Neutral IndusInd Bank Ltd for the Target Rs. 650 by Motilal Oswal Financial Services Ltd

Multiple accounting lapses; discrepancy drags earnings

Cut earnings sharply; estimate FY27E RoA at 0.72%

* IndusInd Bank (IIB) reported a loss of INR23.3b (vs our est. of INR1.4b loss), led by muted NII (interest reversal of INR6.7b and higherslippages) and tepid other income amid the reversal of derivative loss of INR19.6b. The bank also reversed the fee income of INR1.72b. Adjusting for all one-offs amounting to INR46.6b (refer to Exhibit 1), adj. PAT would have been INR12.4b.

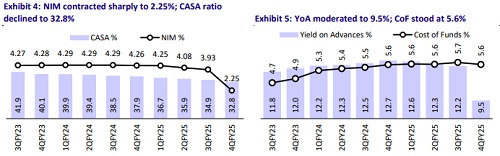

* NII declined 41.7% QoQ to INR30.5b (our est of INR35.7b), while adjusted for all one-offs, NII would have been at INR47b (down 10% QoQ). Reported NIMs contracted to 2.25% (down 168bp QoQ), while adjusted NIMs stood at 3.47% vs our estimate of 3.78%. PPoP loss, thus,stood at INR4.9b. Management indicated an adjusted PPoP run-rate of INR30.6b after adjusting for all one-offs.

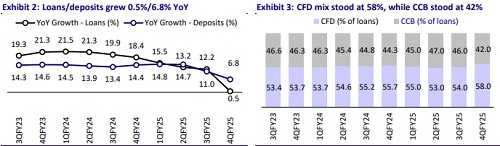

* Loan book declined sharply 6% QoQ to INR3.45t, led by a reduction in the corporate book for liquidity and balance sheet management efforts. Consumer book grew at a modest 2.5% QoQ, despite the MFI book declining 5.1% QoQ. Deposits book stood flat at 0.3% QoQ, while the CASA ratio declined 208bp QoQ to 32.8%.

* Fresh slippages stood elevated, up 128% QoQ to INR50.1b, driven by the rise of slippages in the consumer finance book to INR47.9b. GNPA/NNPA ratio increased 88bp/27bp QoQ to 3.13%/0.95%. The bank has utilized full contingent provisions of INR13.2b on 4Q.

* We cut our earnings estimate sharply by 45% for both FY26 and FY27E, and estimate the RoA/RoE at 0.6%/5.2% for FY26E and 0.72%/6.4% for FY27E. Reiterate NEUTRAL with a TP of INR650 (premised on 0.8x FY27E ABV).

Operating performance remains sluggish; asset quality deteriorates

* IIB reported 4QFY25 loss of INR23.3b (vs our est of INR1.4b loss), driven by a sharp NII miss due to a one-off of INR6.7b and higher slippages, while derivative accounting discrepancy and fee income reversal led to a 70% QoQ decline in other income. Adjusting for all one-offs of INR46.6b, adj. PAT would have been at INR12.4b.

* NII declined 43.3% YoY/41.7% QoQ to INR30.5b (14% miss to MOFSLe). Other income declined 70% QoQ to INR7.1b (due to the reversal of derivative impact of INR19.6b as well as the reversal of fee income of INR1.72b).

* Reported NIMs contracted to 2.25% (down 168bp QoQ), while adjusted NIMs stood at 3.47% vs our estimate of 3.78%.

* Opex grew 11.7% YoY/ 6.7% QoQ to INR42.5b. As a result, the C/I ratio increased to 113.1% (vs 52.5% in 3QFY25). PPoP loss, thus,stood at INR4.9b. Adjusted PPoP would have been at INR30.6b (down 15% QoQ).

* On the business front, loans declined 6% QoQ (up 0.5% YoY), driven by a sharp decline in the corporate and commercial books, as the bank exited certain corporate assets to manage liquidity and balance sheet, leading to a decline of 16% QoQ /6% YoY in the books. Meanwhile, the consumer book grew modestly by 2.5% QoQ, despite the MFI book declining 5.1% QoQ. In the consumer business, the VF business grew 8.1% YoY/ 2.1% QoQ, while the cards business grew at a modest 1.3% QoQ.

* Deposits stood flat at 0.3% QoQ (up 6.8% YoY), while the CASA book declined 7.5% YoY/ 5.6% QoQ. CASA ratio declined 208bp QoQ to 32.8%. Retail deposits as per LCR declined to 45.1%.

* Fresh slippages stood elevated, up 128% QoQ to INR50.1b, driven by the rise of slippages in the consumer finance book to INR47.9b. GNPA/NNPA ratio increased 88bp/27bp QoQ to 3.13%/0.95%. The bank has utilized full contingent provisions of INR13.2b in 4Q. Restructured book declined 6bp QoQ to 0.12%.

Highlights from the management commentary

* Considering the derivative-related issue, the Board undertook an enhanced review and identified the following: 1) In the MFI segment, incorrect recording of fee and interest income over 9MFY25 led to under-provisioning of INR18.85b; and 2) INR7.6b was incorrectly classified as interest income instead of other income under Other Assets & Other Liabilities.

* NIM stood at 2.25% in 4QFY25. Excluding the impact of these discrepancies, it would have been 3.47%.

* On a BAU basis, NII would have been INR47b, other income INR25b, and opex INR42b, resulting in a PPOP of INR30.60b.

* The bank is in advanced stages of finalizing its CEO candidate and plans to submit the names to RBI by 30th Jun’25. In the interim, a committee of executives under the Board’s oversight has been entrusted with managing the bank’s operations.

Valuation and view

IIB’s 4QFY25 was marked by multiple one-offs, including the reversal of several accounting lapses, resulting in a reported RoA of (-1.7%). The bank recognized the full impact of these issues during the quarter, leading to a negative hit of INR46.6b on PBT. The advances book declined as the bank strategically reduced its corporate lending to manage liquidity and optimize the balance sheet. Deposit growth remained muted in light of the ongoing corporate governance concerns. Yields continued to moderate as the bank maintained elevated liquidity buffers to manage deposit outflows, while recent high-cost CD issuances have kept funding costs elevated. Given the evolving situation, we believe the outlook for FY26E remains weak, with subdued return ratios; we, therefore, factor in tepid business growth for the year. We sharply cut our earnings estimates by 45% for both FY26E and FY27E, and estimate RoA/RoE at 0.6%/5.2% for FY26E and 0.72%/6.4% for FY27E. Reiterate NEUTRAL rating with a TP of INR650 based on 0.8x FY27E ABV from INR850 earlier. The appointment of a new CEO and the pace of business recovery will be key near-term monitorable.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412