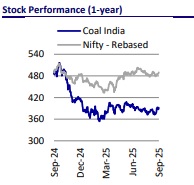

Buy Coal India Ltd for the Target Rs. 450 by Motilal Oswal Financial Services Ltd

Modest volume growth; long-term thermal power dominance to remain intact

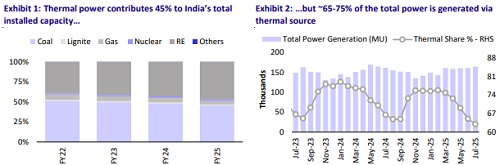

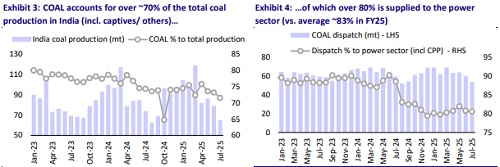

India’s total installed power capacity reached ~490GW as of Jul’25, grew at 7.8% CAGR over the past 15 years. Renewable energy (~237 GW, 49% share) has surpassed thermal capacity (~220 GW, 44% share), where RE and thermal grew at 10.9% and 6.5% CAGR, respectively, over the past 15 years. Despite decarbonization efforts, coal remains a critical source for India’s power demand, contributing ~65-75% of power generation. Therefore, with rising industrial/household activity, coal demand is expected to remain firm. Coal India (COAL) accounts for over ~70% of the total coal production in India (including captives/others), of which over 80% is supplied to the power sector, positioning it as a dominant player in the coal mining space.

? COAL’s earnings are expected to remain under pressure in FY26, driven by a lack of volume growth amid muted power demand as well as the rising share of captive/merchant mining during Apr-Jul’25. Moreover, subdued global coal prices will continue to cap COAL’s e-auction prices/demand.

? We trim our FY26/27E revenue and EBITDA (ex-OBR) by 2/6% and 5/9%, respectively, factoring in the lower volume and rising coal production from captive miners. We expect COAL to post a 2-4% volume CAGR for FY26/27E, while the higher share of e-auction volumes, with a modest premium of ~70% over FY26/27E, will support overall NSR and margins.

? At CMP, the stock is trading at 4x on FY27E EV/EBITDA at its 10-year historical average. We reiterate our BUY rating with a TP of INR450/share, valuing the stock at 4.5x FY27E EV/EBITDA.

Modest volume growth for COAL

Coal dominates India’s energy mix, with over 70% of coal production (including captives/others) supplying >80% to the power sector. COAL is expected to witness modest volume growth (2-4% over FY26-27E) due to the rising share of captive/merchant mines (197mt in FY25, +29% YoY), high inventories (both at mine/power plant level), and operational challenges like erratic rainfall and approvals/clearance delays. Moreover, thermal coal imports dropped 10% YoY to 170mt in FY25, reflecting an increased domestic output. Despite near-term weakness, COAL’s long-term demand outlook remains healthy, with demand projected to reach 1.3-1.5bt by 2030, driven by a projected peak power demand of 363GW by FY30 and over 40GW of new coal-based plants

Higher e-auction volumes to expand margins

COAL’s e-auction volumes stood at ~79mt in FY25 (~10% of total dispatches), at a 68% premium over FSA prices compared to ~99% (with volume of ~70mt; accounting for 9% of total volume) in FY24. Global coal prices have corrected (South African coal at ~USD100/t from USD440/t in Mar’22), stabilizing domestic e-auction prices at INR2,400-2,500/t. COAL aims for 15% of volumes through e-auctions, with premiums expected to remain at ~70% over muted global coal prices and higher production from captive/commercial coal blocks. Therefore, the higher share of e-auction volume, with a modest premium of ~70% over FY26/27E, will support overall NSR and margins.

Capex to drive product diversification and portfolio mix

COAL plans INR150-200b capex each over 4-5 years, focusing on coal production, evacuation infrastructure, and diversification into critical minerals, coal gasification, thermal plants, and renewables. It targets 3GW of renewable capacity by FY28 (INR150b investment) and 6.5 GW by FY30 (additional INR100b). This aligns with the company’s Net Zero goal and strengthens its portfolio mix.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412