Accumulate Torrent Pharmaceuticals Ltd for the Target Rs. 4,200 By Prabhudas Liladhar Capital Ltd

BGx segments continue to outperform

Quick Pointers:

* Minimal GST impact (~0.5%); operations normalized post-September rollout.

* JBChem operational control likely from Jan’26.

Torrent Pharma’s (TRP) Q2FY26 EBITDA was in line with our estimates. Our FY26/ FY27E EBITDA broadly remain unchanged. TRP reported Rs 90bn (80% of total sales) worth of highly profitable branded formulation (BGx) sales spread across India, Brazil and RoW markets. The acquisition of JB Chemicals & Pharma (JBCP) appears strategically compelling, making it the 5th largest player in the domestic pharma market. This will further be strengthening its position in high-margin chronic therapies and opens up many newer therapeutic areas. The deal also adds JBCP’s CDMO vertical, offering diversification and growth optionality.

The deal is considered financially attractive and strategically sound with long -term earnings accretion. TRP trades at 23.5x and 20x EV/EBITDA on FY27E and FY28E for the combined business. We maintain our Accumulate with revised TP of Rs4,200/share, valuing at 25x EV/EBITDA on Sept 2027E for combined entity. Guidance for key synergies from JBCP deal will key.

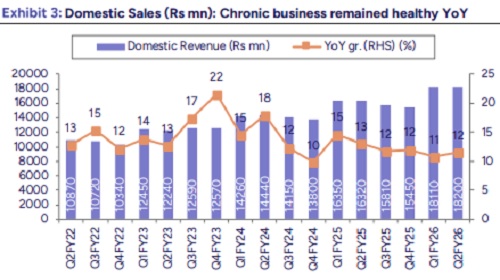

* Domestic and RoW markets aids growth YoY: Revenues grew by 14.3% YoY to Rs 33bn, 3% above our estimates. Domestic business grew by 11.5% YoY. US sales improved 7% QoQ to $38.6mn. Brazil market was up 21% YoY. CC growth was strong at 13% YoY. Top brands and new launches supported growth. Germany delivered growth of 5% YoY to Rs 3bn. CC growth was down by 5% impacted due to certain supply disruption. RoW including CRAMS growth was healthy at 46% YoY.

* In line EBITDA: GM down by 80bps YoY at 75.7%. TRP reported EBITDA of Rs 10.8bn (up 15% YoY), in line with our estimates. Other income came in negative to the tune of Rs 270mn led by forex loss of Rs390mn. Other expenses were up 9% YoY and 3% QoQ. PAT stood at Rs 5.9bn (up 30% YoY); in line with our estimates.

* Key concall takeaways: India: Growth drivers: Volume +3.7%, Price +5.5%, New products +3%. Chronic business grew 13% vs 11% for IPM, led by Cardiac (+14%), Gastro (+15%), Derma (+29%, incl. Curatio). Minimal GST impact (~0.5%); operations normalized post-September rollout. Pricing environment normalized, expecting 5–6% price growth going forward. Field force expanded to 6,800 reps (vs 6,600 in Q1); target 7,000 by FY26E. Expansion largely in Cardiac, Diabetes, CNS.

* Curatio continues to outperform; +29% YoY in Q2, aided by higher ad spends and new region expansion.

* Brazil: Growth led by volume expansion and mid-single-digit price increases. Therapy focus: CNS, Cardiac, and Diabetes; next wave of launches to include GLP-1 analogs (Semaglutide). Market is shifting from Ozempic to Wegovy; expect to be in first wave and likely to capture 10-15% market share. Torrent has 65 products pending approval with ANVISA

* Semaglutide: Filed in Brazil; approval awaited from ANVISA. India launch planned in first wave upon market formation; injectable to precede oral by a few months. Targets 10–15% market share in Semaglutide on commercialization in Brazil.

* Germany: Supply disruption at third-party supplier which impacted sales; expected to normalize by Q4FY26E. Payables lower due to early settlement discounts in Germany.

* US markets: Growth supported by new launches and volume ramp-up on existing contracts. Expect 4–5 product launches in FY26E, rising to ~10 in FY27E and ~15 in FY28E as pipeline accelerates. Exploring partnerships for select complex products and injectables

* JBChemical Acquisition: Operational control likely from Jan’26. Synergy details to be shared post-integration; mgmt indicates potential to enhance branded portfolio leverage across markets

* Other: Capex: Rs 2bn in H1; Rs 3bn expected in FY26E; sustainable at Rs 2.5- 3bn annually for next 3 years. Forex loss: Rs 390 Mn in Q2 (recorded in other income)

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271