Neutral Bajaj Housing Finance Ltd for the Target Rs. 120 by Motilal Oswal Financial Services Ltd

Strong growth despite competitive pressure; margins stable

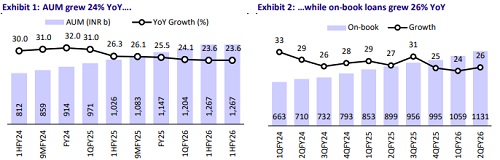

AUM grows 24% YoY; credit costs inch up QoQ but still remain benign

* Bajaj Housing (BHFL) delivered a broadly in-line performance in 2QFY26, marked by healthy AUM growth of ~24% YoY, stable NIMs and stable asset quality.

* BHFL’s 2QFY26 PAT grew 18% YoY to ~INR6.4b (in line). NII rose 34% YoY to ~INR9.6b (in line). Other income declined 23% YoY to ~INR1.4b (in line). NTI grew ~22% to INR11b (in line). Opex rose ~17% YoY to INR2.1b (in line) and PPoP grew 24% YoY to INR8.8b (in line).

* Management expects to achieve its medium-term AUM growth guidance from FY27 onward, supported by strong disbursement momentum and easing portfolio attrition pressure. The company evolves its strategy continuously by deepening its presence across markets and expanding its customer base to sustain growth. However, BT-OUTs increased YoY, owing to competitive pricing from PSUs and large private banks.

* Margins are expected to remain broadly stable at around ~4%, with a potential ~10bp improvement in CoF in the remainder of FY26.

* We continue to believe in our thesis of BHFL and in management’s ability to drive profitability improvement, supported by a healthy AUM CAGR of 22% over FY25-28E; broadly steady NIMs; and benign credit costs. We expect BHFL to continue disbursement growth, although rising competition from PSU banks and higher BT-OUTs may push BHFL to cut its lending rates, which could exert pressure on margins.

* We expect BHFL to post a CAGR of 22%/22% in loans/PAT over FY25-28E and RoA/RoE of ~2.3%/14.2% in FY28E. Maintain Neutral with a TP of INR120 (based on 3.6x Sep’27E BVPS).

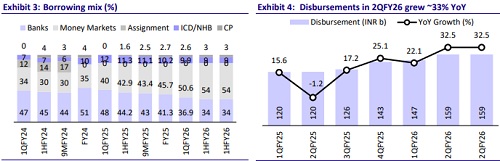

Healthy AUM growth of 24% YoY; disbursements up ~33% YoY

* AUM grew 24% YoY to ~INR1.3t, while disbursements rose ~33% YoY to ~INR159b. Total on-book loans grew ~26% YoY/7% QoQ to ~INR1.1t.

* The non-prime portfolio (including affordable housing) accounts for ~14% of total home loans, while ~86% are prime home loans. Management highlighted that the affordable housing segment is now ready to scale up with increased confidence and operating team in place and expects strong growth in this segment from next year onward.

* LRD also remains a profitable segment for the company owing to its low-risk portfolio and steady returns with minimal operating costs.

Reported NIMs stable at ~4% QoQ; minor improvement in spreads

* Reported yields declined ~20bp QoQ to ~9.3% and CoB declined ~30bp to ~7.4%, leading to ~10bp QoQ rise in spreads to ~1.9%. Reported NIM in 2QFY26 was stable QoQ at ~4.0%.

* Management does not want to indulge in broad-based price cuts but instead has chosen to optimize the pricing on the basis of market demand.

Asset quality stable; credit costs remain benign

* Net credit costs increased sequentially to INR497m, which translated into an annualized credit cost of ~18bp (PQ: ~16bp and PY: ~2bp).

* Asset quality was largely stable with GS3/NS3 at 0.3%/0.1%. PCR declined ~50bp QoQ to ~55.7%. (PQ: ~56.2%).

* Reported RoA/RoE in 2QFY26 stood at ~2.3%/12.2% (1QFY26 RoA/RoE: 2.3%/11.6%). Leverage stood at 5.5x and CRAR stood at ~26.1% as of Sep’25.

* Reported credit cost stood at 18bp in 2QFY26 (vs. 2bp in 2QFY25), with the prior year aided by Covid overlay releases. The company continues to follow a disciplined risk framework focused on medium-risk, medium-return segments.

Highlights from the management commentary

* Fee income increased during the quarter, primarily driven by higher insurance income. Additional income streams such as foreclosure charges and scheme switching charges also contributed to the higher fee income. Insurance income remains the key growth driver for non-interest income and is aligned with business volumes.

* Product-wise yields in HL stood at ~8.6%, LAP at ~10.3%, LRD at ~8.1-8.2%, and developer finance at ~11.5% and the yield differential between prime and nonprime portfolios (including the affordable segment) remained at ~1.25-1.5%.

* The company reiterated that increasing the DSA payouts was not a sustainable way to gain market share, as home loan payout structures are largely commoditized across the industry.

Valuation and view

* BHFL delivered a strong performance in 2QFY26 with strong AUM and disbursement growth across products, despite heightened competition. The company was successful in maintaining its margins, despite a declining interest rate environment, while maintaining pristine asset quality.

* We believe BHFL is a strong franchise that is well-positioned to navigate rising competition and a declining interest rate environment while sustaining healthy growth and profitability. Maintain Neutral with a TP of INR120 (based on 3.6x Sep’27E BVPS).

* Key risks: a) slowdown in the overall growth and demand environment, b) inability to drive NIM expansion amid competitive pricing, c) deterioration in the asset quality while scaling up the non-prime segments.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412