F & O Rollover Report 29th December 2025 by Axis Securities

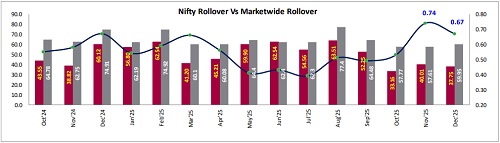

Nifty Rollover: The Nifty December rollover settled at 37.8% on Friday, representing a notable deceleration from the 40.0% recorded during the corresponding period of the previous expiry. This participation rate currently trails both the three-month average of 41.8% and the more robust six-month mean of 51.0%, suggesting a degree of caution or a reduction in directional bets among benchmark traders as they head into the new month.

Bank Nifty Rollover: Banking index participation mirrored the broader caution, with the Bank Nifty December rollover standing at 40.1% on Friday, a marginal dip from the 40.4% seen in the previous series. This activity remains below the historical three-month and six-month averages of 43.7% and 47.7%, respectively, signaling that financial heavyweight are seeing a more restrained carry-over of positions.

Market wide Rollover: In contrast to the headline index, the market-wide December rollover advanced to 60.0% on Friday, improving upon the 57.6% observed at the same stage of the prior cycle. Although this indicates a healthy carry-forward of broad-market positions, the figure remains neutral compared to its three-month average of 60.0% and slightly subdued relative to the six-month benchmark of 63.7%, reflecting a steady yet selective participation across the wider equity landscape.

Rollover Cost: The cost of carry for the December transition was recorded at 0.67% on Friday, marking a contraction from the 0.74% seen during the previous expiry. This softening in rollover costs, while still positive, hints at a marginal decline in aggressive bullish conviction, pointing toward a more balanced or "wait-and-watch" approach by participants regarding immediate upside momentum.

Stock-Level Rollover Gains: Stronger-than-average conviction was visible in specific counters, with SAIL, APLAPOLLO, DALBHARAT, ICICIGI, and TORNTPOWER all witnessing an uptick in rollover activity compared to the previous expiry. These gains suggest a concentrated buildup of interest and potential for continued momentum in these individual names during the upcoming series.

Stock-Level Rollover Declines: Conversely, a deceleration in trader interest was evident in NMDC, INOXWIND, TCS, NYKAA, and BPCL, which reported lower rollovers relative to the previous month's same day. This reduction in carry-forward positions may indicate profit-taking or a lack of immediate catalysts to drive further exposure in these specific stocks.

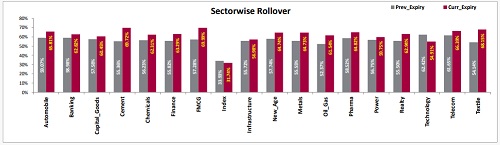

Sector-Level Rollover: The sectoral landscape revealed a clear divergence in sentiment, with Cement, Textile, FMCG, Oil & Gas, and Metals emerging as the primary beneficiaries of higher rollover activity. In contrast, the Technology sector stood as the sole laggard, witnessing a reduction in rollover interest, which highlights a rotation of capital away from IT and toward cyclical and consumption-driven segments.

NIFTY HIGHLIGHTS

Nifty December rollover settled at 37.8%, lower than the previous 40.0% and trailing the 3-month (41.8%) and 6-month (51.0%) averages, signaling cautious benchmark trading. Bank Nifty December rollover Stood at 40.1%, a slight dip from 40.4% and below the 3-month (43.7%) and 6-month (47.7%) averages, indicating restrained financial sector participation. The rollover cost contracted to 0.67% from 0.74%, suggesting a softening in aggressive bullish conviction and a balanced market approach. Market-wide rollover advanced to 60.0% from 57.6% previously; this aligns with the 3-month average (60.0%) but remains below the 6-month benchmark (63.7%). The option data for the December series indicates a strong Call Open Interest (OI) at the 26,100-strike price, followed by 26,200. In contrast, a substantial concentration of Put OI is observed at 26,000, with additional levels at 25,800. This suggests the likely range for the current expiry is between 25,800 and 26,200.

Nifty Rollover Vs Market-wide Rollover

Stock & Sector Highlights

* SAIL, APLAPOLLO, DALBHARAT, ICICIGI and TORNTPOWER saw higher rollover on Friday compared to same day of previous expiry.

* NMDC, INOXWIND, TCS, NYKAA and BPCL saw lower rollover on Friday compared to same day of previous expiry.

* Highest rollover in current expiry for the day is seen in WIPRO, NAUKRI, APLAPOLLO, RVNL and MARICO.

* Lowest rollover in current expiry for the day is seen in HAL, INOXWIND, NYKAA, RECLTD and BPCL.

Sector-wise Rollover

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Daily Derivatives Report 18 July 2025 by Axis Securities Ltd