Buy Hyundai Motor Ltd for the Target Rs. 2,979 by Motilal Oswal Financial Services Ltd

Targets to launch seven new nameplates by 2030

Exports to account for 30% of total production by 2030

* Hyundai Motor India (HMIL) plans to invest a total of INR450b over FY26-30, with 60% to be invested in R&D and 40% in capacity expansion and modernization. It has guided for revenue of INR1t, margin of 11-14% and a dividend payout range of 20-40% during the same period. HMIL targets to launch 26 new models by 2030 (including five EVs), with 52% of its mix featuring eco-friendly powertrains. Of these, seven are expected to be new nameplates, with two of them to be launched over FY27-28 and the remaining five in the next two years.

* HMIL launched the fully redesigned Venue on 15th Oct. It would also look to enter the MPV and off-road SUV segments in due course. It plans to launch Genesis (luxury brand) in India by 2027 and ramp up operations significantly by 2032. For EVs, HMIL aims to achieve 100% localization in EV manufacturing by 2027, positioning India as a key global hub for the company’s EV operations. Further, HMIL aims for exports to constitute 30% of its total production by 2030. We keep our estimates unchanged at this stage.

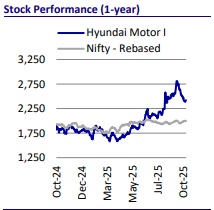

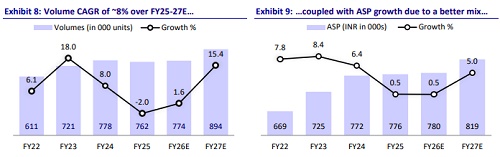

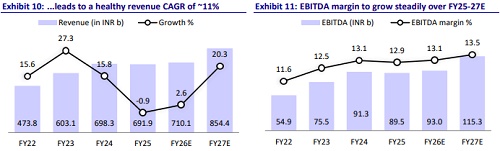

* We factor in HMIL to post a CAGR of 10%/15%/16% in volume/EBITDA/PAT over FY25-28E. Reiterate BUY with a TP of INR2,979, valued at 30x Sep’27E EPS.

FY30 roadmap

* Over FY26-30, the company plans total investments of INR450b, with 60% allocated to R&D and 40% to capacity expansion and modernization.

* FY26-30 targets – Revenue: INR1t | Margin guidance: 11-14% | Dividend payout: 20-40%

Update on new product launches

* HMIL plans to launch 26 new models by 2030, with 52% of its mix featuring eco-friendly powertrains such as EVs, hybrids, and CNG.

* The company will expand its nameplate portfolio from 14 to 18 by FY30.

* Of these, seven are expected to be new nameplates, with two of them to be launched over FY27-28 and the remaining five in the next two years.

* Further, in terms of powertrain options, HMIL would have 13 ICE models, five EVs, eight hybrids and six CNG models.

* HMIL launched the fully redesigned Venue on 15th Oct and also conveyed its intent to enter the MPV and off-road SUV segments in due course.

* It plans to launch Genesis (luxury brand) in India by 2027 and ramp up operations significantly by 2032.

Update on Domestic operations

* The Indian passenger vehicle market is projected to grow at a 5.2% CAGR through FY30. In contrast, HMIL expects to outperform the industry with a 7% CAGR in volumes, supported by a richer model mix and higher realization per unit. This is expected to result in HMIL’s market share improving to 15% by 2030.

* HMIL believes that UVs and MPVs will represent ~72% of the total Indian market by 2030, while HMIL’s own exposure to these categories will be around 82%.

* In terms of the SUV powertrain mix, the EV/hybrid powertrains are expected to record 500%/600% growth in volumes by 2030, while the traditional ICE powertrain would record a 10% decline in volumes, as per HMIL. This will result in a change in HMIL’s fuel mix to 47% ICE only by 2030 (86% currently), 20% CNG (13%), 16% hybrid (nil), and 17% EV (1%).

* Thus, HMIL is fully aligned with the upcoming CAFÉ 3 fuel efficiency and emission standards. Its proactive investments in EVs, hybrids, and CNG models should enable HMIL to comfortably meet the regulatory norms once finalized.

* HMIL operates a wide network of over 3,600 customer touchpoints in 1,050+ cities and 77% district coverage across India, ensuring strong market penetration across both urban and rural regions. The company is consolidating its dealer partnerships to enhance coverage and efficiency. By FY30, it aims to achieve 85% district-level presence and 30% volume contribution from rural areas.

* Customer mix: Among HMIL’s customer base, first-time buyers account for about 40% of sales, while non-white vehicles make up 44% of total sales. The company’s customer retention rate is 77%, and extended warranty penetration stands at 54%. The age mix is relatively youthful, with 22% of customers aged between 18 and 29 years, and 37% between 30 and 39 years, reflecting the brand’s strong appeal among younger consumers.

