Neutral Jubilant Foodworks Ltd for the Target Rs. 700 by Motilal Oswal Financial Services Ltd

Driving growth through volume and store expansion

We interacted with the management of Jubilant Foodworks (JUBI) to discuss the industry outlook, growth prospects for its business, profitability outlook, and other focus areas. Here are the key takeaways from the discussion:

* Demand has remained steady but has yet to show material pickup. JUBI expects demand recovery to begin from 3QFY26, supported by GST reforms. Moreover, strong participation in recent sale events such as Big Billion Days, etc., indicates a positive consumer spending momentum. The GST 2.0-driven relief is likely to boost disposable incomes, benefiting discretionary categories such as QSR. JUBI believes that there is ample underlying demand, and the right combination of location, pricing, and value will be a key enabler to unlock growth, mainly in rural markets. That said, JUBI continues to actively invest in its products and brands to stimulate growth (advertising in major events like the Asia Cup Cricket tournament).

* JUBI’s store addition strategy varies by location. For competitive large metros, where delivery accounts for ~70% of business, the focus is on differentiation through faster delivery times. Thus, JUBI in these markets densifies their presence via smaller-format stores (800-850 sq ft). In smaller towns, where the dine-in and delivery split is closer to 50:50, the strategy centers on the right product proposition, pricing, and overcoming supply-side constraints, along with a bigger store size (1,500-1,600 sq ft).

* JUBI is leveraging innovation to drive growth by tapping into new categories while strengthening its indulgence portfolio (mainly cheese). It has entered the INR10b sourdough market with sourdough pizza starting at INR349. Moreover, it is expanding its chicken portfolio, including offerings such as chicken burst, chicken wings, etc., to address its under-indexation in the non-vegetarian category. The company continues to target the indulgence segment through cheese-led innovations such as the Cheesiken range and Cheesy Volcano, which delivered strong traction and enabled JUBI to take selective price hikes. Similarly, the Lunch Feast, initially launched as a dine-in format, has been successfully scaled to the delivery channel. While these innovations have supported revenue growth, they have exerted some pressure on margins; however, JUBI continues to mitigate this pressure through selective pricing actions to protect gross margins. Over the longer term, Popeyes is expected to play a significant role in JUBI’s growth.

* Margins are likely to gain 50-60bp from GST 2.0, primarily through savings on cheese procurement. Paneer remains unaffected, as JUBI sources unbranded paneer. Rising milk prices (+INR2-3 every few weeks) continue to pose a cost headwind; moreover, competitive discounting by food aggregators exerts pressure on gross margin. To offset these challenges, JUBI is leveraging its procurement scale, deploying cohort-based smart pricing, driving in-house productivity initiatives such as chicken marination, and enriching product mix through innovation.

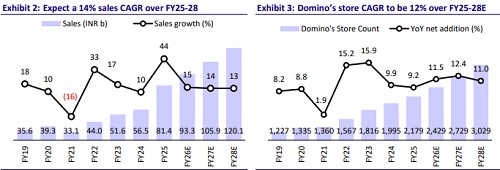

* Over the medium term, management is targeting 5-6% LFL growth per store, with 1-2% expected from pricing and the balance to be driven by volume and mix improvements. Store growth will be ~10%, which will aid ~8% revenue growth every year. Thus, the domestic business can deliver 13-15% sustainable growth over the medium term. We model a 15% revenue CAGR over FY25-28E.

* The company remains focused on driving cost efficiencies across procurement and operations to support profitability. It aspires to deliver over 200bp expansion in standalone pre-IND-AS EBITDA margins over the next three years, driven by lower losses of new ventures (~200bp impact), better GM of Domino’s, and cost efficiencies. While simultaneously pursuing aggressive expansion plans with a target of opening 1,000 new stores by FY28.

* Turkey operations remain stable despite the volatile macro conditions. JUBI mentioned that the only risk there is currency fluctuation. Turkey is a positive contributor to JUBI’s earnings as it operates on an asset-light, margin-accretive model, with a PAT margin of 8-9%. The recent exit of Yum! Brands (PH & KFC), due to the bankruptcy of the master franchisee, has been a key positive for DP Eurasia.

Valuation and view

* JUBI has been the key beneficiary of healthy traffic growth for the delivery business. Delivery is likely to outperform in the near term, which will continue to lead to better growth metrics than those of its peers in the near term.

* JUBI’s focus on customer acquisition and increasing order frequency has been fueling strong growth in the delivery segment. Value offering and product innovation will continue to drive order growth in FY26. We model a standalone pre-IND AS EBITDA margin of 12-14% for FY26-28E.

* The 2HFY26 base is unfavorable (revenue/LFL growth was 19%/12.5% and 19%/12.1% in 3QFY25 and 4QFY25, respectively), and reported performance may not appear as attractive as it has been over the last nine months. Thus, the coming quarters' performance and commentary will be crucial for stock performance.

* We remain constructive on the business franchise and higher orientation for growth. However, given the expensive valuations, we reiterate our Neutral rating on the stock with a TP of INR700, valuing the Indian business at 35x EV/EBITDA (pre-IND AS) and the International business at 15x EV/EBITDA on Sep’27E.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412