Buy DCB Bank Ltd for the Target Rs.160 by Motilal Oswal Financial Services Ltd

Weak quarter; accelerated provisions drag earnings

NIM contracts 9bp QoQ

* DCB Bank (DCBB) reported an 11% QoQ decline in PAT to INR1.57b (20% YoY growth, 10% miss) due to higher provisions in 1QFY26.

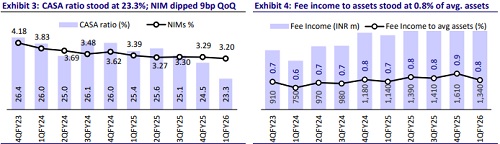

* NII grew 16.9% YoY/4% QoQ to INR5.8b (in line), while NIM contracted 9bp QoQ to 3.2%. Provisions increased sharply by 71% QoQ (up 306% YoY) to INR 1.15b as the bank made accelerated provisions across MFI, unsecured DA, and secured DA portfolios.

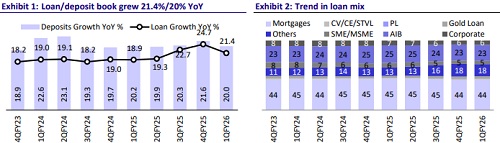

* Business growth was muted with an advances growth of 21.4% YoY (flat QoQ) to INR512b, while deposits grew 20% YoY/3.3% QoQ to INR620.4b. CASA mix moderated 120bp QoQ to 23.3%.

* Fresh slippages increased to INR5.8b (from INR3.7b in 4QFY25). The GNPA ratio improved 1bp QoQ to 2.98%, while the NNPA ratio increased 10bp QoQ to 1.22%. PCR declined to 59.7% from 63.2% in 4QFY25.

* We cut our earnings estimates by 10%/4% for FY26/FY27 and project an FY27E RoA/RoE of 1.0%/15.5%. Reiterate BUY with a TP of INR160 (based on 0.8x FY27E ABV).

Business growth muted; asset quality deteriorates

* DCBB reported an 11% QoQ decline in PAT to INR1.57b (20% YoY growth, 10% miss) due to higher provisions, partly offset by better other income.

* NII grew 16.9% YoY/4% QoQ to INR5.8b (in line), while NIM contracted 9bp QoQ to 3.2%. Other income grew 65% YoY/ 8% QoQ to INR2.36b (4% beat), resulting in 27.7% YoY/ 5.1% QoQ growth in total revenues (inline). Treasury gains stood at INR1b vs INR430m in 4QFY25.

* Opex grew 13% YoY/3.9% QoQ to INR4.9b (inline). PPoP grew 59% YoY/ 7% QoQ to INR3.3b (6% beat). Provisions increased sharply by 71% QoQ (up 306% YoY) to INR 1.15b (53% higher than MOSLe).

* The advances growth was muted at 21.4% YoY (flat QoQ); however, adjusted for IBPCs, the growth was healthy at 25.1% YoY / 3.4% QoQ. MSME dipped 8% QoQ, while corporate grew 9% QoQ. Deposits grew 20% YoY/ 3.3% QoQ to INR620.4b. The CASA mix moderated 120bp QoQ to 23.3%.

* Fresh slippages increased to INR5.8b (vs. INR3.7b in 4QFY25) due to MFI and unsecured DA segments, with some stress also visible in secured DA loans in the INR0.2-0.6m range. The GNPA ratio improved 1bp QoQ to 2.98%, while the NNPA ratio rose 10bp QoQ to 1.22%. PCR declined ~350bp QoQ to 59.7%.

Highlights from the management commentary

* RoA is guided to remain above 1% over the near term with the following details:

* 1) NIM is projected at 3.2%, 2) fee income is expected to contribute 1.1%, thus resulting in a total revenue yield of ~4.3%, 3) the cost-to-assets ratio stood at 2.5%, translating into a PPoP of 1.8%, 4) considering a credit cost of 45bp, PBT is expected to be in the range of 1.35%–1.4% thus supporting an RoA of ~1%+.

* The bank has submitted revised documents to the RBI following the demise of its promoter, Aga Khan. This is expected to increase the promoter’s stake to above 15%.

* DCBB currently has 465 branches and aims for 480-490 branches by the end of FY26.

Valuation and view

DCBB reported a weak quarter with a miss in earnings amid higher provisions, partly offset by treasury gains. Margin moderated by controlled 9bp QoQ, but the bank expects it to remain under pressure in the near term due to the lagged impact of repo rate cuts. Loan growth was muted while DCBB aims to grow its advances by ~20% over the medium term. Fresh slippages increased while PCR declined to 59.7%, though management expects credit cost to remain below 45bp over the coming quarters. We cut our earnings estimates by 10%/4% for FY26/FY27 and project an FY27E RoA/RoE of 1.0%/15.5%. Reiterate BUY with a TP of INR160 (based on 0.8x FY27E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412