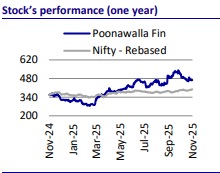

Buy Poonawalla Fincorp Ltd for the Target Rs. 600 by Motilal Oswal Financial Services Ltd

Smart risk, sharp execution, strong outcomes

Driving predictable scale via smart underwriting and diversified growth engines

We hosted Mr. Arvind Kapil, MD & CEO of Poonawalla Fincorp (PFL), for a meeting with a group of foreign institutional investors to discuss the company’s future trajectory and the progress achieved over the past year under the new leadership team. PFL continues to deliver on its stated ambition of building a digitally enabled, multi-product, and high-ROA retail lending franchise. Under the leadership of its new MD & CEO, the company has rapidly scaled newer businesses, invested significantly in AI-driven risk and operational systems, and strengthened its governance and cultural fabric. The strategy focuses on disciplined, diversified growth with balanced exposure across secured and unsecured retail products. The organizational culture is driven by a focus on high performance and innovation, coupled with a commitment to continuous improvement. With multiple new products scaling well, robust risk practices, and strong execution capabilities, PFL is well-positioned to sustain (or potentially exceed) its ~35- 40% AUM CAGR guidance, while improving profitability. The company targets to achieve its guided ROA of 3.0-3.5% by Jun’28, supported by higher operating leverage, superior cross-sell, and cost efficiency from automation. Over the next 4-5 years, the company aspires to set the stage for greater revenue stability, supported by sustained growth and consistent improvement in ROA.

Multi-product, multi-channel strategy driving robust AUM momentum

* Over the past year, PFL has introduced six to seven new products across consumer durable loans, education loans, gold loans, Prime PL, CV, and shopkeeper loans, each supported by detailed product engineering and a risk-calibrated execution framework.

* This diversification across multiple businesses not only creates different distribution strengths for the future but also generates revenue stability, which is vital for sustainable profit. The portfolio is being transformed into a highly resilient, scalable, and geographically diverse one, spanning retail, multi-channel, multi-product, and balancing secured and unsecured lending.

* The company has focused on building multiple distribution engines such as digital channels, DSAs, physical branches, dealer networks, and counsellorled channels to drive visibility, customer acquisition, and cross-sell opportunities. Notably, PFL’s emphasis has been on creating sustainable growth engines, ensuring that every new product contributes meaningfully to both customer franchise expansion and profitability.

* Consumer durable loans are already active through 10k dealer outlets across urban and semi-urban markets, while education loans are distributed via counselor networks, where PFL is gaining strong acceptance. The company’s digital lending platform continues to enable seamless onboarding, and its gold loan operations are targeted to be fully rolled out across ~400 focused branches by Mar’26.

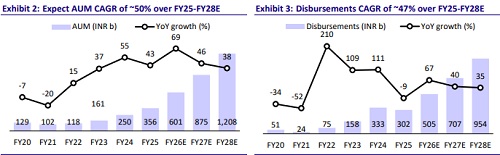

* The company is focusing on high-yield, granular products, disciplined underwriting, and strong cost controls. Management reiterated confidence in sustaining robust AUM growth momentum in FY26, supported by improving productivity and diversification benefits. We model AUM growth of 69%/46% in FY26/FY27E, leading to AUM CAGR of ~50% over FY25-FY28E.

Rapid scale-up across all its new lending engines

* PFL continues to demonstrate strong and broad-based traction across its newly launched businesses, with disbursements scaling sharply in multiple segments. The prime PL business has gained rapid market acceptance, with monthly disbursals scaling to ~INR4b and 26% of volumes processed through a fully digital straight-through processing (STP) journey, underscoring the strength of PFL’s tech-led origination capabilities.

* Gold loans have also accelerated meaningfully, with disbursements rising from INR280m in Jun’25 to INR1.1b in Sep’25, supported by rapid branch expansion to 160 locations and a clear roadmap to reach 400 branches by Mar’26.

* The CV business continues to scale strongly as well, with disbursals doubling to INR1b and network expansion to 49 locations and 450 channel partners, alongside a successful launch of the new CV product.

* Education loans have built early momentum, with over 10k files logged, INR1b disbursed in a single month, and a growing base of 200 counsellors. Collectively, these businesses are gaining scale at a rapid pace and are set to evolve into robust and sustainable growth engines for PFL over the medium term.

