Buy CEAT Ltd for the Target Rs. 3,818 by Motilal Oswal Financial Services Ltd

Margins set to improve with softening input costs

Replacement to be a key growth driver, expect a steady recovery in OE

* Ceat Ltd (CEAT)’s 4QFY25 performance was ahead of estimates as it posted 100bp margin expansion QoQ to 11.3% (vs. an estimate of 10.5%) led by a marginal reduction in input costs and price hikes taken in Q4. Management expects the international mix to improve to 26% from ~19% currently, fueled by the Camso acquisition, focus on OHT, and expanded distribution, especially in the US. This is not just expected to drive healthy growth but should also bode well for its overall profitability.

* CEAT’s focus on strategic areas such as PVs/2Ws/OHT/exports (to help margins), along with prudent capex plans (to benefit FCF), should continue to improve its returns in the long run. We reiterate our BUY rating on the stock with a TP of INR3,818 (based on ~18x FY27E EPS).

Decline in input costs and improved pricing boost margins

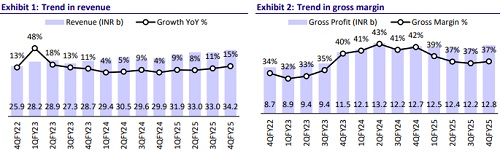

* CEAT’s net sales grew 14.3% YoY (+3.7% QoQ) to INR34.2b (in line), primarily due to healthy YoY volume growth in the OEM and replacement segments.

* On a QoQ basis, the OEM segment was the key growth driver, while replacement and exports remained flat.

* However, international business was hurt both on a YoY and QoQ basis due to the adverse global macro environment.

* Realization improved both on a QoQ and YoY basis.

* Segment mix: Truck/bus 30%, 2/3Ws 27%, PV 21%, OHT 15%, Others 7%

* Market mix: Replacement 53%, OEM 28%, Exports 19%

* Gross margin improved 60bp QoQ (vs. estimate of flat GM QoQ) due to a flat RM basket and price hikes taken during the quarter.

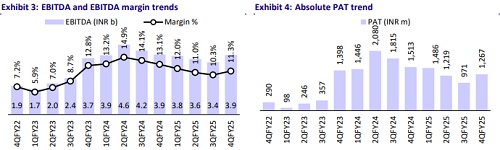

* As a result of this and operating leverage benefits, EBITDA margin improved 100bp QoQ to 11.3%.

* Adjusted for VRS expenses, PAT declined 16% YoY (+31% QoQ) to INR1.26b – ahead of our estimate of INR1.1b.

* Working capital increased on a QoQ basis, which led to around INR950m increase in debt sequentially to INR19.3b. The D/E ratio stood at 0.44x, while the debt/EBITDA ratio came in at 1.29x.

* Capex for the quarter was INR2.4b, funded through internal accruals. The company has announced investments of INR4b toward capacity addition in Nagpur, which will increase the capacity by 30% by the end of FY28.

* For FY25, revenue grew 11% YoY to INR132b. EBITDA margin dipped 270bp YoY to 11.2%, primarily due to a rise in input costs. Adjusted PAT declined 28% YoY to INR4.9b.

Highlights from the management commentary

* Domestic outlook: Following a weak demand in FY25, management expects the CV OEM segment to post a mid-single-digit growth in FY26. PV OEM is likely to post a low single-digit growth. Moreover, the rural outlook is better than the urban outlook. Hence, given its distribution reach, the company expects to grow well in the 2W and farm segments. The OHT segment has also been facing headwinds over the last two years. With reducing input costs, management expects that the industry would be able to hold on to its pricing. Hence, management expects the gross margin to improve if this trend continues.

* International business outlook. It continues to see stable demand from key markets like Europe, Southeast Asia, and the Middle East. However, the company is seeing demand headwinds in markets such as Latin America and the US.

* Tariff impact on Camso and international business: As per the management, CEAT’s exposure to the US (ex of Camso) is in the low single digits. For Camso, about 30% of its business exports to the US are from Sri Lanka. Of this, 15% of exposure comes from tracks and 15% from tyres. Sri Lanka has imposed a 44% reciprocal tariff on tyre imports to the US. While the reciprocal tariff has now been postponed by 90 days, given the ongoing dialogues with trading partners and global OEMs, management is confident that it would hear some positive solution on this front for the industry. However, track imports to the US attract about 4% duty only. Tracks are about 50% of Camso's revenue.

* Update on capex and debt: The company invested INR9.5b in capex in FY25, and it expects to invest INR9-10b for FY26 as well. Gross debt for FY25 stood at INR19.3b with D/EBITDA at 1.3x and D/E at 0.44x. Management indicated that debt may rise to INR30b levels in the coming years with D/EBITDA at ~2.4-2.5x.

Valuation and view

* The replacement segment is likely to continue to be the key growth driver. In OEMs, the outlook for 2Ws and tractors is healthy with a pick-up expected in the TBR segment. Following the integration of Camso, its international business contribution will rise to 25% from 19% currently. Given the reduction in input cost, we have raised our FY26/FY27 EPS estimate by 4%/8%.

* CEAT’s focus on strategic areas such as PVs/2Ws/OHT/exports (to help margins), along with prudent capex plans (to benefit FCF), should continue to improve its returns in the long run. We reiterate our BUY rating on the stock with a TP of INR3,818 (based on ~18x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)