Neutral KNR Constructions Ltd for the Target Rs. 210 by Motilal Oswal Financial Services Ltd

Miss on execution; lack of order inflows to curb growth ahead

* KNR Constructions (KNRC)’s 4QFY25 revenue dipped 28% YoY to ~INR8.5b (20% below our estimate).

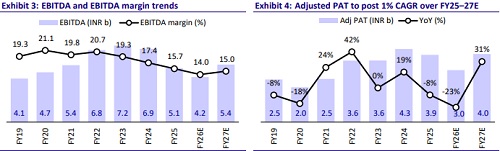

* EBITDA margin contracted 340bp YoY to 13.8% (vs. our estimate of 17.0%) in 4QFY25. EBITDA declined 42% YoY to INR1.2b (vs. our estimate of INR1.8b). In line with weak operating performance, its APAT decreased 43% YoY to INR752m (39% below our estimate of INR1.2b).

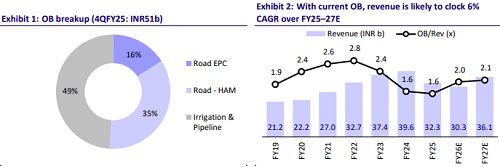

* The current order book is ~INR51b, of which HAM projects make up 35%.

* In FY25, revenue was INR32.3b (-18% YoY), EBITDA stood at INR5.1b (-26% YoY), EBITDA margin was 15.7%, and APAT stood at INR3.9 (-8% YoY).

* The operating performance for 4QFY25 was far below our estimates due to muted execution. Management expects flat-to-negative revenue growth in FY26 due to a limited executable order book, and it has also reduced its EBITDA margin guidance for FY26 because of weak execution.

* Factoring in weaker execution trends and a soft order book, we cut our revenue estimates for FY26/FY27 by ~18%/24% and our EBITDA estimates by ~32%/33% for the same period. We expect EBITDA margin estimates to range ~14-15% over FY25-27, up from the earlier estimate of 16-17%. Further, considering sluggishness in NHAI’s order awarding and the lack of diversification to other infra segments, the growth outlook appears challenging for KNRC. We downgrade the stock to Neutral (from Buy) with a revised SoTP-based TP of INR210. We value the EPC business at a P/E of 12x on FY27E EPS and BOT assets at 1x investment value.

Key takeaways from the management commentary

* As of Mar’25, KNRC reported an order book of INR50.5b. The current bidding pipeline is strong, with opportunities worth INR300-400b from NHAI, INR100-150b from various state government projects, and an additional INR20-50b from the mining sector.

* For FY26, KNRC expects revenue worth INR25-30b from its existing order book. Additional revenue could accrue depending on the award of new contracts, such as those from MSRDC, which could contribute INR3-4b.

* The company anticipates EBITDA margins in the range of 13–14%, slightly lower YoY due to elevated overheads and a relatively softer execution.

* Meanwhile, there is no ban on the parent company for bidding for projects, although the involved subsidiary may face a ban. The company is actively engaging with authorities and is optimistic about a favorable resolution. Insurance coverage is unlikely to cover the repair costs for the damaged structure, but the impact is expected to be manageable.

Valuation and view

* Factoring in a subdued execution in FY25 and a thin order book, we now expect a tepid revenue CAGR of 6% over FY25–27E. EBITDA margin assumptions are also revised downward to 14–15% (from 16–17% earlier), in line with weak guidance. Given the ongoing slowdown in project awards by NHAI, we sharply cut our revenue estimates for FY26/FY27 by ~18%/24% and EBITDA estimates by ~32%/33%.

* We downgrade the stock to Neutral (from Buy) with a revised SoTP-based TP of INR210. We value the EPC business at a P/E of 12x on FY27E EPS and BOT assets at 1x investment value.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412