Commodity Weekly Insights 29th December 2025 by Axis Securities

The Week That Was

* Comex Gold extended its winning streak for three weeks in a row, with prices rallying more than 4% last week. This marked its strongest weekly gain since Oct’25. A softer dollar and safe-haven demand supported prices as investors sought refuge in the yellow metal amid renewed Geopolitical tension and strong ETF inflows. Additionally, markets are now pricing in two interest rate cuts in 2026, which is expected to remain supportive for bullion prices.

* NYMEX Crude Oil snapped its two-week losing streak, with prices recovering to settle in positive territory last week. Early gains were driven by heightened geopolitical tensions after President Donald Trump intensified the U.S. naval blockade of Venezuela, with the seizure of oil tankers marking the latest escalation. Although Venezuelan crude represents a relatively small share of global supply, it remains a vital source of revenue for the government. Adding to supply concerns, Kyiv carried out an attack on the Novoshakhtinsk oil refinery on Thursday, a key supplier of diesel and jet fuel to Russian forces. On the same day, Trump also announced that the U.S. had conducted an airstrike against ISIS in Nigeria, an OPEC member. However, further upside in crude prices was capped by persistent concerns over an oversupplied European market, which weighed on investor sentiment.

* Spot silver settled higher for a fifth consecutive week, recording its largest weekly gain on record at nearly 20%. Prices turned parabolic, surging close to the $80 mark. Expectations of prolonged U.S. rate cuts, a weaker dollar, and a flare-up in geopolitical risks have combined to propel precious metals to fresh record highs. Silver has gained roughly 170% YTD, significantly outperforming gold's nearly 72% gain. The rally has been fueled by persistent structural supply deficits, silver’s designation as a U.S. critical mineral, and robust industrial demand.

* Comex Copper extended its winning streak for the second straight week, rallying over 6% to trade near the 52-week high of $5.9. The metal continues to benefit from the global energy transition, contributing to its 42% annual gain in New York. Prices were further supported by a recent slump in the US dollar, which made raw materials more affordable for international buyers. Meanwhile, lingering concerns over potential U.S. tariff reviews in 2026 have heightened the risk of supply tightness in global markets, further underpinning copper prices.

MCX Gold

Technical Outlook:

MCX Gold extended its winning streak for seven weeks in a row. It surged to a record level of Rs 1,09,800 in the domestic market, rallying more than 4% last week. Near-term trend remains strong as it is comfortably placed above 9 and 60 EMAs on the weekly chart. Additionally, the RSI is trading above the 70 level, signalling strong upside momentum in the near term. We expect the metal to trade with a positive bias as long as it sustains above the Rs 1,30,000 level on a weekly closing basis.

Recommendation

We recommend buying MCX Gold around Rs 1,37,000 with a stop-loss below Rs 1,35,500 and targets of Rs 1,39,000

Current Market Price (CMP): Rs 1,39,940

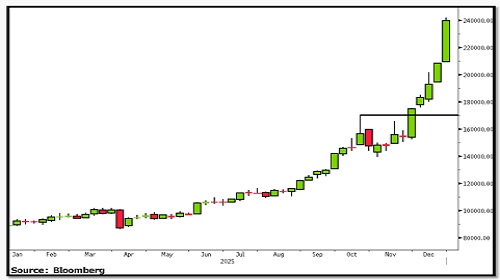

MCX Silver

Technical Outlook:

MCX Silver surged to a record high last week as prices propelled towards the Rs 2,40,000 level. The metal rallied by more than 15% last week, posting its best weekly gain on record. The RSI is above the 90 level, signalling exceptionally strong upside momentum. Additionally, prices are comfortably trading above the 9- and 60-week EMAs, confirming a bullish trend. We expect prices to head higher towards the Rs 2,50,000 mark in the short term as long as the Rs 2,20,000 level is intact on the downside

Recommendation

We recommend buying MCX Silver around Rs 2,30,000, with a stop-loss below Rs 2,22,000 and targets of Rs 2,50,000 and Rs 2,55,000.

Current Market Price (CMP): Rs 2,40,000

MCX Crude Oil

Technical Outlook:

MCX Crude oil snapped its losing streak last week, settling marginally higher by 1.4%. Prices are stuck in a trading range between the Rs 5,400 and Rs 5,000 levels from Oct’25. On the weekly chart, crude is trading below the 9- and 60-period EMAs, signalling a bearish trend. However, a positive divergence between the RSI and price suggests a potential reversal from the current levels.

Recommendation:

We recommend buying MCX Crude Oil around Rs 5,180, with a stop-loss below Rs 5,000 and targets of Rs 5,400 and Rs 5,600.

Current Market Price (CMP): Rs 5,180

MCX Copper

Technical Outlook:

MCX Copper rallied by more than 13% last week, extending its winning streak for five weeks in a row. Price action is wellsupported as it is placed above 9 and 60 EMAs, confirming a broader bullish undertone. A sustained move above Rs 1,300 could open the door towards Rs 1,340-Rs 1,380 levels, while immediate support rests at Rs 1,200, followed by Rs 1,150.

Recommendation:

We recommend buying MCX Copper around Rs 1,240, with a stop-loss below Rs 1,200 and targets of Rs 1,300 and Rs 1,340.

Current Market Price (CMP): Rs 1,277

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633