Neutral Kfin Technologies Ltd for the Target Rs. 1,200 by Motilal Oswal Financial Services Ltd

Strong annuity base with emerging international upside

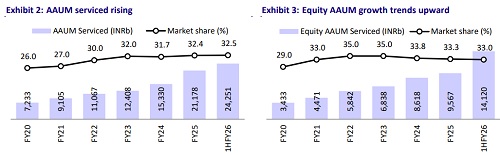

* KFintech remains a dominant, cash-generative market infrastructure platform with leadership across domestic MF investor solutions and issuer services, underpinned by deep AMC relationships (~54% of AMCs; ~32% industry AAUM), strong annuity visibility and consistently high mandate win rates.

* MF revenue continues to grow steadily (up 10% YoY with ~70% revenue share), supported by marginally higher-than-industry AAUM growth, resilient SIP flows and increasing contribution from value-added services (5.2% in 2QFY26 vs. 4.8% in 1QFY26). Structural yield compression (~3.5-4% annually) has been largely de-risked, leaving only two renewals over the next two years. However, the recent changes in TER regulations pose risk to future yields.

* Issuer Services business is structurally scaling up to a high-mix, annuity-led growth engine, contributing ~16% of revenue. Growth is driven by a strong IPO pipeline, a rising share in large mainboard listings (43.8% share by issue size in 2QFY26 vs. 34.4% in 2QFY25), deeper NSE-500 penetration (49.6% share) and an expanding post-listing annuity base, reducing cyclicality and supporting a stable mix.

* International business (14% of revenue mix): The scale-up is driven by higher realizations, larger mandates and platform cross-selling. Ascent Fund Services acquisition has expanded KFintech’s addressable market into private-markets fund administration and supports faster growth with medium-term margin expansion.

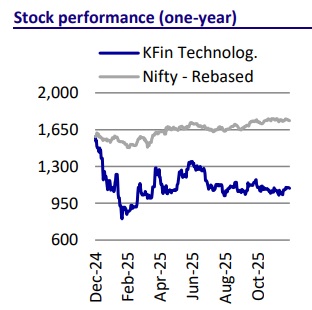

* We expect a CAGR of ~16%/16%/18% in revenue/EBITDA/PAT over FY25-28E. The stock trades at a premium to traditional capital-market intermediaries, reflecting revenue visibility and high RoCE. We reiterate Neutral rating with a one-year TP of INR1,200, based on 40x Sep’27E EPS.

Industry trends in India

* Duopolistic structure with strong moats: CAMS (~68% AUM) and KFin (~32% AUM) dominate the MF RTA market, with deep moats from analytics, MIS, and digital-physical integration, creating high switching barriers and pricing power.

* Robust industry growth: India’s MF AUM grew at a ~20% CAGR to INR67.4t (FY14-25), with equity MF AUM recording ~55% CAGR. Medium-term AUM CAGR is expected at ~14-15%, driven by rising incomes, investor awareness, and tech-enabled investing. ? High stickiness and defensibility: RTAs operate under strict SEBI norms, ensuring compliance and data security. High switching costs make them stable, annuity-like partners for AMCs, supporting strong margins and RoE.

* Revenue diversification: KFin generated ~30% of 2QFY26 revenue from non-MF segments, including international fund administration, issuer solutions, and AIFs, reducing concentration and providing higher realization growth opportunities.

* Strategic positioning: Leveraging domestic MF dominance, international expansion, and private-market administration (Ascent acquisition), KFin is positioned for scalable, high-quality growth with strong margins and premium valuation.

Market dominance in MF RTA continues

* KFin continues to dominate India’s MF investor solutions space, supported by leadership in AMCs serviced (29 of 54 AMCs), rising SIP flow market share (38%) and a consistently high win rate in new mandates (21 of 34 new AMCs historically; 4 of 4 recent launches).

* In 2QFY26, KFintech serviced MF AAUM of ~INR25t (+16.8% YoY), marginally outperforming industry growth of 16.5%. Equity AAUM rose 14.1% YoY to INR14.6t, accounting for ~58.5% of total MF AAUM, with overall and equity market shares steady at ~32.5% and ~33%, respectively.

* SIP flows remained resilient despite market volatility, rising to INR330.9b in 2QFY26 (19% YoY/6.2% QoQ), with market share remaining stable at 38% as of Sep’25. Transaction volumes grew 15.6% YoY to 144.7m. However, live SIP folios declined 13.8% YoY to 36.7m, underperforming the industry decline of ~1.5% YoY, reflecting heightened churn in smaller-ticket accounts.

* MF revenue increased 10% YoY to INR2.2b, driven by strong net inflows and stable market share, contributing ~70% of overall revenue. Management indicated that MF’s revenue share is likely to moderate over time, as international operations (including Ascent) scale faster (~30% growth vs. ~15- 20% growth in the domestic MF segment).

* Value-added services (VAS) continue to gain traction, contributing ~5.2% of MF revenue in 2QFY26 (vs. ~4.8% in 1QFY26). The quarter saw a key data-lake contract win from an existing AMC, incremental SIF mandates from three AMCs, and a new RTA mandate from Lakshya Asset Management, with revenue contribution expected to build meaningfully over a 3-4-year horizon.

* Yields moderated to ~3.5bp (vs. 3.7bp in 2QFY25), though sequential stability has emerged. Management reiterated expectations of structural yield compression of ~3.5-4.0% annually under the telescopic pricing model, with pricing risks largely mitigated as most contract renegotiations are complete and only two large renewals remain over the next two years.

* On the technology front, KFin is re-engineering FinEx—its 40-year-old core MF technology stack supporting ~50% of retail investors and ~INR30t+ AUM—with 2 of 16 modules now live. This is expected to enhance operating efficiency, shorten client onboarding timelines and lower long-term technology costs. New platforms such as IGNITE (distributor engagement) and IRIS (multi-product advisory across MF, pensions, loans and cards) further strengthen digital depth and client stickiness.

* Overall, the MF business remains a high-quality annuity franchise with strong client retention, predictable AUM- and transaction-linked revenue and technology-led scalability, continuing to serve as a core cash-generative pillar even as growth increasingly shifts toward international and adjacent platforms.

* We expect this segment to post a 13% revenue CAGR over FY25-28E.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412