Buy Aadhar Housing Finance Ltd For Target Rs.550 - ICICI Direct

Attractive play on affordable housing finance…

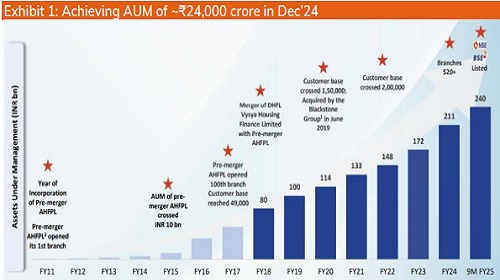

About the stock: Established in 2010, Aadhar is the largest player in affordable housing space with AUM of Rs.23,975 crore. Diversification in terms of business mix, customer base and distribution remain core strength.

• Business mix remains well balanced and granular with home loans comprising ~75% of AUM, while LAP constitutes remaining 25%. Salaried borrowers mix comprised 56% salaried and 44% self-employed segments of AUM.

• As of December 31, 2024, Aadhar operates 557 branches across 21 states and union territories.

Investment Rationale

• Pan-India presence with low concentration risk: Aadhar has large distribution presence with 557 branches across 21 states, amid strategy to expand reach over deepening penetration, thereby keeping concentration risk with in check. No state contributes >14% of AUM, and top 3 states account for ~40% (vs >50% for peers). Post geographic expansion undertaken over the years, now plan is to deepen penetration in select tier 4/5 cities. Thus, geographic diversification & low concentration risk enhances stability, while focused tier 4/5 expansion drives sustainable growth.

• Prudent under-writing & structured distribution strategy to aid efficiency: Aadhar’s robust underwriting framework, dual property valuation, strong legal check ensures sound risk management. This is depicted in stage 3 assets being rangebound (1.1- 1.5%) despite company’s focus on under-penetrated non-white-collar segment. Structured distribution model (deep impact, ultra-micro, micro, small and main branch) enables cost-efficient expansion and deeper market penetration and scalability.

• Granularity, balanced business mix remain core strategy: Maintaining a balanced and granular business mix has remain core strategy which has led to sustained performance. The portfolio is entirely secured, comprising 75% home loans and 25% LAP. A significant share of the AUM is towards salaried borrowers (~57% of AUM), though self-employed segment has been gradually scaling. Aadhar has balance mix of asset liability with ~79% of borrowing and ~77% of assets at floating rate. On liabilities side, well-diversified borrowing mix, stable credit rating (AA Stable) coupled with effective liability management is seen to keep CoF relatively competitive (8.1%) and thus aid margin trajectory ahead.

Rating and Target Price

• Aadhar remains an attractive play in the affordable housing finance segment with a robust business model combining efficiency, stability and prudent underwriting practice, leading to healthy and sustainable performance across cycles. Expect AUM growth to sustain at ~19%, while steady asset quality and gradual improvement in margins and efficiency is expected to result in earnings CAGR of ~23% in FY25-27E.

• Given its strong RoA of 4% and RoE of 18%+, while delivering credit growth of above 20%, valuations remain attractive at current level. We value Aadhar at 2.7x FY27E BV and assign a target price of ?550. We recommend a BUY rating.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631