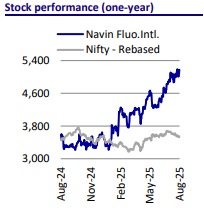

Neutral Navin Fluorine International Ltd for the Target Rs.5,100 by Motilal Oswal Financial Services Ltd

Steady earnings visibility amid strategic expansion initiatives

We attended the Navin Fluorine International Limited (NFIL) analyst meet, where management discussed demand trends, company strategy, and outlook across key segments. The planned capex of INR7b-10b will be deployed without impacting return ratios. Detailed capex plans will be announced in the next six months.

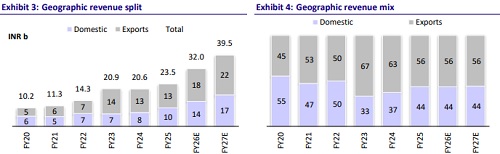

* Strategic focus remains on scaling the HF business and accelerating the adoption of electronic-grade HF through its partnership with Buss ChemTech. R32 sales to the US comprise ~25% of total revenue, with 15% protected under anti-dumping duties, offering partial pricing support.

* The CDMO segment also gained traction, with Phase 1 completed and 5-6 molecules currently under development, while Phase 2 will begin once utilization hits 60-65%.

* The Advanced Materials segment is emerging as a long-term growth driver, targeting ~15% revenue share by FY30, supported by products co-developed with Chemours for semiconductors and data centers. The TFMAP segment continues to face pricing pressure, though volumes are improving.

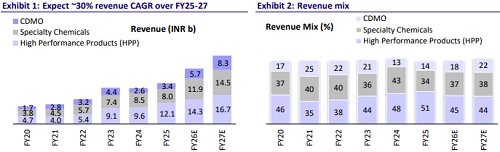

* We expect a revenue/EBITDA/adj. PAT CAGR of 28%/37%/41% over FY25-27. The stock is trading at ~46x FY27E EPS of INR116.1 and ~27x FY27E EV/EBITDA. We reiterate our Neutral rating.

HPP business positioned as a long?term strategic initiative

* The company has seen strong volume growth in the High-Performance Products (HPP) segment (contributed 51% of sales in FY25), driven by increased sales and higher utilization of R32, R22, and HFO products.

* The company is actively exploring value-added opportunities within the hydrofluoric acid segment. With anticipated customer interest, the focus is on accelerating market adoption and creating a network effect.

* The company plans to undertake targeted investments aimed at facilitating faster adoption and enhancing its positioning in the HF value chain.

* The newly commissioned R32 production facility was scaled up efficiently, supported by robust demand from both domestic and international markets.

* The company expects limited downside risk to R32 prices, underpinned by stable demand conditions. This is likely to support short-term pricing stability in further quarters.

* R32 enables a cost-effective shift from high-global warming potential (GWP) to low-GWP refrigerants, positioning it as a strategic product within the company’s portfolio.

* HFO and R32 operations continued at an optimum level with higher R32 sales, followed by improved realizations across key products.

* Demand for HFO products is largely dependent on infrastructure growth in the US and Europe. Future capital expenditure in this segment will be contingent on the pace of infrastructure development in these key regions.

* Recent tariff changes have introduced uncertainty around demand visibility and the timing of potential capacity expansion in the HFO segment.

* India exports approximately 60% of R32 volume. Capacity expansion for R32 globally is expected to be completed by Dec’26, with no further expansions planned from FY27 onwards. The company has also scheduled the addition of 15,000MT of R32 production capacity by Dec’26.

* R32 sales to the US market account for approximately 25% of the company’s total business. Of this, around 15% is safeguarded under anti-dumping duty protection, ensuring partial insulation from pricing pressure.

* The company has an exclusive partnership with Buss ChemTech AG, Switzerland, to commercialize its high-purity electronic grade HF, making significant progress in engaging global customers in the electronic market. This serves as a foundation for advancing its broader product portfolio, with several products currently in the development and pilot stages.

CDMO business on the right track

* CDMO (15% of sales in FY25) has successfully completed Phase 1, with operations now stabilized. Phase 2 expansion will commence once capacity utilization reaches 60-65%.

* The company is evaluating additional capex opportunities, driven by a ramp-up in existing products and ongoing discussions with prospective clients.

* Currently, 5-6 molecules are in the development stage, indicating a healthy project pipeline that could support future scale-up and incremental investments.

* The company has observed strong performance in both the HPP and CDMO segments, with superior asset turnover and EBITDA generation compared to the specialty chemicals segment. This trend is expected to continue going forward.

Scale specialty, build advanced materials

* The company is expanding the capacity of its specialty chemicals segment (contributes 34%) through debottlenecking. The capacity expansion is focused on three key molecules, two of which present large opportunities. The company aims to enhance both capacity and operational efficiency. The segment’s asset turnover stands at 1.1x

* Contribution from the pharmaceutical segment is gradually declining, primarily due to the phasing out of generic pharma contracts.

TFMAP (3-trifluoro methyl acetophenone)

* The TFMAP segment is expected to see an uptick in demand at competitive prices.

* Contribution margins are expected to remain at a healthy level.

* The company does not expect a material impact on absolute EBITDA. Greater clarity on demand trends for FY26 is anticipated by the end of 2QFY26.

Advanced materials

* The company anticipates that the advanced materials segment will contribute approximately 15% to its expanded revenue capacity by FY30. Management believes this segment will be a key future growth driver for the specialty segment, with the potential to reach the scale of the CDMO business.

* The asset turnover ratio for the advanced materials segment is expected to remain in the range of 1.6 to 1.7.

* The global liquid electronic chemicals market is currently valued at INR55b and is expected to reach INR130b by 2030.

* The company has co-developed liquid electronic chemical products in collaboration with Chemours, and the patents are not owned by the company.

* India’s rapidly growing data center industry presents a significant opportunity. There are several liquid electronic products in the market that are widely used in data center operations.

* The Advanced Materials portfolio will target niche and high-value areas such as immersion cooling technologies and electronic-grade materials.

Valuation and view

* We believe the company is well-positioned to sustain its growth momentum in FY26, supported by the commercialization of three new molecules in 2QFY26 and material contributions expected from the Fluoro Specialty unit at Dahej, which commenced operations in Dec'24. The company reiterated its EBITDA margin guidance of approximately 25%. We believe the EBITDA margin guidance has a potential upside risk, driven by improved operating leverage and segmental mix.

* The medium-term outlook is further supported by: 1) a strategic partnership with Chemours to foray into high-growth advanced materials and 2) the approval of a key molecule by both the US and EU, enabling expanded applications in the CDMO segment.

* We expect a revenue/EBITDA/adj. PAT CAGR of 28%/37%/41% over FY25-27. The stock is trading at ~45x FY27E EPS of INR116.1 and ~27x FY27E EV/EBITDA. We value the company at 45x FY27E EPS to arrive at our TP of INR5,100. Valuations remain expensive; thus, we reiterate our Neutral rating.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412