Neutral United Breweries Ltd for the Target Rs.2,000 by Motilal Oswal Financial Services Ltd

Beat in volume growth; pressure on margins

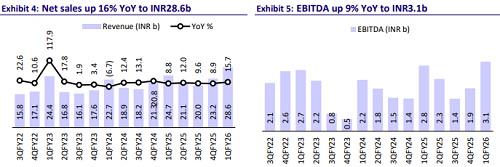

* United Breweries (UBBL) delivered strong revenue growth of 16% YoY (est. 10%) in 1QFY26. Volume growth was 11% YoY (est. 4%, 5% in 4Q, 6% in FY25), aided by share gain and a low base from the election-impacted quarter last year. Of the overall growth, 2-2.5% was attributed to the low base. The premium portfolio continued its strong momentum, growing 46% YoY in 1QFY26 (vs. 32% in FY25), and now contributes 10% to overall volumes.

* Regionally, North, West, and South posted growth of 8%, 13%, and 16%, respectively, while the East declined 1%. Volume growth was led by Andhra Pradesh, Assam, and Uttar Pradesh, though partly offset by declines in Karnataka and West Bengal. A favorable price mix supported revenue, aided by hikes in Telangana, UP, Orissa, and Rajasthan, along with continued premiumization.

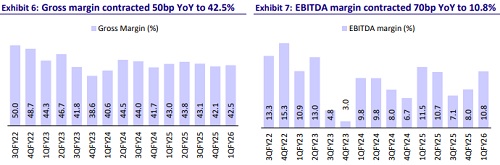

* Gross margin contracted by 50bp YoY to 42.5% (vs. est. 43.7%) due to temporary pressures from inter-state transfers and an adverse state mix, partially offset by revenue management and cost controls. EBITDA margin declined 70bp YoY to 10.8% (vs. est. 12.1%), with the majority of the impact stemming from weakness in Karnataka. However, underlying margin trends remain healthy, supported by stable raw material costs and improved bottle returns. The company reiterated its focus on achieving double-digit EBITDA margins over the medium term. We model EBITDA margins of 10.2% in FY26 and 11.9% in FY27.

* UBBL remains focused on volume-led growth and further market share gains in the premium segment. However, the ongoing shortage of cans (which account for 20-22% of the portfolio) remains a key near-term headwind. To address long-term supply chain risks, the company is prioritizing backward integration in both bottles and cans to improve scalability and resilience.

* We expect a ~14% revenue CAGR over FY25-27, led by high single-digit volume growth and a steady recovery in margins, which have been under pressure for the past five years. However, given the rich valuations and lingering regulatory headwinds, we maintain our Neutral stance on the stock with a TP of INR2,000 (55x Jun’27E EPS).

Strong volume growth despite seasonal headwinds; miss on margin

* Beat on revenue: UBBL’s standalone net sales grew 16% YoY to INR28.6b (est. INR27.2b). Volume growth stood at 11% YoY (est. 4%), with premium segment’s volume posting a sharp 46% YoY growth.

* Regional performance: The North, West, and South regions posted 8%, 13%, and 16% growth, respectively, while the East reported a 1% drop. Volume growth, mainly driven by Andhra Pradesh, Assam, and Uttar Pradesh, was partially offset by declines in Karnataka and West Bengal. The positive price mix was driven by price increases in Telangana, Uttar Pradesh, Orissa, and Rajasthan, coupled with a favorable mix, mainly from premiumization.

* Miss on margins: Gross margin contracted 50bp YoY to 42.5% (est. 43.7%; 42.1% in 4QFY25). Employee expenses grew 9% YoY and other expenses were up 19% YoY. EBITDA margin contracted 70bp YoY to 10.8% (est. 12.1%, 8% in 4QFY25).

* EBITDA increased 9% YoY to INR3.1b (est. INR3.3b). Interest cost jumped ~600% YoY to INR112m (est. INR24m). APAT rose 6% YoY to INR1.8b (est. INR2.1b).

Highlights from the management commentary

* The company is facing major headwinds due to the shortage of cans, which account for 20-22% of the portfolio. The government has also imposed BIS regulations on the import of cans.

* In Telangana, receivables have improved compared to the prior quarter; old dues have been cleared, though some new payments are still pending.

* With the recent hike in excise duty on spirits, retailers in Maharashtra have stocked up in anticipation of further price hikes. However, spirit companies protest the hike, but if the state maintains the current policy, it could help to drive double-digit volume growth for beer.

* Karnataka saw a 16-17% volume decline, largely in line with the contraction in the overall category due to a steep hike in excise duties. Importantly, the company retained its market share.

* West Bengal witnessed a double-digit category decline, exacerbated by price competition, as some players did not pass on tax increases in the economy segment.

Valuation and view

* We cut our estimates by ~5% for FY26 and 4% for FY27, factoring in the miss on EBITDA margin in 1Q.

* The company is facing numerous challenges, including stiff competition from both local and international brands in India and state regulatory issues in the industry.

* UBBL posted 6% volume growth in FY25, while its premium volume grew ~32%, maintaining its robust growth momentum. We estimate a CAGR of 14%/28%/37% in revenue/EBITDA/adj. PAT over FY25-27.

* We estimate EBITDA margin recovery in FY26 and FY27; any delay in margin recovery could lead to further earnings cuts. We maintain our Neutral rating on the stock. Our TP of INR2,000 is based on 55x Jun’27E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412