing revenue. We expect EBITDA margin to remain strong at 29.6%/28.5%/27.2% for FY26/FY27/FY28, fueled by indigenization efforts taken by the company as well as lower provisions. With an annual capex of INR40b/ INR50b/INR60b over FY26/FY27/FY28 and comfortable working capital, we expect PAT to register a 17% CAGR over FY25-28. With improving revenue and stable margins, we expect RoE/RoCE to remain comfortable, reaching 22.1%/22.6% by FY28.

Valuation and view

HAL is currently trading at 33.2x/29.5x/24.0x P/E on FY26E/FY27E/FY28E EPS. We broadly maintain our estimates and reiterate our BUY rating on the stock with an unchanged TP of INR5,800, based on the average of DCF and 32x two-year forward earnings.

Key risks and concerns

Key risks would include 1) slower-than-expected finalization of large platform orders, 2) further delays in deliveries of key components such as engines for Tejas Mk1A, 3) delays in payments from MoD, and 4) increased involvement of the private sector

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412