Buy Shriram Finance Ltd for the Target Rs. 1,180 by Motilal Oswal Financial Services Ltd

Strategic investor strengthens AUM growth and return outlook

Growth strategy anchored in customer retention and multi-product execution

* Shriram Finance (SHFL) hosted an investor call on 30th Dec’25 to provide further clarity and address investor queries regarding the proposed preferential allotment of a ~20% equity stake to MUFG Bank for an aggregate consideration of USD4.4b. Management emphasized that MUFG is being onboarded as a long-term strategic partner, bringing not only significant capital support but also meaningful value addition through funding diversification, treasury and capital market expertise, and digital capabilities.

* The company highlighted that the proposed capital infusion will materially strengthen SHFL’s balance sheet and is expected to accelerate AUM growth from the current ~16-17% to ~18-20% over the medium term. Management reiterated confidence in sustaining this higher growth trajectory without any change to the core business model, with growth largely driven by customer retention and upward migration of existing customers rather than aggressive expansion into new products or geographies.

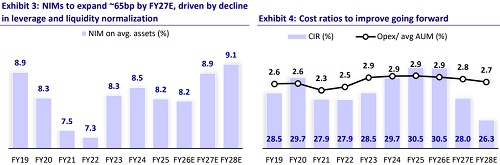

* A key positive from the transaction is the anticipated structural reduction in CoF. Management guided for a ~100bp decline in CoB over the next 2-3 years, driven by liability repricing, moderation in retail deposit rates, repricing of capital market borrowings, and credit rating upgrades.

* As highlighted in our earlier note after the MUFG deal announcement, we had expected the deal to potentially catalyze a credit rating upgrade for SHFL. In line with this expectation, CARE Ratings upgraded SHFL’s long-term rating from AA+ to AAA with a stable outlook on 29th Dec’25, barely a week after the deal announcement. We believe this upgrade is likely to be followed by similar actions from other CRAs in the coming quarters, which should ease CoF.

* After the capital raise, leverage is expected to decline sharply from ~4.3x to ~2.6x, providing substantial balance sheet headroom. Leverage is expected to gradually normalize as capital is deployed, with steady-state leverage guided at 4-5x (optimal ~4.5x) over the next 5-6 years. Profitability is expected to remain healthy, with RoA guided at ~3.6% by FY31 and RoE expected to revert to pre-capital raise levels of ~16-17% as leverage normalizes.

* While we had earlier upgraded our EPS estimates after the capital raise to reflect lower leverage and marginally higher growth assumptions, we have further fine-tuned our forecasts to align more closely with management’s guidance. Accordingly, we raise our FY26/FY27 EPS estimates by 3% each to reflect slightly higher growth, lower credit costs and lower CoF.

* We expect SHFL to deliver a PAT CAGR of ~26% over FY25-28E and RoA/RoE of 3.9%/13.6% by FY28. Reiterate our BUY rating on the stock with a revised TP of INR1,180, based on 2.2x Mar’28E P/BV.

Multi-product strategy and branch productivity

* SHFL is now capable of deploying a multi-product strategy across almost its entire branch network. Nearly all branches can offer multiple lending products, which improves customer cross-selling, enhances retention and drives better branch-level economics.

* Management believes this structural shift will continue to support higher growth and operating leverage over the coming years, without requiring aggressive geographic expansion or major changes to the core business model.

Growth with discipline: Focus on core segments and retention

* SHFL will continue to anchor its strategy around small-ticket lending while progressively enabling customers to migrate to new vehicles and moderately higher ticket sizes as their income profiles and business scale improve. New vehicle loans will be targeted largely at existing customers, with this segment expected to account for ~5% of AUM.

* Management shared that customer retention remains a key growth driver, with SHFL highlighting that ~30% of customers typically exit as their credit needs rise beyond current ticket sizes. Improving retention and facilitating customer upgrades alone provide sufficient runway to sustain ~20% AUM growth over the medium term.

