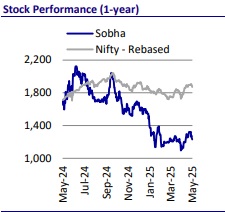

Buy Sobha Ltd for the Target Rs. 1,803 by Motilal Oswal Financial Services Ltd

Approval delays impact FY25 performance, but strong growth ahead

SOBHA ended FY25 with 6% lower presales YoY due to approval delays, but the company has a strong project pipeline, supported by its extensive land bank. SOBHA is expected to post a 39% CAGR in presales over FY25-27E, further boosted by its entry into MMR. The recent fundraise through the rights issue has alleviated debt concerns, shifting the company’s focus to driving growth by accelerating BD in new geographies. SOBHA’s track record of delivering quality products in a timely manner will allow it to generate a strong cumulative operating cash flow of INR64b over FY25-27E, which can be used for project acquisitions. We remain confident in SOBHA’s growth story, as its substantial land bank supports its projected growth. Hence, we reiterate our BUY rating with a revised TP of INR1,803/share, implying a 37% upside.

Strong pipeline to support presales growth

* The company recently launched two projects in Bangalore in 4QFY25 – 1) SOBHA Madison Heights and SOBHA Hamptons (3.7msf) in TownPark and 2) plotted development project spread over 18.38 acres offering a total saleable area of 0.44msf. These projects thereby led to 76% sales contribution from Bangalore in 4QFY25. In FY25, Bangalore contributed to 68% of sales, followed by Gurgaon at 20%.

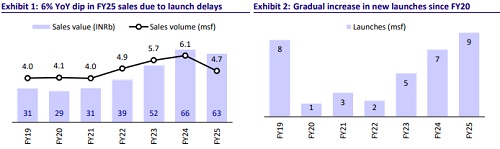

* Due to delays in launches, bookings in FY25 were down 6% YoY at INR62.8b, yet 2% above our estimate. The company has outlined ~30msf of launches, with ~4.1msf having already been launched in 4QFY25 and the remaining to be launched over the next two years.

* With its vast land reserves of 1,795 acres, SOBHA aims to launch 30- 40msf of projects over the next three to four years. These launches will include the initial phases of its projects on large land parcels in Hosur (Tamil Nadu) and Hoskote (Bengaluru).

* With these upcoming launches, presales are estimated to clock a 39% CAGR during FY25-27E, reaching INR121b by FY27.

Fundraise to accelerate growth

* Over the last two years, the company has focused primarily on reducing debt while maintaining steady growth. Going forward, it intends to expedite launches to generate strong cash flows.

* In 2QFY25, to capitalize on consolidation opportunities, the company raised funds through a rights issue of up to INR20b, of which ~INR9b was utilized for debt reduction and ~INR12b would be used for business development opportunities over the next 12 months.

* The company will now have three strong levers of growth: a) launches from the land bank, b) cash generated from the existing pipeline, and c) fresh equity capital.

Margin expansion to allay concerns

* EBITDA margins have steadily declined over the past three fiscal years, dropping to 9% in FY24 from 11% in FY23 and 21% in FY22. This consistent contraction in margins is largely attributable to the underwhelming performance of the contractual segment, which continues to face headwinds due to cost overruns in legacy projects. These older projects, often initiated under less favorable conditions or outdated cost assumptions, have consistently underperformed, thereby dragging down overall profitability.

* This margin pressure has continued into FY25 as well, reflecting the continuing impact of losses in the contractual segment. The company has not yet been able to fully resolve these legacy issues, and as a result, EBITDA margin for FY25 is estimated at 7%, indicating a further decline from the previous year and underscoring the ongoing challenges in this segment.

* In addition to the issues in the contractual business, the company’s residential segment has also shown signs of margin stress in FY25. So far in FY25, residential margins have come in at 12% for 1Q, 11% for 2Q, and 12% for 3Q, reflecting a contraction compared to previous years. This is particularly noteworthy because the company continues to price its residential products at a 10-15% premium over peers, signaling that higher pricing alone has not been sufficient to maintain or improve profitability.

* Despite premium pricing, residential margin compression remains a key investor concern, highlighting the need for better cost control and execution. Margin expansion is now critical for any potential stock re-rating.

* Management expects margin recovery post-resolution of legacy contracts, targeting EBITDA margins of 21% by FY27. This will be driven by new, highermargin projects with improved cost and execution efficiencies.

Net debt well under control; 3x increase in OCF to drive growth

* Net debt is expected to stabilize as the company shifts its focus to business development to strengthen its future pipeline in new geographies. However, ~INR9b of debt has been reduced with the proceeds of the rights issue, bringing the net debt to INR4.5b, with a D/E ratio of 0.13x.

* Net operating cash flow is expected to increase ~3x from FY25 to INR40b by FY27, as we estimate real estate collections for the same period to increase ~2x with planned launches. Further, funds raised from the remaining tranche of the rights issue will be allocated to BD activities to enhance the future launch pipeline.

Strong collections guide revenue CAGR of 18% from FY25-27E

* The company’s projected growth trajectory, driven by a significant ~2x increase in collections, is expected to drive revenues to INR58b by FY27, reflecting a robust 18% CAGR over FY25-27E. This substantial revenue expansion is anticipated to drive a 4x jump in EBITDA to INR12b during FY25-27E, with an impressive 21% EBITDA margin, addressing earlier concerns regarding profitability.

* Margin expansion will be guided by the recognition of higher-margin projects and a recovery in contractual business margins to the previous levels of ~18%.

* Furthermore, PAT is estimated to surge to INR8.2b at a 164% CAGR over FY25- 27, representing a 7x increase compared to FY25.

Valuation and view

* SOBHA continues to provide strong growth visibility by unlocking its vast land reserves. Additionally, the strong cash flows will enable the company to focus on new land acquisitions, which will further enhance its growth pipeline.

* We incorporate the updated launch pipeline and new projects acquired during the year. The ongoing and upcoming projects are valued at INR75b after deducting future land acquisitions and adjusting for incremental BD during the year.

* Our land reserve estimated for SOBHA is ~165msf and is valued at INR87b assuming 25-75 years of monetization.

* We reiterate our BUY rating on the stock with a revised TP of INR1,803 (previously INR1,714), indicating a 37% upside potential.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412