* Recent GST reductions have boosted demand for compact SUVs such as Venue and Exter, which have witnessed a notable uptick in bookings. The ongoing shift from hatchbacks to compact SUVs and higher-trim variants continues, mirroring the consumer transition observed over the past five years. Supported by robust festive season demand and multiple upcoming product launches, HMIL expects domestic sales growth to accelerate to 4.5-5% in 2HFY26.

* While HMIL continues to grow its domestic footprint, its strategic priority is to enhance profitability by focusing on high-margin export markets, rather than merely pursuing domestic volume expansion.

EVs and clean mobility strategy

* HMIL has already localized EV assembly and battery pack assembly operations and is now advancing toward the localization of high-technology components, including e-powertrain systems and battery cells. The company has signed MoUs with local vendors to establish domestic LFP cell manufacturing and is actively engaging with Tier-1 to Tier-3 suppliers to build a fully integrated EV supply chain.

* By 2027, HMIL aims to achieve 100% localization in EV manufacturing, positioning India as a key global hub for the company’s EV operations.

* HMIL’s first fully localized EV, a compact SUV, will be offered with both standard and long-range variants, with advanced infotainment systems and ADAS level 2 providing a superior driving experience to the customer.

* HMIL also plans to launch five EVs by 2030 and expand charging infrastructure to include more than 600 fast-charging stations by 2032.

* Future battery development will focus on reducing costs and improving efficiency. By 2027, HMIL targets 30% lower battery costs, 15% higher energy density, and 15% shorter charging times, with flexibility to use NCM batteries for performance models and LFP batteries for affordability.

* Hyundai Motor Co.’s (HMC) Ioniq 5’s EV technology is already proven to retain over 90% battery life even after 400,000km of usage, underscoring its long-term durability.

* HMIL has 125 DC chargers across 98 cities and 946 AC chargers across 232 cities to support EV adoption.

Exports

* HMIL exports vehicles to over 150 countries, reaffirming its position as HMC’s primary global export hub.

* HMIL aims for exports to constitute 30% of its total production by 2030.

* By 2030, the company’s targeted export mix includes 50% of volumes to the Middle East and Africa, focusing on compact sedans, SUVs, mild hybrids, and entry-level EVs; 40% to Central and South America, covering hybrids, compact sedans, and hatchbacks; and 10% to the Asia-Pacific region, primarily compact sedans, hybrids, and entry-level EVs.

* Export realizations are approximately 6% higher than domestic ASPs, reflecting a richer mix and more favorable market pricing.

Manufacturing capabilities

* HMIL’s Chennai facility, spread over 536 acres, comprises two vehicle plants and five powertrain shops, with an annual capacity of 824,000 units and a 90% utilization rate. The plant rolls out one car every 30 seconds, demonstrating world-class efficiency.

* The Pune plant, covering 300 acres, will produce 170,000 units p.a. initially and is expected to produce 250,000 units p.a. by 2028. It is designed as a softwaredefined smart factory, integrating automation and data-driven manufacturing systems.

* HMIL has localized 100% of EV alternators and alloy wheels and plans to expand localization across the entire value chain, including Tier-3 suppliers.

* Supply chain localization for ICE models stood at 82% in FY25, and this is expected to rise to 90% by FY30.

Hyundai Motor Corporation – understanding parent support to HMI

* HMC is the 3rd largest auto OEM globally by volume, the 2nd largest in terms of profitability and among the top 5 brands in 26 global markets.

* HMC operates through 17 production plants worldwide, supported by a network of 5,400 dealers, underscoring its extensive global reach. The company has developed significant intellectual property strength, with over 250 hybridrelated patents, placing it alongside Toyota as one of the few automakers possessing comprehensive hybrid system capabilities. These hybrid systems are adaptable across both small and large vehicle segments, allowing flexibility in product development.

* HMC’s initial hybrid technology (TMED1) was 62% more fuel efficient and gave 27% more power vs. ICE vehicles. The new TMED 2 hybrid system provides even more power (+3.4% in transmission torque) and better fuel efficiency (up to 4.3% improvement) compared to TMED1.

* HMIL benefits from Hyundai Motor Group’s ecosystem of affiliated companies across R&D, logistics, component manufacturing, and financial services, enabling strong operational and technological synergies.

* In terms of production (sales, R&D support, design and allied functions), HMIL has already achieved 100% local production for its India and Korea production facilities. The localization level stands at around 50% in the Asia-Pacific region, 80% in Europe, 70% in Central and South America, 40% in the United States, and below 10% in the Middle East and Africa.

Other partnerships

* Effective 1st Jan’26, Mr. Tarun Garg, currently a Whole-Time Director and COO, will assume the role of MD and CEO, succeeding Mr. Unsoo Kim, who will return to Hyundai Korea.

* HMIL is establishing Hyundai Capital India, expected to launch in 2QFY26, initially offering dealer inventory and working-capital financing. In subsequent phases, the platform will expand into consumer loans, leasing, and fleet management and then move beyond mobility.

* HMIL is also pursuing a strategic partnership with TVS in the micro-mobility space, focusing on e-3Ws.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412