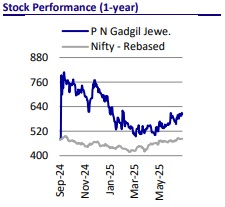

Buy P N Gadgil Jewellers Ltd for the Target Rs.825 by Motilal Oswal Financial Services Ltd

Inspiring store rollout plans for FY26; soft industry demand in 1QFY26

We interacted with the management of PN Gadgil (PNG) to discuss the industry outlook, growth prospects for its business, profitability outlook, and other focus areas. Here are the key takeaways from the discussion: -

* Jewelry demand was subdued in 1QFY26, particularly in Jun’25, due to a ~30-35% YoY surge in gold prices (crossed INR100,000 mark in retail market). Consumers started postponing shopping, which is a typical trend during such steep inflation. Besides, there were two festivals, Akshaya Tritiya and Gudi Padwa, in 1QFY25, whereas 1QFY26 has only Akshaya Tritiya (Gudi Padwa was on 30th Mar’25, company recorded sales of INR1,235m). Demand in the studded and polki segments remained resilient, supported by stable diamond prices. Demand recovery is expected in 2QFY26, driven by the onset of festive occasions (Raksha Bandhan and Ganesh Chaturthi) and anticipation of stable gold prices.

* PNG continues to expand its retail footprint, with 22-25 new store openings planned in FY26, including eight PNG (COCO) and 12-13 LiteStyle outlets. Retail revenue is expected to grow >35% in FY26, aided by incremental contribution from FY25 store additions and the upcoming launches. Franchisee and ecommerce channels are projected to grow ~45% and ~35%, respectively.

* The LiteStyle format—targeted at younger, design-conscious consumers—offers a high-margin profile (15-16% gross margin) and is expected to break even within 12-15 months. PNG has also improved its studded jewelry mix to 8% (up 300- 350bp over the last four years), with further headroom for growth.

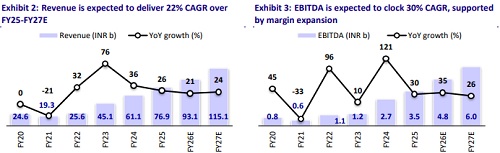

* With a better product mix, operating leverage, and efficient sourcing, the company is well-positioned to expand EBITDA margins to 5.1%-5.2% over FY26- 27. We model a CAGR of 22%/30%/26% in revenue/EBITDA/APAT over FY25-27E. PNG has strengthened its balance sheet by repaying INR3b in debt from IPO proceeds. The company has so far successfully rolled out new stores and achieved breakeven for all new stores opened in FY25. We will keep an eye on its entry into new states and its success in those markets. We reiterate our BUY rating with a TP of INR825, valuing the stock at 30x Mar’27E EPS.

Spike in gold prices weighs on consumer demand

* In 1QFY26, gold prices surged by ~30-35% YoY and ~15% QoQ, breaching the INR100,000 mark (per 10gm) in the retail market, driven by ongoing geopolitical tensions. This sharp and rapid increase has led to consumer budget constraints, with many customers choosing to delay purchases in anticipation of a price correction or stabilization. As a result, demand was soft in 1QFY26, particularly in the second half of the quarter. Old exchange gold mix was high during the quarter

* Despite the overall slowdown, the polki and studded jewelry segments performed relatively well, supported by stable diamond prices and consistent consumer interest in value-added pieces. To navigate the weak demand environment, the company is actively focusing on upselling and strengthening consumer engagements through various initiatives, including selective reductions in making charges to drive conversions.

* Management expects a recovery in demand from 2QFY26, aided by the onset of key festivals such as Raksha Bandhan and Ganesh Chaturthi, which typically drive a seasonal uplift in jewelry purchases. The company remains confident that its customer-centric approach and festive preparedness will help it regain momentum in the coming quarters.

Expansion beyond Maharashtra to unlock new markets

* As of FY25, PNG has 53 stores, comprising 40 company-owned companyoperated (COCO) stores, 12 franchise-owned company-operated (FOCO) stores, and one international store in the US.

* For FY26, the company aims to accelerate its retail expansion by adding 22–25 stores across COCO and FOCO models. Under the COCO model, it plans to open eight PNG-branded stores and five LiteStyle outlets, while the FOCO model will contribute an additional five PNG stores and seven LiteStyle stores.