AI-led transformation driving structural improvement in operating leverage

* A defining pillar of PFL’s transformation is its AI innovation lab in collaboration with IIT Mumbai, where 45 projects are underway and 16-17 are already live. Out of 45 initial projects tabled, 16-17 have been commissioned and executed. It is believed that five or six of these projects could be pathbreaking, while the others are designed to incrementally enhance decision-making speed and cost efficiency. These projects cover areas like risk analytics, collections, underwriting, marketing efficiency, and even internal audit and governance automation.

* PFL aims for the organization to fully embrace AI. AI and ML models are extensively used in collections, providing a significant edge compared to the industry. The agility enables PLF to launch new AI or ML models in potentially less than one-third of the time required by industry peers.

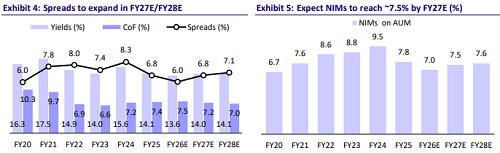

* This digital transformation is expected to yield significant cost efficiencies over the next 12-18 months, structurally improving PFL’s cost-to-income ratio. We model the cost-to-income ratio to decline to ~42% by FY28E (FY25: 51%).

Building strong cross-sell engines for scalable customer growth

* Digital lending provides pan-India access, unrestricted by pin codes, enabling seamless spread across geographies. The PL Prime 24x7 digital journey is an industry benchmark, capitalizing on customers who prefer taking loans late at night or early in the morning based on their cash flow and EMI requirements.

* The new businesses are strategically designed to create strong cross-sell opportunities and customer acquisition funnels. For instance, investing in consumer durables, which may not generate rapid standalone profit, is primarily intended for accelerated cross-sell. The goal is for each new customer to become a multi-product relationship. The ability to approve education loans quickly is aided by digital backend capabilities. Over time, these funnels are expected to meaningfully reduce customer acquisition costs, improve profitability, and enhance customer stickiness, creating a strong base for longterm compounding growth.

Reinforced risk framework driving sustained asset quality gains

* PFL maintains a risk philosophy centered on making the portfolio more granular, retail-focused, and completely diversified. This strategic approach is intended to design a model that is resilient and can withstand external shocks and economic cycles. The company reiterated that credit costs will continue on a declining trend in the foreseeable future till it stabilizes at steady-state levels. This will be achieved by planning for the contribution of lower-risk secured products (like gold and education loans) to increase substantially over the next three years.

* MSME portfolio, a key area of investor focus, remains predominantly secured, with ATS generally >INR5m and prudent underwriting. Management stated that the portfolio has been intentionally designed for low risk.

* The erstwhile STPL book continues to run down, now forming about 2% of AUM (vs 4% in Jun’25). Around 70% of this portfolio is zero-dpd and adequately provided. First EMI bounce rates in the recalibrated STPL book have improved 70% (relative to the legacy STPL book), with collection efficiencies improving by ~40%. As the mix shifts towards secured, salaried, and prime segments across gold, CV, LAP, education, and prime PL, credit costs are expected to decline over the next 3-5 years.

* Underwriting standards are calibrated using dynamic credit scoring models and algorithms built internally. There is strong investment in AI-driven risk analytics and collections, ensuring that collection capability translates into measurable outcomes. The disciplined approach of combining secured lending with prudent unsecured exposure ensures the credit cost profile remains structurally lower, even during volatile economic periods.

Valuation and view

* PFL is transitioning into a structurally stronger, digitally advanced, and welldiversified retail NBFC. The company’s disciplined approach to growth, strong leadership bench, and emphasis on technology and governance provide a clear path toward consistent, high-quality profitability. With multiple engines of growth and improving operating leverage, PFL is well-positioned to deliver sustained superior returns in the medium-to-long term.

* Culturally, the organization combines high-performance innovation with continuous improvement, reflecting what management calls a ‘smart organization mindset’. The company now employs over 3k people across multiple verticals, operating cohesively toward clearly defined profitability and governance objectives.

* PFL trades at 3.2x FY27E, and we estimate AUM/PAT CAGR of 42%/92% over FY26-FY28E with RoA/RoE of 2.6%/20% in FY28E. Reiterate our BUY rating on the stock with a TP of INR600 (premised on 3.7x Sep’27 BVPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412