Neutral CDSL Ltd for the Target Rs. 1,520 by Motilal Oswal Financial Services Ltd

Strong revenue traction; opex elevated

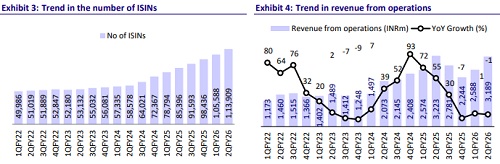

* CDSL’s operating revenue declined 1% YoY but grew 23% QoQ to INR3.2b (7% beat) in 2QFY26. The sequential growth was propelled by a 195% growth in IPO & corporate action charges and 28% growth in online data charges. For 1HFY26, its revenue remained flat YoY at INR5.8b.

* EBITDA declined 11% YoY but rose 36% QoQ to INR1.8b, resulting in an EBITDA margin of 55.7% (vs. 62% in 2QFY25 and 50.4% in 1QFY26). For 1HFY26, EBITDA declined 13% YoY to INR3.1b. Operating expenses grew 15% YoY to INR1.4b, driven by a 32%/10% YoY increase in employee costs/other expenses.

* CDSL’s PAT declined 14% YoY but rose 37% QoQ to ~INR1.4b in 2Q (18% beat led by strong revenue growth). PAT margin stood at 43.9% vs. 50.3% in 2QFY25 and 39.6% in 1QFY26. For 1HFY26, the company’s PAT declined 18% YoY.

* Technology and employee costs continue to rise, driven by ongoing investments in infrastructure and regulatory initiatives; management expects continued proactive investment in these areas to support future growth and innovation.

* We raise our FY26E earnings by 11% to reflect the strong quarterly performance, while retaining our FY27 and FY28 estimates to incorporate higher cost expectations. We project CDSL to post a revenue/EBITDA/PAT CAGR of 13%/11%/ 10% over FY25- 28. We reiterate our Neutral rating on the stock with a one-year TP of INR1,520 (premised on a P/E multiple of 45x on FY28E earnings).

IPO & corporate action and online data charges drive strong revenue growth

* On the revenue front, transaction revenue declined 29% YoY/5% QoQ to INR590m on account of lower cash delivery volumes during the quarter. Within transaction revenue, pledge income stood at INR 50.9m in 2QFY26 vs INR 50.5m in 1QFY26.

* Annual issuer charges rose 42% YoY to INR 1.2b, driven by a sharp increase in the number of unlisted companies issued (3,593 in 2QFY26). The total includes a one-time application fee of INR53.9m and unlisted issuer charges of INR35.3m. The market share stood at 30-32%.

* Revenue from IPOs and corporate actions grew 19% YoY/195% QoQ on account of a spike in the number of IPOs during the quarter.

* Online data charges declined 30% YoY but grew 28% QoQ. The sequential rise was attributed to higher fetch volumes across AMCs and mutual funds, reflecting stronger transaction activity.

* The total income of its subsidiary, CVL, dipped 36% YoY to INR928.4b, while total expenses were INR570m in 1HFY26. PAT dipped 59% YoY to INR270m.

* The insurance repository business showed 30% growth YoY in account openings, with LIC integration expected to go live in Nov’25, which should materially boost account additions; future growth is anticipated from the broking channel and online portal initiatives.

* Total expenses surged 15% YoY to INR1.4b, led by a 32%/10% YoY increase in employee and other expenses. CIR stood at 44.3% vs 38% in 2QFY25 and 49.6% in 1QFY26.

* Other operating income declined 38% YoY/QoQ each to INR225m. It comprised e-CAS/e-voting/investment income/other operating income of INR120m/ INR200m/INR214.6m/INR60m, for the quarter.

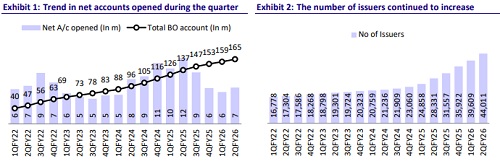

* Demat account additions during the quarter stood at 6.5m in 2QFY26 vs. 11.8m in 2QFY25 and 5.7m in 1QFY26.

Key takeaways from the management commentary

* The insurance repository business is set to gain a significant boost with the LIC integration expected to go live in Nov’25, which should materially accelerate account additions. Further growth is likely to be driven by the expansion of the broking channel and new online portal initiatives.

* The average tax rate remained in the 22–25% range (comprising a 22% base rate plus education surcharge and other cess), subject to variations arising from adjustments related to deferred tax assets (DTA) and deferred tax liabilities (DTL).

Valuation and view

* Though core business drivers, such as steady demat account additions (6.5m in 2QFY26), healthy unlisted company admissions, and growing KYC fetch activity, continue to support recurring revenue visibility, continued investments in human resources and technology for future growth could restrict gains from operating leverage.

* We raise our FY26 earnings estimate by 11% to reflect the strong quarterly performance, while maintaining our FY27 and FY28 estimates to incorporate higher cost expectations. We expect CDSL to post a revenue/EBITDA/PAT CAGR of 13%/11%/10% over FY25-28.

* We reiterate our Neutral rating on the stock with a one-year TP of INR1,520 (premised on a P/E multiple of 45x on FY28E earnings).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412