Buy Kalpataru Projects Ltd for the Target Rs. 1,300 by Motilal Oswal Financial Services Ltd

Strong execution ramp-up in 4Q

Kalpataru Projects (KPIL) reported broadly in-line revenue/EBITDA/PAT in 4QFY25. In FY25 as well, KPIL performed well in terms of balance sheet and cash flows, with debt reduction, improved working capital and strong cash balance. The company continues to benefit from strong traction in T&D and Buildings and factories pipeline, while it maintains a cautious stance on railways and water segments. We increase our estimates by 2% each for FY26/27 to take into account improved order inflows and lower debt. The stock is currently trading at 20.2x/15.1x P/E on FY26/27E earnings. Retain BUY with a revised SoTP-based TP of INR1,300 based on 18x P/E for the core business (INR1,200 earlier).

Healthy performance in 4QFY25

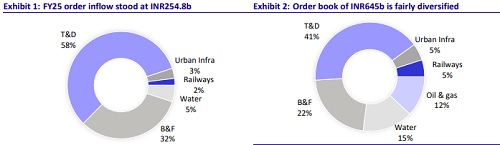

4Q revenue came broadly in line at INR62b (+21% YoY), driven by robust project progress and strong order backlog. T&D/B&F segment revenue grew 19%/21% YoY, and O&G/Urban Infra revenue surged 152%/33% YoY. Water and Railways declined 32% and 8% YoY, respectively. EBITDA margin improved to 8.4% YoY due to a low base in 4QFY24, largely in line with our estimate. EBITDA at INR5.2b grew 31% YoY/30% QoQ, due to lower-than-expected other expenses. Adj. PAT jumped 52% YoY to INR2.66b, beating our estimate of INR2.32b by 15%. This was driven by lower other non-operating expenses (including depreciation) and an exceptional item of INR330m in the quarter. Order inflows at INR52.9b were down 56% YoY on a high base of INR119.6b in 4QFY25. The order book stood at INR645b (+10% YoY). NWC days stood at 94 in 4QFY25 vs. 99 in 4QFY24. Net debt declined YoY and QoQ to INR18.3b in 4QFY25. For FY25, revenue/EBITDA/PAT grew 13%/16%/20% to INR189b/INR16b/INR6.7b, while order inflows stood at INR255b, down 15% YoY. FY25 OCF/FCF stood at INR8.4b/INR2.9b

Segmental performance driven by T&D, B&F and oil & gas segments

Segmental performance was driven by T&D, B&F and Oil & Gas. Consolidated T&D revenue grew by 28% YoY (including subsidiaries LMG and Fasttel) in FY25. Both LMG and Fasttel grew at a much faster pace at +79% YoY and +35% YoY, respectively. B&F revenue grew by 22% YoY for FY25 on improved project execution and healthy order mix. Going ahead, we expect the growth to be driven more by standalone T&D and B&F segments as inflows have been strong for the company. O&G revenues grew by 114% for FY25, led by execution of the Saudi project. The company plans to start taking in new orders for the O&G segment in FY26. Water/railways segment revenues declined by 35%/29% YoY during FY25 due to slower execution and selective bidding in said segments. We expect water and railways segments to remain for next one year.

T&D and B&F to be key contributors to future growth of the company

Looking ahead to FY26, management expects a strong addressable market in both domestic and international segments for T&D business, with an expectation of surpassing FY25 order inflows. With strong order inflows, the company is confident of improved execution, leading to +20% YoY growth in revenues in FY26. Revenue growth visibility comes from 1) strong domestic tendering from PGCIL, PFC, REC, and 2) high traction in international markets: Latin America, Europe, Middle East, and Africa. The company will focus on HVDC segment, grid expansion and energy transition. Outlook for B&F segment also remains strong, with pipeline visibility coming from 1) high activity in residential real estate across India, 2) continued work with selective, long-term clients, and 3) opportunities in airports, industrial, commercial, and data centers. We expect the T&D/B&F segments to clock a CAGR of 21%/19% over FY25-27, led by order inflow CAGR of 10%/15% over the same period.

Downtrend in water projects expected to continue

Water business of KPIL was impacted by delayed payments from the government for JJM projects during the year. Receivables stood at INR15b, of which the company has recovery visibility for only 60-70% of the receivables. KPIL expects these receivables to start coming in from 2QFY26 onward. We expect water segment revenue growth to remain weak in FY26

International subsidiary poised for growth

LMG Sweden delivered strong revenue of INR18b (+79% YoY), EBITDA margins of 5.6%, and a record order book of INR28.0b. The company expects 20-25% annual growth in LMG over the next 2-3 years and is exploring fundraising options. In Brazil, Fasttel improved significantly, growing revenue to INR9.4b (+35% YoY) and halving losses from INR700m to INR350m. With a planned capital infusion, management targets to achieve the breakeven in the next two years for Fasttel. The Saudi operations (IBN Omera) closed out its projects and reported losses, but management expects a turnaround in FY26. Other international markets such as Chile, Guyana, and Surinam are performing well, with the company planning to expand into two to three additional countries. Overall, management anticipates enhanced profitability and contribution from its overseas businesses in the coming fiscal year.

Financial outlook

We increase our estimates by 2% each for FY26/27 to take into account improved order inflows and lower debt. We expect KPIL to report a CAGR of 19%/25%/37% in revenue/EBITDA/PAT over FY25-27. This would be driven by: 1) inflows of INR280b/INR312b FY26/FY27 on a strong prospect pipeline, 2) a gradual recovery in EBITDA margin to 8.9%/9.3% in FY26E/FY27E, 3) control over working capital owing to improved customer advances, better debtor collections from water and railways, and claims settlement. Driven by improvement in margins and moderation in working capital, we expect KPIL’s RoE and RoCE to improve to 15% and 13% in FY27E, respectively.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)