Neutral Bosch Ltd for the Target Rs. 29,581 by Motilal Oswal Financial Services Ltd

Healthy growth in the auto segment drives outperformance

New NOx sensor line will also cater to global requirements

* Bosch (BOS)’s 4QFY25 EBITDA margin at 13.2% was above our estimate of 12.7%, mainly led by strong revenue growth. However, its PAT at INR5.5b was below our estimate of INR5.8b due to a higher-than-expected tax rate.

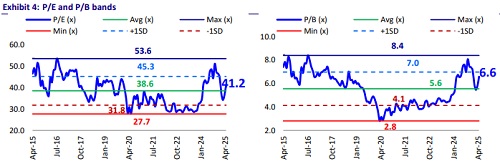

* The auto demand outlook continues to be subdued across key segments in the near term. At ~39x FY26E/33.8x FY27E EPS, the stock appears fairly valued. Given the lack of any earnings triggers, we reiterate our Neutral rating on the stock with a TP of INR29,581 (based on ~32x FY27E EPS).

Mobility business and services fuel revenue growth

* BOS’s 4QFY25 operational numbers have been ahead of estimates primarily due to strong revenue growth. However, despite this, PAT at INR5.5b was below our estimate of INR5.8b due to a higher tax rate.

* Revenue jumped 16% YoY to INR49.1b (ahead of our estimate of INR45b) and was primarily driven by 14.9% YoY growth in the mobility business. Within mobility, the power solutions business was up 16.9% YoY, aftermarket rose 7.9% YoY, and the 2W segment grew 21.4% YoY. Growth was also led by the closure of one large application service project in 4QFY25.

* In contrast, the consumer goods segment posted just 2.9% YoY growth. Further, the energy & building technologies business declined 8.7% YoY.

* Margins remained stable YoY at 13.2% (above our estimate of 12.7%). On a segmental basis, while auto segment margins improved 140bp YoY to 15.3%, non-auto margins declined 200bp YoY to 9.4%.

* The average tax rate for 4Q stood at 28.9%.

* Overall, PAT declined 2% YoY to INR5.5b.

* For FY25, revenue grew 8% YoY to INR180.8b.

* The mobility business posted 7% YoY growth driven by 5.8% growth in the power solutions segment, 8% growth in aftermarket, and 18.5% growth in the 2W segment.

* While the consumer goods segment grew 6% YoY, the energy & building technologies business posted an 8% YoY growth for FY25.

* EBITDA margin improved 30bp YoY to 12.8%.

* Overall, PAT grew 10% YoY to INR20.1b.

* The Board declared a final dividend of INR512 per share (vs. INR375 per share in FY24), which translated into a dividend payout of 75%.

* For FY25, BOS generated an FCF of INR20.6b post-capex of INR3.1b.

Highlights from the management commentary

* On the outlook, tractors are expected to post healthy growth in FY26E, led by positive rural sentiments. Even the 2W industry is likely to post steady growth, fueled by positive rural sentiments and higher income in the hands of the consumer. While CVs are expected to post gradual growth (the bus segment is likely to continue to outperform), the low-tonnage segment is likely to continue to see competition from 3W EVs. Further, PVs are anticipated to post modest growth in FY26, led largely by SUVs.

* The NOx sensor line at Bidadi is likely to scale up to 2.1m sensors by 2027. BOS has indicated that this production line is made in India for global requirements as well. However, BOS has not applied for a PLI incentive for this product.

* Exports remain a high-priority business for BOS in India. It continues to export spark plugs and injectors. With the new NOx line ramping up, the company would start exporting these sensors in due course. While there are multiple global headwinds currently, management expects exports to grow in FY26.

Valuation and view

* The auto demand outlook continues to be subdued across key segments in the near term. Further, while BOS continues to work towards the localization of new technologies, given the long gestation projects, its margin is likely to remain under pressure with no visibility of any material improvement, at least in the near term.

* At ~39x FY26E/33.8x FY27E EPS, the stock appears fairly valued. We reiterate our Neutral rating on the stock with a TP of INR29,581 (based on ~32x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)