Neutral Eris Lifesciences Ltd for the Target Rs.1,700 by Motilal Oswal Financial Services Ltd

Domestic formulations business drives earnings

Strategic reset lowers trade generics and intensifies focus on GLP-1/ CDMO outlook

* Eris Lifesciences (ERIS) delivered in-line revenue for 1QFY26. However, its EBITDA and PAT were lower than our expectations (3%/7% miss). Higher operating costs and the reduced international business led to lower profitability for the quarter.

* ERIS is transitioning its domestic branded formulation (DBF) business by increasing its focus on the anti-diabetes portfolio and minimizing its efforts in the trade generics business.

* It is enhancing its business prospects in Insulin and GLP-1 products by solving shortage issues (Insulin) and adding capacities at the Bhopal plant.

* Through the EU-accredited Swiss parenteral facilities, ERIS is garnering CDMO contracts in Europe and building a further growth lever in the international business.

* We broadly maintain our earnings estimate for FY26/FY27. We value ERIS at 30x 12M forward earnings to arrive at our TP of INR1,700.

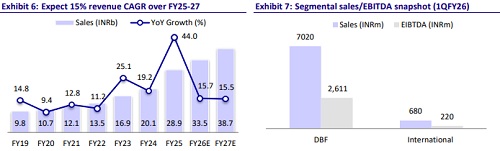

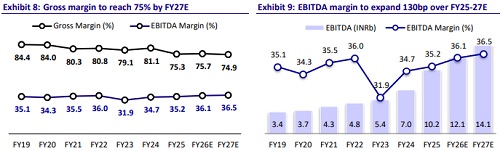

* We expect a 16%/18% revenue/EBITDA CAGR over FY25-27, led by improved traction in its flagship therapies (anti-diabetes and cardiac) and emerging therapies (women’s health, critical care, and oncology). The reduction in net debt is likely to lower the interest outgo and drive a 46% PAT CAGR over FY25-27.

* However, we reiterate our Neutral rating on ERIS due to its rich valuations.

Segmental mix drives better profitability YoY

* ERIS’ 1QFY26 revenue grew 7% YoY to INR7.7b (vs. our est: INR7.8).

* Gross margin expanded 120bp YoY to 76% due to lower cost of buying finished goods and a better business mix.

* However, EBITDA margin expanded 100bp YoY to ~36% (our est. 37%), due to increased gross margins. Employee costs and other expenses (+30bp/- 10bp YoY as a % of sales) were stable for the quarter.

* EBITDA rose 11% YoY to INR2.7b (vs. our estimate of INR2.8)

* Adj. PAT increased 41% YoY to INR1.2 (vs. our estimate of INR1.3b).

Highlights from the management commentary

* ERIS reaffirmed its overall revenue guidance of INR33.2b-INR35b with EBITDA of INR11.9b-INR12.5b for FY26.

* While its 1Q sales declined in the international business, ERIS remains confident of achieving a revenue of INR3.8b in FY26.

* Management could not get approval to launch liraglutide 3mg in India, and hence, the business from this product has been lower. It is expected to pick up in the coming months.

* The patient enrolment for semaglutide would be completed by Aug’25. Six months would be required for the study. Subsequently, it would take two months for approval. Hence, ERIS remains confident to launch semaglutide in India in the first wave of market formation.

* While net debt increased by INR1b QoQ in 1QFY26, Eris is expected to reduce the net debt to INR18b by the end of FY26.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)