Neutral Torrent Pharma Ltd for the Target Rs. 3,770 by Motilal Oswal Financial Services Ltd

Execution gains in DF/LATAM/US

Softness in EU persists in 2Q; valuation limits upside

* Torrent Pharma (TRP) delivered in-line financial performance for the quarter. YoY growth improved in the US generics and LATAM markets, led by new product launches and steady market share gains in the base portfolio.

* After a slowdown in the LATAM business in FY25, TRP has revived growth in this segment, outperforming the market over the past two quarters. Product approvals and enhanced marketing efforts have driven higher YoY growth. The company has already submitted the application for Semaglutide and is well-positioned to benefit from this opportunity, given its strong brand franchise in this market.

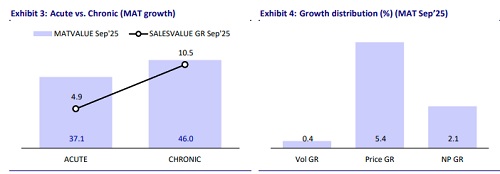

* In the Domestic Formulation (DF) segment, TRP faced minimal impact from the GST transition and outperformed the industry. Notably, it recorded a higher YoY volume growth of 3.7% vs the industry (0.5%) in 2QFY26.

* Following the receipt of a voluntary action indicated (VAI) at its US site in Aug’24, the business has recorded healthy growth over the past two quarters, driven largely by new product launches.

* We largely maintain our estimates for FY26/FY27/FY28. We value TRP at 40x 12M forward earnings to arrive at a TP of INR3,770. TRP remains wellpositioned to deliver industry-leading growth in DF/LATAM. While current product launches have enabled a pick-up in the US growth, the pace of filings is expected to accelerate from FY27 onwards. Temporary disruptions continue to impact the EU business in the near term. Considering all these factors, we expect a 13%/16%/23% revenue/EBITDA/PAT CAGR over FY25- 28. Integration and synergy benefits from the JB acquisition are expected to materialize following the completion of the acquisition process. Considering the limited upside from current levels, we reiterate Neutral on the stock.

Sales/EBITDA rise 14%/15% YoY; PAT grows at a high rate of 33% due to lower tax rate

* Sales grew 14.3% YoY to INR33b.

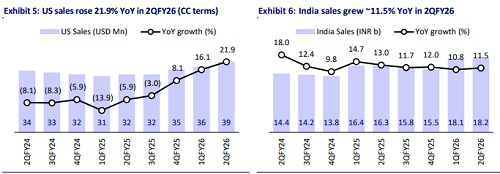

* DF revenue grew 11.5% YoY to INR18.2b (55% of sales). US generics grew 25.7% YoY to INR3.4b (10% of sales). LATAM business grew 21% YoY to INR3.2b (10% of sales). ROW+CDMO sales grew 19.6% YoY at INR5.2b (16% of sales). Germany sales rose 5.2% YoY to INR3b (9% of sales).

* Gross margin contracted 75bp at 75.8% for 2QFY26.

* EBITDA margin expanded 30bps YoY to 32.8%, as the increase in RM costs (up 75bps YoY as a % of sales)/employee costs (up 20bps YoY as a % of sales) was offset by lower other expenses (down 125bps YoY as a % of sales).

* Accordingly, EBITDA grew 15.3% YoY to INR10.8b (vs our Est: INR10.7b).

* Adj. PAT grew 32.6% YoY to INR6b. Exceptional item pertains to regulatory/statutory fees.

* For 1HFY26, Revenue/EBITDA/PAT grew 13%/14%/17% YoY

Highlights from the management commentary

* TRP delivered volume/new launches/price YoY growth of 3.7%/3%/5.5% in the DF segment for the quarter.

* The company delivered 13% YoY growth in the chronic segment vs industry YoY growth of 11%. The outperformance was driven by a superior show in therapies like cardiac and gastro.

* TRP’s DF segment faced minimal impact from the GST transition during the quarter.

* TRP delivered 13% YoY CC growth in the Brazilian market vs the industry YoY growth of 7% in 2QFY26.

* The company has filed for Semaglutide in the Brazilian market. Given the product’s relevance for the patient population, the Brazilian regulatory agency may prioritize Semaglutide submissions across companies.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412