Buy Adani Ports & SEZ Ltd for the Target Rs.1,700 by Motilal Oswal Financial Services Ltd

Navigating new frontiers with global expansion

In this note, we present the key takeaways from the FY25 annual report of Adani Ports & SEZ (APSEZ).

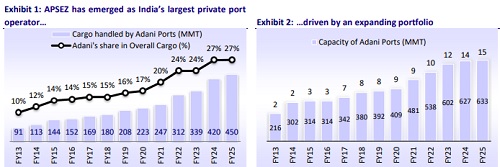

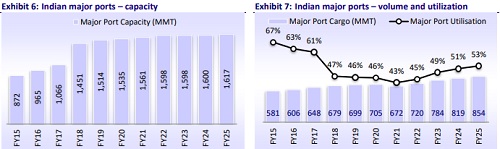

* APSEZ ended FY25 with 7% growth in total volumes to 450MMT, supported by a network of 15 ports/terminals across the country’s coastline, including India’s largest port at Mundra that handled ~200MMT of cargo in FY25. In India, APSEZ handled 431MMT cargo. In FY25, APSEZ domestic ports portfolio witnessed ~6% YoY volume growth, outpacing India’s cargo growth rate of 4%.

* In FY25, ~27% of all-India cargo volumes were routed through APSEZ ports. In FY26, the company is targeting cargo volumes of 505-515MMT.

* The company expanded both domestically and internationally by acquiring Gopalpur Port, commencing operations at Vizhinjam and Colombo ports, and securing long-term concessions at Dar es Salaam and Kolkata. It also approved the acquisition of North Queensland Export Terminal (NQXT) in Australia and saw strong progress at Haifa Port in Israel.

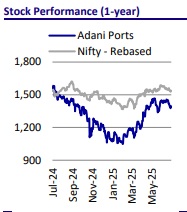

* APSEZ demonstrated strong operational momentum in FY25, marked by robust cargo growth, market share gains, and record volumes at key ports like Mundra. The company continued to expand its integrated infrastructure through strategic domestic and international acquisitions, including ports in Sri Lanka, Tanzania, and Australia. With plans to generate over INR1t in operating cash flow during FY26-30, APSEZ is well-positioned to scale up its cargo volumes to 1b tons by 2030. We reiterate our BUY rating with a TP of INR1,700 (implying 21% potential upside).

Expansion across business segments

* APSEZ, India’s largest integrated transport utility, has a strategically located pan-India port network of 15 domestic and four international ports. APSEZ handled 27% of India’s total cargo and ~46% of container volumes in FY25, significantly outpacing national cargo growth. Mundra, its flagship port, became the first Indian port to surpass 200MMT in annual volumes.

* The company's vertically integrated logistics infrastructure—spanning 12 multimodal logistics parks (MMLPs), 132 operational rakes, 3.1m sq. ft. of warehousing, and a trucking network—further supports seamless hinterland connectivity and value-added services, creating significant competitive moats.

* APSEZ is expanding its global presence through strategic port acquisitions and concessions, including operationalization of the Colombo terminal, a 30-year deal at Dar es Salaam, and the planned acquisition of NQXT. These initiatives are set to raise international contribution to 15% by 2030 from 5% in FY25 while reducing geographic concentration risk.

Targets to double port volumes by 2030

* APSEZ handled 450MMT (+7% YoY) of cargo volumes in FY25. The growth was supported by containers, which rose 20% YoY. Management has projected to handle 505-515MMT of cargo in FY26.

* Further, APSEZ targets to double its volumes handled to 1b tons by 2030. This would be mainly driven by domestic port volumes.

* APSEZ is expected to drive volume growth by market share gains and capacity expansion at existing ports. The logistics business will serve as a value addition to the domestic port business with a focus on enhancing last-mile connectivity.

Integrated Logistics Business: Strong growth and network expansion in FY25

* In FY25, APSEZ’s logistics business continued to scale up rapidly, driven by strong growth across container, bulk, and agri logistics. Container volumes at MMLPs rose 21% to 0.45m TEUs, while bulk cargo volumes increasing 9% YoY to ~22MMT.

* The company expanded its logistics infrastructure with 132 operational rakes (including container, GPWIS, agri, and AFTO rakes), 12 MMLPs, and warehousing capacity growing from 2.4 to 3.1m sq. ft. Agri-silo capacity stood at 1.2MMT, with plans to expand to 4MMT. These developments reflect APSEZ’s integrated strategy to offer end-to-end, multimodal logistics solutions.

Marine services as a scalable global platform

* APSEZ is aggressively scaling up its marine business through its marine division, comprising Ocean Sparkle Ltd., Astro Offshore, and The Adani Harbour International DMCC.

* The company operates 115 third-party vessels and 28 dredgers, making it India’s largest marine services and private dredging provider. The acquisition of Astro Offshore extended APSEZ’s presence across the Middle East, East Asia, and Africa, with expectations to triple the business within two years.

* Additionally, an order for eight tugboats from Cochin Shipyard under the Makein-India initiative supports long-term capacity expansion and localization. Marine services are set to become a scalable global platform, contributing to earnings diversity and resilience.

Strong financial performance and visibility

* APSEZ delivered robust financial performance in FY25, with 14%/16% growth in revenue/EBITDA, driven by efficiency gains, volume growth across key ports, and a growing contribution from its logistics and marine services businesses.

* With an EBITDA margin of 73% in its domestic ports segment, the company remains one of the most profitable port operators globally. It aims to generate over INR1t in operating cash flow over FY26-30, providing ample internal accruals to fund capex and international expansion without compromising balance sheet health.

* FY26 guidance includes cargo volumes of 505-515MMT and revenue of INR360- 380b and EBITDA of INR210-220b, underpinned by full-year operations at Vizhinjam (India’s first automated transshipment port) and the Colombo terminal, as well as improved efficiencies across the portfolio.

Focus on ESG initiatives

* Environment: APSEZ targets Net Zero emissions by 2040 and is actively reducing Scope 1 and 2 emissions through enhanced operational efficiency, adoption of renewables (277MW commissioned), electric vehicles (400 deployed), and plans to scale renewable capacity to 50GW by 2030.

* The company is investing in social infrastructure through projects like the Adani Healthcare Temples and an INR20b skill university in Mundra while engaging in large-scale community service initiatives like the Mahaprasad Seva at the Maha Kumbh Mela.

* APSEZ maintains a balanced board with 50% independent directors and a 10% female representation. It declared a dividend of INR7 per share for FY25. APSEZ appointed statutory auditors for a five-year term ending in 2029.

Valuation and view

* APSEZ is anticipated to outpace India's overall growth, driven by a balanced port mix along India's western and eastern coastlines and a diversified cargo mix. The company continues to invest heavily in the ports and logistics business to drive growth. The commencement of operations at the transshipment hubs will enable the company to further boost volumes.

* APSEZ’s diversified cargo mix and ongoing infrastructure investments are expected to support its target of 505-515MMT cargo handling in FY26. We expect APSEZ to report 10% growth in cargo volumes over FY25-27. This would drive a CAGR of 16%/16%/20% in revenue/EBITDA/PAT over FY25-27. We reiterate our BUY rating with a TP of INR1,700 (premised on 16x FY27E EV/EBITDA)

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412