* The company aims to capitalize on its strong brand equity in Maharashtra by deepening its presence in the state while entering new geographies. PNG has planned three store launches outside Maharashtra in 1HFY26: one each in Lucknow and Kanpur (Uttar Pradesh), and one in Indore (Madhya Pradesh). Depending on the initial customer response, further expansion in these regions will be planned. Additionally, PNG plans to launch two stores in Bihar—Patna and Muzaffarpur—during 2HFY26, marking its foray into the eastern market. A major milestone in its expansion strategy will be the opening of a flagship 5,000 sq. ft. store in Dadar (Mumbai) in 1HFY26

* The successful execution of multiple store rollouts during the Navratri season (Oct’24), shortly after its IPO, reflects the management's strong operational capabilities and boosts investor confidence in the company's growth trajectory. PNG’s calibrated expansion strategy aims to enhance market reach, drive brand visibility, and unlock long-term value across regions.

Strategic rollout of LiteStyle format to target Gen Z and millennials

* PNG LiteStyle is a strategic retail format designed to cater to younger, fashionforward consumers seeking trendy yet affordable jewelry. These stores will be smaller in size (1,500-2,000 sq. ft.) and focus primarily on lightweight jewelry, including 14-carat and 18-carat gold pieces, with an emphasis on design and impulse buying.

* Positioned as a differentiated format from traditional PNG stores, LiteStyle stores aim to offer a curated, fashion-driven experience at accessible price points under the brand message: “Though it’s light, it’s serious fashion.” These outlets will be located in high streets and malls to maximize footfall and visibility among Gen Z and millennial consumers.

* In FY26, PNG plans to launch 12-13 LiteStyle stores, both in COCO and FOCO models. The initial investment per store, including inventory and capex, is expected to be under INR80-90m funded through internal accruals. The model also includes a strong digital presence, enhancing its omnichannel reach. PNG expects that LiteStyle outlets would achieve breakeven within 12-15 months, supported by higher margins and rising demand for lightweight and design-led jewelry.

* In 1QFY26, PNG inaugurated its first two LiteStyle stores in Pune, Maharashtra. These launches underline the company’s commitment to modernizing its portfolio and expanding its reach among new-age buyers.

Strong retail growth; refinery sales discontinuation impact reported growth in 1HFY26

* PNG is among the few jewelry companies that are aggressively expanding their retail footprint. The company’s FY26 retail revenue can be segmented into three store cohorts: (1) 24 legacy stores from FY24, (2) 16 new COCO stores opened in FY25, and (3) 13 planned COCO store additions in FY26. The 24 legacy stores delivered 25% revenue growth in FY25, driven by higher gold prices, and they are expected to grow ~15% in FY26. The 16 COCO stores launched in FY25 contributed ~INR5.5b in about four months of operation, and they are projected to generate INR15-16b in FY26 as they mature and operate for the full year. The 13 COCO stores planned for FY26 are expected to contribute incremental revenue of INR5-7b. Overall, retail revenue is expected to grow ~35% in FY26. Franchisee and e-commerce segments are also projected to grow ~45% and ~35%, respectively, driven by store expansion and rising digital traction.

* The company stopped accounting refinery transfers to vendors as sales from 3QFY25, which impacted reported revenue growth in 2HFY25 (~15%). This high base effect is expected to continue into 1HFY26, limiting reported revenue growth to ~8-10%. On a full-year basis, we expect consolidated reported revenue to grow ~20% in FY26.

Margin expansion led by better product mix and efficiency

* PNG continues to focus on increasing the contribution of studded jewelry and scaling its high-margin LiteStyle format, which offers gross margins of 15-16%. The company has also improved its studded jewelry mix to 8% (up 300-350bp over the last four years), with further headroom for growth.

* Maharashtra is already a favorable market for studded products (~20% studded mix market); therefore, there is significant potential for further improvement in this mix.

* With a more favorable product mix, operating leverage and improved sourcing, the company is well-positioned to expand its operating margin. We model an EBITDA margin of 5.1%-5.2%% for FY26 and FY27.

* Gold metal loan (GML) rates have also corrected and currently stand at ~4%.

Valuation and view

* The company has strengthened its balance sheet by reducing debt, having repaid INR3b from IPO proceeds. It has also implemented a robust hedging strategy through GML, with 100% hedged by Mar’25 and now fully covered. This will lower interest costs and further boost profitability.

* We model a CAGR of 22% in sales, 30% in EBITDA, and 26% in APAT over FY25- 27E.

* The company has so far successfully rolled out new stores and achieved breakeven for all new stores. We will keep an eye on its entry into new states and its success in those markets. We reiterate our BUY rating with a TP of INR825, valuing the stock at 30x Mar’27E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412