Buy Home First Finance Ltd for the Target Rs.1,600 by Motilal Oswal Financial Services Ltd

Strong core business with passing weakness

Disbursements slightly weak; asset quality deteriorates with 1+dpd up 90bp QoQ

* HomeFirst’s 1QFY26 PAT grew 35% YoY to INR1.2b (in line). NII grew ~33% YoY to INR1.9b (in line). Other income jumped 60% YoY to INR609m (est. INR395m), aided by higher assignment income of INR247m (PY: ~INR195), higher fee income from insurance commissions, and higher investment income from the proceeds of the equity raise in Apr’25.

* Opex grew 33% YoY to INR868m (~8% higher than est.). PPoP rose ~41% YoY to INR1.7b (~5% beat). Credit costs stood at INR177m (est. INR90m), translating into annualized credit costs of ~36bp (PQ: ~25bp and PY: ~22bp).

* In Apr’25, HomeFirst successfully raised INR12.5b through QIP. After the capital raise, CRAR stood at ~49.6% and its credit rating was upgraded to AA (Stable) by ICRA, India Ratings and CARE.

* Management highlighted that disbursements were weak during the quarter, primarily due to a slower start in April. However, volumes picked up in May and June and have remained steady through July. The company expects to recover the INR50m shortfall in disbursements in the second half and has maintained its full-year disbursement guidance of INR56-58b.

* Asset quality saw seasonal deterioration, with an increase in 1+ dpd and 30+ dpd, largely due to stress in a few markets (mainly Surat, Tirupur and Coimbatore). However, the situation has improved in Jul’25, with a meaningful recovery in Surat, while Coimbatore is expected to stabilize over the next 2-3 months. The company further shared that these delinquencies are expected to normalize over the next couple of quarters.

* We believe HomeFirst is a resilient franchise, which is currently navigating turbulent weather with transitory headwinds. The company’s execution track record has been consistently better than its peers, and it is well-positioned to capitalize on significant opportunities in the affordable housing segment. We estimate a CAGR of ~26%/~32% in AUM/PAT over FY25-27. While HomeFirst exhibited asset quality weakness in 1Q, we believe it will be able to pull back on these elevated delinquencies and report a gradual improvement in its asset quality in the subsequent quarters. Reiterate BUY with a TP of INR1,600 (based on 3.4x Mar’27E BV)

Healthy AUM growth of ~29% YoY; BT-out rate dips YoY

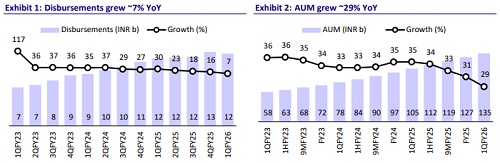

* Disbursements grew 7% YoY to ~INR12.4b, and this led to AUM growth of 29% YoY to ~INR135b. 1QFY26 was the first quarter after Covid when disbursements saw a minor sequential decline.

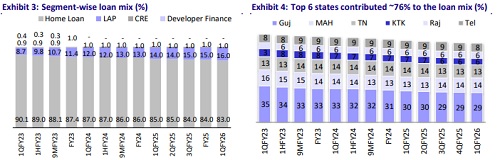

* Management shared that over the past two years, HomeFirst has steadily increased its disbursement market share from around 1.5% to 2.3%. It aims to take this further to 4-5% over the next 4-5 years by focusing on key states like Madhya Pradesh, Rajasthan, Uttar Pradesh, and Uttarakhand.

* The BT-OUT rate (annualized) in 1Q declined to ~6% (PY ~6.3% and PQ: 7.5%), driven by benign competitive intensity in the first quarter of the fiscal year.

Yields stable sequentially; reported NIM up ~10bp QoQ

* Reported yield was stable QoQ at 13.5% and reported CoF was steady QoQ at 8.4%. Reported spread (excl. co-lending) was flat QoQ at 5.1%. Management guided for spreads to be in the range of ~5.0%-5.25% in FY26.

* Incremental CoF and origination yield in 1QFY26 stood at 8.5% and 13.4%, respectively. Reported NIM rose ~10bp QoQ to 5.2%. Management shared that its marginal CoB in Jun-Jul’25 was below 8%, leading to expectations of a ~20bp decline in CoB to 8.2% in 2QFY26. Further, with banks reducing the MCLR, the company anticipates CoB to fall below 8% by 4QFY26. We model NIM of 6%/6.1% in FY26/FY27 (FY25: 5.7%).

1+dpd up ~90bp QoQ; minor increase in bounce rates

* GS3 rose ~15bp QoQ to 1.85%, and NS3 rose ~17bp QoQ to 1.4%. PCR declined ~3pp QoQ to ~22%. GS2 rose ~30bp QoQ to 1.6%.

* HomeFirst’s 1+dpd rose ~90bp QoQ to 5.4%. Bounce rates increased ~40bp QoQ to ~16.8% in 1QFY26 (vs. ~16.4% in 4QFY25). However, in Jul’25, bounce rates declined to 15.8%.

Highlights from the management commentary

* The company has not made any changes to its pricing or yields and does not plan to revise its PLR in 2QFY26. It will reassess its pricing strategy around mid-3Q.

* Management indicated that both ticket size and number of loans have seen strong growth in Madhya Pradesh. Maharashtra has also witnessed a turnaround, with AUM now growing at 30%. Additionally, leadership issues in Telangana and Tamil Nadu have been resolved, and the company expects its performance in these states to improve going forward.

Valuation and view

* HomeFirst’s performance during the quarter was a mixed bag, as AUM growth remained healthy, while asset quality saw seasonal deterioration (1+ dpd up ~90p QoQ), along with an increase in overall credit costs. Despite rising competition in a declining rate environment, reported yields have remained stable, reflecting a balanced pricing strategy.

* HomeFirst has invested in building a franchise, positioning itself well to capitalize on the significant growth opportunity in affordable housing finance. The company continues to expand its distribution network in a contiguous manner, covering Tier I and II cities within its existing states.

* We estimate HomeFirst to clock a ~26% AUM CAGR over FY25-FY27 and NIM (as % of average AUM) of 6%/6.1% in FY26/FY27. Reiterate our BUY rating on the stock with a TP of INR1,600 (premised on 3.4x Mar’27E BVPS).

* Key downside risks: a) higher BT-outs, leading to lower AUM growth; and b) deterioration in asset quality in its LAP product and self-employed customer segments, resulting in higher credit costs.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412