* The company does not intend to enter large-ticket lending or LAP in the near term. In MSME lending, SHFL will continue to focus on cash-flow-based underwriting, with a preference for secured products over the next few years as the segment matures further.

* In new vehicle financing, SHFL currently holds ~3% market share and aims to double this over the next three years. Growth is expected to be driven primarily by upgrades from the existing customer base rather than aggressive new customer acquisition, with a focus on higher-ticket, lower-risk sub-segments. In two-wheelers, SHFL remains the market leader and plans to retain this position while selectively expanding into premium bikes where risk-adjusted returns are attractive.

Geographic focus and portfolio mix

* SHFL shared it does not plan aggressive expansion into metro markets and will continue to leverage its strong franchise in rural and semi-urban regions. While southern states remain faster growing, management sees meaningful headroom in northern, central and eastern regions, where penetration is relatively low.

* The portfolio mix is expected to remain broadly stable over time. Vehiclerelated lending and non-vehicle segments are likely to gradually shift from the current ~80:20 mix to ~78:22 driven by strong growth expected in gold finance. Gold finance may see a modest ~2% increase in portfolio share, with no material change envisaged in the overall asset mix.

Multiple tailwinds resulting in structural decline in CoF

* Management has guided for a meaningful decline in CoF following the capital raise. The cost of borrowing is expected to decline by ~100bp over the next 2-3 years, driven by repricing of liabilities, reduction in retail deposit rates, repricing of capital market borrowings, and credit rating upgrades.

* Additionally, CARE Ratings upgraded SHFL’s long-term rating from AA+ to AAA with a stable outlook on 29th Dec’25, barely a week after the deal announcement. We believe this upgrade is likely to be followed by similar actions from other CRAs over the coming quarters, which should translate into sustained benefits to the company’s CoF.

* The benefit will accrue gradually as incremental liabilities reprice. Management indicated that part of the funding benefit may be selectively passed on to customers to support retention, particularly in new vehicle financing, without impacting overall NIMs. Despite an increase in new vehicle disbursements, the company does not expect NIM compression, as new vehicle customers will form only around 5% of the total customer base and funding costs are expected to decline in tandem

Leverage, profitability and return metrics

* Immediately after the capital infusion, leverage is expected to decline from around 4.3x to 2.6x. As the company deploys capital and as growth accelerates, leverage is expected to gradually increase over time.

* Management views steady-state leverage in the range of 4-5x as optimal, with 4.5x being the sweet spot, and expects it to take ~5-6 years to reach this level. On profitability, RoA is guided to be around 3.6% by FY31, with the possibility of a temporary uptick to around 3.8% in the interim before normalizing as the balance sheet expands.

* RoE is expected to recover to pre-capital raise levels of around 16-17% over the next five years. Credit costs are also expected to trend lower, with management indicating a potential improvement of 10-20bp over the medium term.

Valuation and view

* The entry of MUFG as a strategic partner represents a transformative milestone for SHFL, materially strengthening its capital base and enhancing its credit credibility. This strategic partnership not only de-risks the company’s growth trajectory but also expands its ability to serve a broader customer base across the CV, MSME, and retail segments, while reinforcing long-term franchise positioning.

* SHFL has navigated recent asset-quality pressures better than most vehicle financiers, delivering stronger performance than peers. NIMs are expanding as excess liquidity normalizes, and growth is set to accelerate, supported by GST rate cuts, a favorable monsoon, and easing inflation.

* Despite strong stock performance (~33% in the past two months and ~67% since Jan’25, when we identified SHFL as a top CY25 idea), we see a further upside as the company enters a phase of stronger execution and profitability. Valuations have re-rated from ~1.5x to ~2.9x FY26E P/BV, with room for additional expansion if growth and asset quality trends hold. At ~2x FY27E P/BV (post money), valuations remain attractive for ~26% PAT CAGR and RoA/RoE of ~3.9%/13.6% by FY28E. We reiterate BUY with a revised TP of INR1,180 (2.2x Mar’28E BVPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412