Neutral Torrent Pharma Ltd for the Target Rs.4,300 by Motilal Oswal Financial Services Ltd

DF/LATAM outperforms; Germany underperforms

Efforts underway to integrate JB Pharma

? Torrent Pharma (TRP) delivered a better-than-expected performance, with 3%/5%/10% beat on revenue/EBITDA/PAT in 3QFY26. Growth was aided by consistent superior execution in domestic formulation (DF)/LATAM, favorable currency benefits in the US, and a lower tax rate.

? In DF, TRP continued to outpace the industry with strong volume offtake, price hike and new launches. Even the OTC sub-segment has been scaling up on the back of promotions and increasing reach through increased number of MRs.

? While industry YoY growth has been moderate in Brazil, TRP has exceeded industry YoY growth, largely led by new launches. It is well positioned for new introductions in this market.

? With gaining control of JB Pharma (JBCP) acquisition effective 21st Jan’26, TRP is geared up to build synergy from the integration through cost efficiency and collective revenue growth.

? After consolidating different aspects of JBCP with TRP in 3-6 months, we expect meaningful benefits to accrue from 4QFY27 onward. ? We have consolidated the financials of JBCP with TRP from 4QFY26. We have lowered our EPS estimates by 15%/21%/7% for FY26/FY27/FY28, as a) the addition of EBITDA from JBCP would be more than offset by interest cost/amortization in the initial years; and b) we consider dilution due to JBCP acquisition. The merger is expected to raise the equity shares of TRP by ~42m. We expect 28% earnings CAGR over FY26-28 on the back of a) sustained outperformance in TRP’s existing business, b) addition of JBCP business, and c) integration benefits.

? We value TRP 24x 12M forward EB/EBITDA and reduce net debt to INR133b to arrive at a TP of INR4,300. Given limited upside from the current levels, we maintain Neutral rating on the stock.

Consistent profitable growth for 13 quarters

? Sales grew 17.6% YoY to INR33b. ? Gross margin contracted 20bp at 75.8%.

? EBITDA margin expanded by 40bp YoY to 32.9%.

? Accordingly, EBITDA grew 19% YoY to INR10.9b (vs our Est: INR10.3b).

? Adj. PAT grew 27.8% YoY to INR6.4b.

? For 9MFY26, revenue/EBITDA/PAT grew 14%/16%/26% YoY

DF/LATAM on a robust YoY growth path

? Sales grew 17.6% YoY to INR33b.

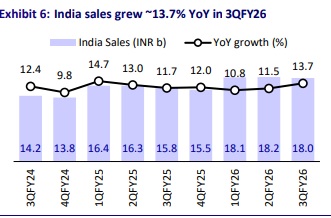

? India formulations revenue grew 13.7% YoY to INR18b (54.5% of sales).

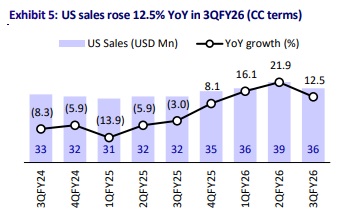

? US generics grew 18.5% YoY to INR3.2b (10% of sales).

? Germany sales grew by 7.8% YoY to INR3b (9% of sales).

? LATAM business grew by 27.5% YoY to INR3.7b (11% of sales).

? ROW+CDMO sales grew 32.6% YoY at INR5.1b (15.5% of sales).

Highlights from the management commentary

? TRP indicated synergy benefits of INR4b-INR4.5b from integrating JBCP over the next 2-3 years, largely driven by the cost efficiency.

? Despite announcement of JBCP acquisition, attrition in JBCP’s marketing team has been in the historical range.

? With JBCP EBITDA margin at 28-29% and TRP EBITDA margin at 32-33%, there is a scope to bring JBCP margins to TRP margin level in FY27.

? Germany business is impacted by continued disruption from a third-party supplier, which has got a regulatory issue and it is difficult to predict the timeline to resolve it. TRP is working on the alternate supplier, which would take 3-4 quarters.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Ltd.jpg)