Buy Waaree Energies Ltd for the Target Rs. 4,000 by Motilal Oswal Financial Services Ltd

Bellwether solar manufacturing play

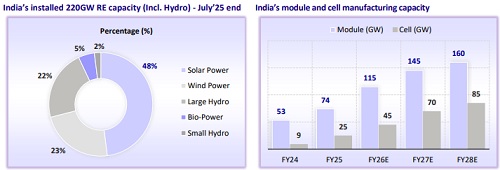

* Play on India’s solar scale-up; indigenization of clean power generation: WEL encapsulates the India module story, with national installed solar capacity set to rise from 100GW in 1QFY26 to 160GW by FY28. A strong pickup in utility-scale bids (from 20 GW in FY23 to 69GW in FY24) and accelerating demand from PM Kusum/Suryaghar Yojana will drive growth for the bread-and-butter domestic module business in FY26-27. Union government has displayed a strong intent to indigenize India’s green power generation via regulations mandating domestically manufactured modules/cells.

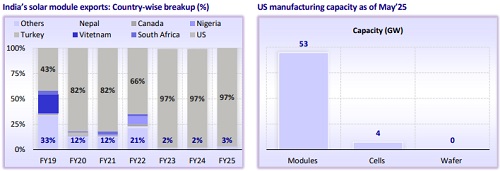

* Unique value proposition with industry-leading scale, speed, integration: We initiate coverage on the solar cell and module manufacturing sector, with a Buy rating on Waaree Energies (WEL) and a TP of INR4,000. Scale: WEL boasts unmatched scale and is a bellwether in the Indian cell/module manufacturing space. With operational cell/module capacity of 5.4GW/16.1GW in India, WEL towers domestic competitors and enjoys a formidable India capacity market share of 21.6%/13.3%. Speed: WEL has responded swiftly to regulatory and macroeconomic changes as evidenced by its move to set up domestic cell capacity ahead of competitors in response to the government’s approved list of cell manufacturers (ALCM) and the planned expansion of its US capacity from 2.6GW to 4.2GW (by 4QFY26) in response to the changing tariff landscape. Integration: Lastly, WEL’s presence across the solar value chain (EPC, BESS, inverters, green hydrogen) makes it an integrated player and places it well to pursue growth relentlessly.

* Multi-decade opportunity in solar manufacturing through 2030 and beyond: India’s installed solar capacity stood at 100 GW as of 1QFY26, against the central government’s 280GW target by 2030, implying a substantial growth runway for the solar segment. Beyond 2030, we expect annual solar module demand of 50– 60 GW, supported by rising power requirements and policy efforts to curb fossil fuel dependence. Upside to this estimate could arise from emerging applications such as green hydrogen, where project economics are steadily improving. Strong domestic demand for solar cells and modules also creates an enabling environment for 1) developing an export base once global tariff conditions turn favorable, and 2) capacity expansion in allied sectors such as batteries and inverters.

* Ambitious government vision ably supported by favourable policies: The central government, aiming to achieve 500 GW of renewable energy (RE) capacity by 2030 using domestically manufactured components, has introduced supportive policies such as the Approved List of Module Manufacturers (ALMM). An Approved List of Cell Manufacturers (ALCM) is proposed from June 2026, while an Approved List of Wafer Manufacturers (ALWM) has already been conceptualized. Industry participants also anticipate a similarly favorable policy framework for ancillary equipment including batteries, inverters, and transformers.

* 43% EBITDA CAGR (FY25-28) amid capacity expansion, new business start-up: WEL plans to expand its total cell/module capacity from 5.4/18.7GW in 2QFY26 to 26.7GW/15.4GW/10GW module/cell/ingot-wafer capacity by FY26/FY27 end. With a current order book of INR470b, earnings visibility for FY26-27 remains high. Management has guided for EBITDA of INR55-60b for FY26 (1HFY26: INR24b). As WEL expands capacity, we estimate a CAGR of 43% in EBITDA and 40% in PAT over FY25-28. By FY28E, the earnings contribution from new businesses is estimated to rise to 15% of EBITDA.

* FY28 margin concerns offset by cell stabilization timelines, new segments: We expect cell margins and pricing to remain resilient through FY27, supported by limited supply additions and elongated stabilization timelines for new capacity in the industry. While profitability is likely to stay firm in 1HFY28, we see potential margin pressure beyond FY28 as incremental cell capacity begins to align with demand. Meanwhile, emerging verticals such as battery energy storage systems (BESS), EPC, and green hydrogen are set to become key growth drivers, contributing an estimated ~15% of EBITDA by FY28E, thereby enhancing business diversification. Additionally, WEL’s planned expansion of its U.S. module capacity to 4.2 GW by 4QFY26—with further scale-up expected—should provide a meaningful boost to growth and international presence.

* Valuation: India’s solar bellwether—strong growth visibility at 13x FY27 EV/EBITDA: The valuation of WEL has been derived through a sum-of-the-parts (SoTP) methodology, resulting in a TP of INR4,000/share. The domestic module business is valued at 15x FY28E EBITDA, representing a premium to global peers. The US module business is valued at 12x FY28E EBITDA, which is in line with global peers. The new business segments, of which over 74% of the contribution is attributed to the EPC and O&M businesses, is valued at 11x FY28E EBITDA, consistent with domestic peer valuations. The sum of these segment valuations (adjusting for net debt) results in a TP of INR4,000/share, capturing a comprehensive value of WEL’s diversified operations.

* Upside risks: 1) slower-than-expected ramp-up of industry cell capacity in FY27- 28, 2) the government formalizing the localization directive for wafers and ingots (similar to ALCM).

* Downside risks: 1) Intensifying competition from large domestic players may pressure pricing and margins; 2) Heavy US market reliance heightens sensitivity to policy, tariff, and geopolitical shifts; 3) If backward integration initiatives (cells, ingot-wafer, and other upstream operations) fail to scale effectively, profitability and competitiveness may be undermined; 4) the company’s aggressive foray into capital-intensive cell and ingot/wafer manufacturing increases exposure to execution and stabilization risks, potentially impacting timelines, costs, and near- to medium-term financial performance

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)