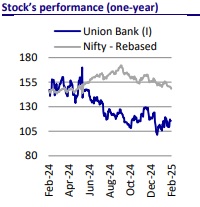

Buy Union Bank of India Ltd For Target Rs.135 by Motilal Oswal Financial Services Ltd

Asset quality outlook steady; remain watchful on near-term margins

Focus on delivering profitable growth

We attended an analyst meet hosted by the top management team of Union Bank (UNBK). Management emphasized the bank's efforts in delivering profitable growth while continually making investments in business and enhancing its technological capabilities. Management has guided FY25E advances growth to be ~11% and NIMs to remain at 2.8-3.0%. Following are the key takeaways from the meet:

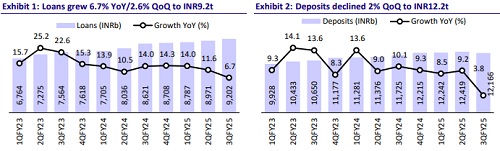

Loan growth to be at lower end of guided range of 11-13%

UNBK reported controlled loan growth in 3QFY25, aided by healthy traction in RAM segments, while corporate segment growth remained sluggish. It has a healthy approval pipeline of INR750b, with ~INR360b pending for disbursement. MSME growth has been muted in the current quarter, primarily due to some portion of the MSME book being upgraded to the mid-corporate segment and some being declassified due to the unavailability of URN numbers. Concerns persist in the micro-segment of MSMEs, though 99% of loans are covered under the CGTSME scheme (75% secured through this mechanism). Agri growth was impacted by debt waivers, though the recovery is expected in the coming quarters. However, 98% of NBFC exposure is rated ‘A’ and above, with no signs of stress in the sector. UNBK is also planning to increase exposure to well-rated NBFCs. Thus, the bank anticipates credit growth to be at the lower end of the guidance of ~11-13% in FY25.

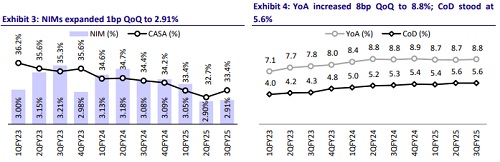

Deposit growth muted due to reduction in bulk deposits; CD ratio guidance at ~76-78%

UNBK expects deposit growth in line with its guidance of ~9-11%, bolstered by retail TDs. It has reduced its bulk deposits to ~25% and aims to maintain this level going forward to guard margins. However, CASA remains a challenge, which, along with a recent cut in policy rates, is likely to exert additional pressure on margins. With a current domestic CD ratio of 77%, UNBK has mechanisms in place to further boost loan growth and aims for a CD ratio of around 76-78%. Moreover, the bank holds excess SLR reserves of INR520b, which can be utilized to enhance credit availability.

NIM to remain in the guided range of 2.8-3.0% backed by healthy share of RAM, MCLR-linked loans

Management stated that the bank will continue to pursue profitable growth and prioritize profits over revenue growth. Its focus on RAM segment has helped to manage costs and thus retain healthy NIMs at 2.91%. UNBK forecasts margins in the range of ~2.8-3.0%. The bank expects a mere 3bp impact on margins due to the rate cut. On the other hand, over the years, the bank has gradually increased its MCLR book, with a majority of the book now at MCLR pricing, which should be beneficial now as the rate cycle starts to turn. Combined with further potential for improvement in the CD ratio, these factors could support margins going forward.

Asset quality robust; recoveries to maintain a healthy run rate

UNBK's asset quality demonstrates ongoing enhancement, characterized by a consistent decline in NPA ratios. The bank has effectively contained slippages, with the bank ranking the second-best in the industry in terms of recoveries. UNBK continues to maintain its recovery guidance of ~INR160b in FY25. The written-off pool stands at INR780b, with recoveries from written-off accounts maintaining a steady rate of 5-5.5%. No corporate loan quality issues have been identified, though some stress has emerged on the retail side (housing loan), leading to slippages into SMA without any significant forward flow. The telecom account that slipped from SMA1 to SMA2 in the quarter has now been resolved and is making regular payments.

Other highlights

* Persistent liquidity constraints continue to hinder the feasibility of an immediate rate cut in term deposits. As a result, deposit rates are likely to be maintained in the near term unless liquidity conditions improve or a rate reduction becomes viable, which could weigh on near-term profitability.

* Gold loans constitute 45-50% of the bank's agri loan book. However, recent regulatory changes restricting collateralization for loans up to INR200k have led to some contraction in this segment.

* Bulk deposits of INR320b were shed in 3QFY25. Retail term deposits are growing at a strong pace, with a healthy 8% growth rate.

* The bank’s focus remains on attracting new-to-bank customers, a critical focus area. Engagements with the existing bank customers have been suboptimal, and to address this, 1,500 employees have been deployed to improve customer engagement.

* The bank has a well-established strategy for its treasury operations. With this plan, the bank is positioned for a strong 25% YoY growth in treasury profits, which could contribute significantly to overall earnings momentum.

Valuation and view

UNBK has been reporting a healthy performance, with earnings driven by healthy revenue and controlled provisions. Fresh slippages have been under control, which, coupled with healthy recoveries and upgrades, has resulted in an improvement in asset quality ratios. Further, a lower credit cost and controlled restructuring provide a better outlook on asset quality. Loan growth is expected to trend at ~11%, aided by healthy growth in RAM segment. Margins are also expected to remain in the guided range of ~2.8-3% despite the rate cut, supported by higher MCLR-linked loans. We estimate loans to grow at ~10% over FY25-27E, with RoA/RoE at 1.1%/15.5% by FY26E. We reiterate our BUY rating with a TP of INR135 (premised on 0.8x Sep’26E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412