Buy Mahindra & Mahindra Ltd for the Target Rs. 3,482 by Motilal Oswal Financial Services Ltd

FES performance impresses; drives margin beat

Well-placed to outperform in both Auto and FES segments

* MM reported a better-than-expected operating performance in 4QFY25, led by a strong margin beat in the FES segment (at 19.4% vs 17.3% estimated). The QoQ margin improvement was particularly commendable as it came in a seasonally weak quarter. Auto segment margins, adjusted for contract manufacturing at MEAL, came in at 10% (+30bp QoQ).

* Given the sustained demand momentum in UVs and tractors, we have raised our earnings estimates by 4%/6% for FY26/FY27E. Reiterate BUY with a TP of INR3,482 (based on FY27E SOTP).

Strong FES segment performance drives operational beat

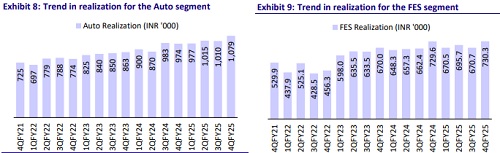

* Revenue grew 24.5% YoY to INR313.5b, ahead of our estimate of INR297b. The beat was largely driven by a 5% beat in ASPs across both the Auto and FES segments.

* EBITDA margin expanded 180bp YoY to 14.9%, ahead of our estimate of 14.1%. The beat was driven by improved ASP and better performance in the FES segment.

* While the Auto segment’s margins remained largely flat YoY at 9.2% (down 50bp QoQ and slightly below our estimate of 9.5%), the FES segment’s margins sharply rose 360bp YoY, driven by last year’s low base to 19.4% (ahead of our estimate of 17.3%).

* The Auto segment’s EBIT margins were impacted by the ramp-up of EV models. Adjusted for the same, ICE auto EBIT margin stood at 10%.

* The FES segment posted record-high margins in Q4, despite it being a seasonally weak quarter, making the performance particularly commendable. Management indicated that the margin expansion was attributed to the lower-than-usual competitive intensity in the industry but expects this to normalize in the coming quarters.

* However, lower other income and higher interest and depreciation led to an in-line PAT at INR24.4b.

* For FY25, while revenue grew 17% YoY to INR1,165b, adjusted PAT grew 11% YoY to INR118.6b. EBITDA margin expanded 140bp YoY to 14.7%.

* On a consolidated basis, MM posted an adjusted PAT growth of 20% YoY and delivered an RoE of 18%, in line with its guidance.

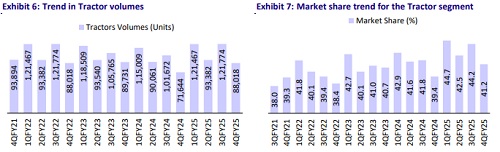

* The auto segment delivered 45.2% RoCE, while the tractor segment delivered 53.7% RoCE in FY25.

Highlights from the management commentary

* Auto: Management remains optimistic about sustaining outperformance to the UV industry in FY26. Incremental growth is expected to be driven by the full-year benefit of launches, including the Thar Roxx and XUV 3XO, along with contributions from recently launched EVs.

* Following recent launches, MM has outlined a product roadmap to launch seven ICE SUVs (two mid-cycle enhancements), five BEVs, and five LCVs (two of which will be EVs) by 2030. For CY26, it targets to launch three ICE SUVs (two mid-cycle enhancements), two BEVs, and two LCVs (one of which will be EV in the <3.5T segment). Management has confirmed that the new SUV expected in CY26 will not be a five-seater.

* Tractors: Management has guided for high single-digit growth in the tractor industry for FY26. It also expects to outperform the industry, supported by a favorable market mix (with good demand seen in its strong markets of South and West).

Valuation and view

* We believe MM is well-placed to outperform across its core businesses, led by a healthy recovery in rural areas and new product launches across both the UVs and tractors segments. Given the sustained demand momentum in UVs and tractors, we have raised our earnings estimates by 4%/6% for FY26/FY27E. We estimate MM to post a CAGR of ~13%/13%/18% in revenue/EBITDA/PAT over FY25-27E.

* While MM has outperformed its own targets of earnings growth and RoE of 18% in each of FY24 and FY25, it remains committed to delivering 15-20% EPS growth and 18% ROE, ensuring sustained profitability and shareholder value. Reiterate BUY with a TP of INR3,482 (based on FY27E SOTP).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412